Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreAI Applications in Finance

AI Applications in Finance: An Overview

In this second article in the AI in Finance series, we explore some of the most common AI applications and how finance professionals are using them. Before we dive into the AI applications for finance, let’s find out who is actually responsible for AI in finance, how finance professionals use AI, and what are some of the common AI applications in finance. Below are insights into some of the frequently asked questions.

Learn more about this topic by exploring the other articles in the AI in Finance series: AI in Finance Overview, AI Use Cases in Finance, and the Future of AI in Finance. Continue below to learn how modern finance professionals are leveraging AI applications in finance to gain a competitive edge with this emerging technology.

AI Applications for Finance FAQs

What are AI Applications for Finance?

Like many industries, finance is being impacted by new technologies and advancements in AI. Advanced AI applications and solutions can empower finance professionals, enhancing efficiency, accuracy, and decision-making processes. AI applications in finance include a range of software that utilize artificial intelligence to perform complex and time-consuming tasks typically performed by humans. AI applications apply algorithms, machine learning, and natural language processing (NLP) techniques to analyze data, identify trends, and generate predictions. As a result, these AI applications are becoming indispensable for modern finance professionals.

A few common AI applications for finance and accounting include:

- Data Science and Analytics

- Anomaly Detection and Risk Alerts

- Document Processing

- Predictive Forecasting and Scenario Planning

- Generative AI

Who is Responsible for AI in Finance?

Many stakeholders throughout the organization play a crucial role in implementing and utilizing AI in finance to achieve strategic objectives.

Typically, the Chief Financial Officer (CFO) oversees machine learning and artificial intelligence in finance. The Chief Technology Officer (CTO) or Chief Information Officer (CIO) is directly tasked with evaluating, implementing, and managing technology solutions, including artificial intelligence in finance, within the organization. IT leaders work closely with these executives throughout system implementation and management. Data science teams build AI models, algorithms, and analytical applications, while compliance and risk teams assess AI against regulatory requirements and industry standards. All of these teams collaborate to apply AI in finance solutions to meet strategic business objectives.

How do Finance Professionals Use AI in Finance?

So, how is AI used in finance? Today’s finance professionals use AI tools and applications for a broad range of business benefits from streamlining operations, to reducing costs, and enhancing decision-making processes. AI automates routine tasks such as data entry, reconciliation, and compliance checks – freeing up time for higher-value analysis. Additionally, AI-driven predictive models improve financial forecasting, enabling teams to make more informed, forward-looking business decisions.

What are the Best AI Applications for Finance Professionals?

Common AI Applications for Finance Professionals

ChatGPT

Today, ChatGPT is arguably the most recognized name in AI tools. Developed by OpenAI, ChatGPT is an AI language model that uses natural language processing (NLP) to generate human-like, conversational text that can assist finance professionals in a multitude of ways. For customer service, it can generate natural language responses to queries, automating responses to frequently asked questions. ChatGPT can also enhance efficiency and accuracy in financial report generation and data analytics.

IBM Watson

IBM Watson offers a suite of AI applications specifically designed for the finance industry. Watson’s capabilities include natural language processing, machine learning, and data analytics. Finance professionals use Watson for tasks such as risk assessment and fraud detection. IBM Watson’s ability to process and analyze vast amounts of data in real-time makes it a valuable asset for decision-making and strategic planning.

Alteryx

Alteryx is a data analytics platform that finance professionals can use to prepare, blend, and analyze data from various sources. Alteryx offers a combination of data cleansing, integration, and analytics that allow users to create predictive models and data-driven insights.

