Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreFuture of AI in Finance

Future of AI in Finance: An Overview

In the fourth article of the AI in finance series (find the first article here, second here, and third here), we look to the horizon and forecast the future of AI in finance. While the advantages and disadvantages of AI and its impact on society are being discussed, finance professionals can rest assured that AI is not an untested, scary technology. In fact, AI is already evolving beyond basic task execution and taking on more high-cognition processes, freeing up finance teams to better focus on strategy and innovative ideas.

Below are insights into some of the frequently asked questions regarding the future of AI in finance, the biggest advantages, and how finance teams can get started harnessing the power of AI technologies.

Future of AI in Finance FAQs

What is the Future of AI in Finance?

The future of financial planning involves a blend of human expertise and technology, with advisors adapting to digital tools and client preferences, while also providing holistic, personalized advice, particularly for a younger, tech-savvy generation.

Artificial Intelligence (AI) is transforming industries across the globe, and finance is no exception. The rise of AI technologies offers opportunities to improve operational efficiency, decision-making, and to expedite complex processes. From streamlining financial reporting processes to financial forecasting, AI has already made significant strides in finance departments, but the future promises even more exciting advances.

Looking ahead: Computation and Comprehension

Decades ago, advances in computational technologies such as spreadsheets and relational databases were embraced by finance teams, saving countless hours of tedious manual calculations. Today’s Generative AI adds a layer of comprehension, allowing technologies to better understand and interpret the data. Advances in dataset comprehension bring the ability for finance professionals to interact with the technology using natural language.

What is the Future of AI in Finance for Organizations?

AI’s future in finance lies in its ability to allow finance teams and C-level executives streamline operations, reduce costs, and optimize complex decision-making processes. For companies and organizations, AI can process vast amounts of data in real time, providing predictive insights that guide business planning and resource allocations. As organizations embrace AI-driven financial management platforms, finance teams will further benefit from tailored recommendations and insights that enhance strategic planning.

The progression of AI in finance can be summarized as the following:

- Operational Automation: tasks and eventually, processes

- Analytics & Insights: deeper, automated, explainable insights

- Decision Support: recommending and executing on data-driven decisions

Will AI Take Finance Jobs?

Despite any sensationalism, media headlines or sci-fi movie plots, AI will not take finance jobs. Like spreadsheets, AI will make finance and accounting teams better, faster, and smarter.

AI will undoubtedly automate many aspects of finance, potentially displacing some roles. Tasks that involve repetitive data processing, such as accounting, reporting, and forecasting, are likely to be handled by AI systems. However, AI will not eliminate the need for human professionals. Instead, it will shift the focus toward higher-value work, requiring humans to supervise AI systems, interpret their outputs, and make strategic decisions that require human judgment.

New jobs will emerge in areas like AI governance, data science, and AI system maintenance. As financial departments become more AI-driven, finance professionals will need to develop new skills, especially in understanding and managing these technologies. In essence, while AI may replace some jobs, it will also create new roles that require creativity and complex decision-making.

Finance and Generative AI

Generative AI, which can create new content from vast datasets, holds promising applications for finance teams. For example, generative AI can be used for predictive modeling, creating scenarios that allow financial professionals to plan for a range of outcomes.

What are the Biggest Advantages of Using AI in Finance?

The use of AI in finance comes with key advantages:

Increased Insight Accuracy:

Generative AI enabled intuitive, conversational experiences will provide additional insights to finance teams faster and with increased accuracy. Examples such as ChatGPT, Gemini, or Copilot exhibit conversational AI’s capabilities and potential. Finance teams will be able to explore more areas of interest and find more opportunities by asking questions in natural language and getting fast and accurate results.

Enhanced Business Growth:

Companies and organizations will place a much greater emphasis on AI across all business departments including planning, marketing, customer service, and sales. Finance teams will have more data, be more agile and more efficient. AI will increasingly be an accelerant to growth.

Increased Market Competitiveness:

AI technologies, beyond finance and accounting productivity, are being adopted by forward looking companies and CFOs to strengthen their positioning against current and future competitors. Finance leaders agree that AI adoption is a requirement for medium to long-term success.

The sooner companies begin to harness the power of AI, the sooner they will realize improved customer experience, enhanced sales effectiveness, accelerated product development, optimized marketing targeting, and more.

Learn more about how finance teams can benefit from using AI in an article from CFOdive.

How Does My Organization Get Started Using AI in Finance?

To effectively implement AI in finance, companies and organizations should take the following steps:

Assess Current Needs: Companies should identify which areas of their financial operations can benefit most from AI. Whether it’s automating routine tasks, tackling more complex processes, understanding where AI fits is the first step.

Invest in Data Infrastructure: AI thrives on data, so companies need to invest in a robust data or financial management platform. A well-organized, clean dataset is essential for training AI systems.

Collaborate with Experts: Companies should partner with AI in finance experts to help implement effective solutions. This might include working with AI in finance vendors.

Pilot Programs: Start small by running pilot AI programs in specific areas. This allows companies to test the technology’s effectiveness and identify potential challenges before scaling up.

Train Employees: Upskilling the workforce is critical to AI success. Employees need to be trained to work alongside AI systems, interpret AI-generated data, and manage the technology.

By following these steps, companies can ensure a smooth transition to AI-driven financial operations.

Learn the 3 reasons why it’s time to get on board with AI for growth.