Planful AI

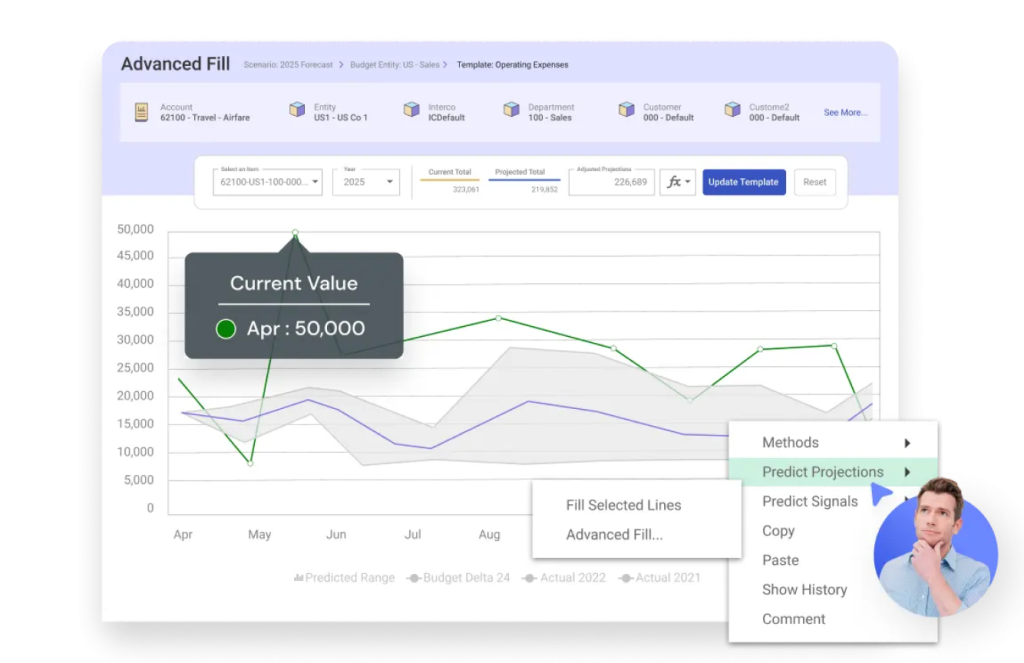

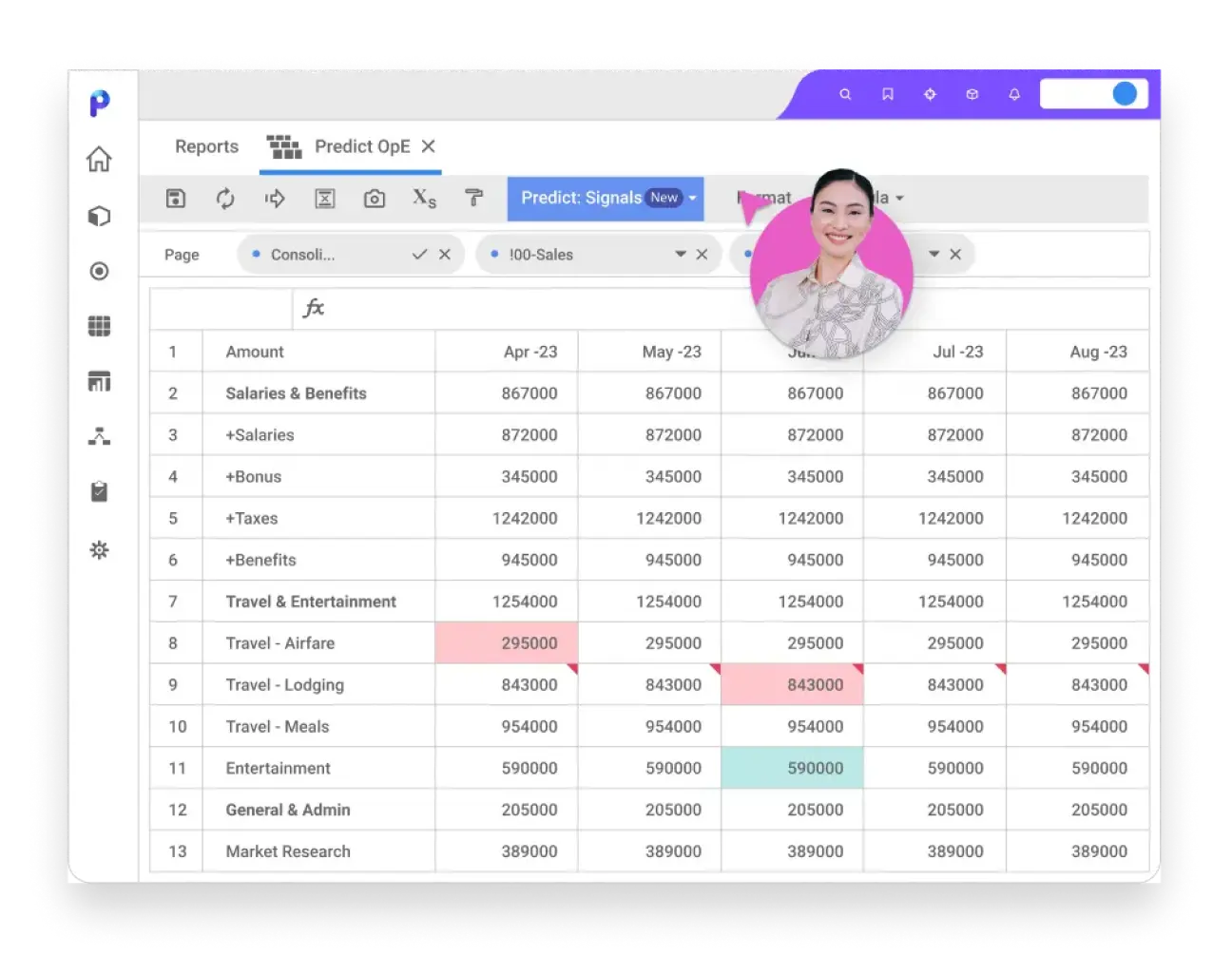

Planful AI is a purpose-built cloud-based platform that delivers a suite of advanced AI-driven solutions designed specifically for agile and accurate financial decision-making. Planful AI reviews data for errors, identifies patterns, and leverages machine learning algorithms to provide intelligent forecast recommendations optimizing budgeting processes, and enhancing forecasting accuracy. Uniquely focused on finance, Planful AI helps finance professionals identify trends, assess risks, and make confident informed decisions by providing real-time insights and predictive analytics.

What are Common Artificial Intelligence Applications in Finance?

As finance professionals adopt AI in finance and accounting, they gain a multitude of applications available to enhance their workflows and outcomes.

Below are a few examples of AI applications and how they are being used to bolster the work of finance professionals. Common examples include: data science and analytics, anomaly detection and risk alerts, predictive forecasting and scenario modeling, document processing, and generative AI.

Data Science and Analytics

AI applications enhance data science and analytics, allowing finance professionals to process large datasets rapidly and efficiently. They are able to better identify trends, correlations, and outliers that might be missed through manual analysis. With deeper insight into performance and customer behaviors, AI applications can elevate and expedite strategic decision-making.

Anomaly Detection

Anomaly detection is ideal for identifying unusual patterns or behaviors that could indicate fraud, errors, or other financial risks. AI applications for accounting and finance can analyze data in real-time, allowing finance professionals to detect and flag anomalies in financial datasets. These capabilities help finance professionals maintain data integrity and ensure ongoing compliance with regulatory standards.

Document Processing

AI-driven document processing tools automate the extraction, classification, and analysis of information from financial documents. These tools are especially useful for finance professionals, automating time-consuming or monotonous tasks including data processing, regulatory compliance management and reporting. By reducing manual effort, they help minimize human error, improving operational efficiency and accuracy while freeing up time for strategic planning.

Predictive Modeling

Predictive modeling uses AI to forecast future events based on historical data. Predictive analytics software for finance can uncover opportunities with intelligent AI-driven insight. Finance and business leaders are better equipped to make confident, intelligent financial decisions with greater agility and accuracy.

Generative AI

Generative AI is used by finance professionals to generate reports, summaries, and financial insights. Generative AI enhances productivity for finance professionals by automating the creation of complex documents, providing real-time insights, and streamlining financial reporting processes

AI Applications for Finance Summary

AI applications are transforming the finance industry by automating routine tasks, enhancing data analysis, and improving decision-making processes. AI is rapidly becoming an integral part of modern finance. AI applications for finance, like ChatGPT, IBM Watson, Alteryx, and Planful AI offer a broad range of capabilities tailored to the evolving needs of finance professionals. As AI continues to evolve, its applications in finance will expand, driving innovation and efficiency, and strategic value across the industry.

Does Planful Offer AI Applications for Finance Professionals?

Yes, Planful delivers AI-enabled assistants as a service through its software, augmenting human effort, streamlining collaborative processes, accelerating planning cycles, and upskilling teams. With persona-based intelligence, Planful AI enables smarter decisions and drives financial and operational excellence.

Planful’s AI/ML capabilities significantly reduce FP&A cycle times, identifying anomalies in financial data, reducing manual effort, and increasing trust in the data. This confidence boost allows finance teams to focus on delivering insights and guiding high-level business decisions.

Planful AI – Detect identifies potential errors in data and creates hyper-accurate financial forecasts, allowing users to parse historical data and highlight anomalies where inputs and historical trends don’t align. With Planful in the trenches, finance teams can focus on supporting growth with strong financial planning decisions.

Ready to transform your FP&A processes with AI? Take a tour of the Planful AI Labs video series for insights into how cutting-edge AI advancements are reshaping financial processes, or register for Planful’s on-demand webinar, “AI’s Impact on FP&A,” in partnership with the CFO Leadership Council.

You can also get an interactive demo to see Planful in action.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?