Future of AI in Finance Summary

AI is reshaping the financial landscape, offering companies and organizations new ways to improve efficiency, enhance decision-making, and better predict outcomes. Generative AI and other cutting-edge technologies will continue to evolve, providing even more advanced tools for financial professionals.

As AI becomes more prevalent in finance, companies must strategically implement these technologies, ensuring that they have the right data, expertise, and infrastructure to maximize their potential. The future of finance is undeniably AI-driven, and those who embrace these innovations will be better positioned to thrive.

Explore a guide on how it’s not too late to get into AI.

Does Planful Offer an AI in Finance Solution?

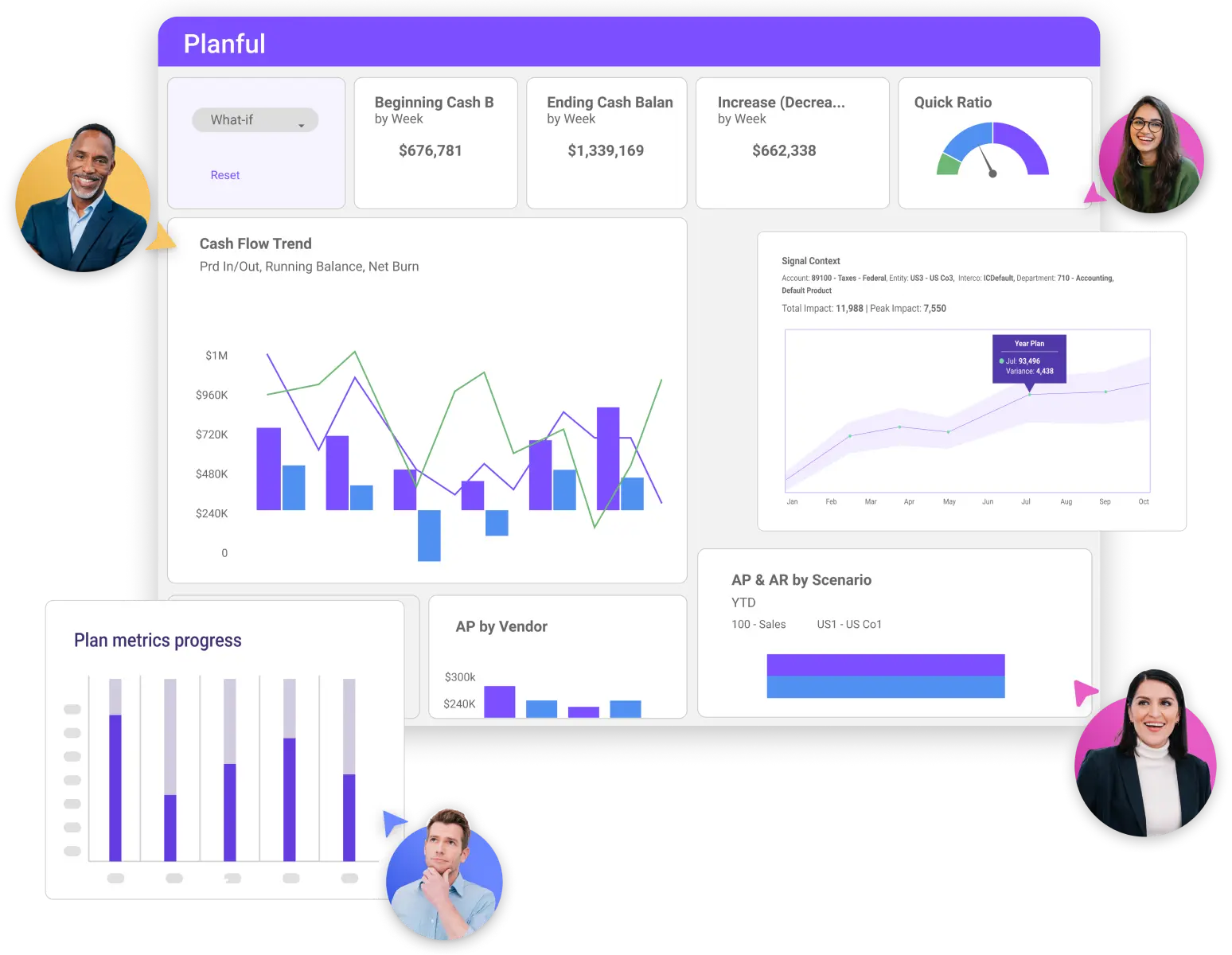

Yes, Planful delivers AI-enabled assistants as a service through our software, augmenting human effort, streamlining collaborative processes, accelerating cycles, and upskilling teams. With persona-based intelligence, Planful enables smarter decisions and drives financial and operational excellence.

Planful’s AI/ML capabilities slash FP&A cycle times, identifying anomalies in financial data, reducing manual effort, and increasing trust in the data. This confidence boost allows finance teams to focus on delivering insights and guiding high-level business.

Planful AI – Detect spots potential errors in data and creates hyper-accurate financial forecasts, allowing users to parse historical data and highlight anomalies where inputs and historical trends don’t match. With Planful in the trenches, finance teams can focus on supporting growth with strong financial planning decisions.

Ready to transform your FP&A processes with AI? Take a tour of our Planful AI Labs video series for insights on how cutting-edge AI advancements are reshaping financial processes, or register for our on-demand webinar, “AI’s Impact on FP&A,” in partnership with the CFO Leadership Council.

You can also get an interactive demo to see Planful in action.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?