Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreConsolidations Built for Complexity, No Compromises.

Accelerate close, consolidations, and reporting in one platform, enhanced by AI to improve efficiency, control, and guide strategic action.

Consolidations Built for Complexity, No Compromises.

1500+ Customers Trust Planful

Close and consolidation transformed with Planful: faster close, stronger control, deeper insights.

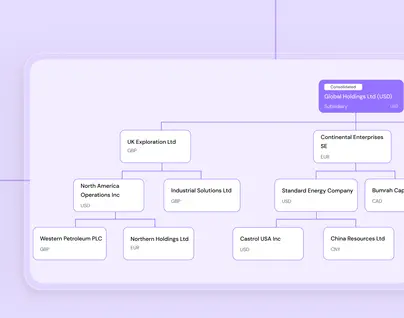

Launch quickly with built-in consolidation logic that supports complex org structures and adapts easily to business change.

Planful connects data across account reconciliations, close and consolidations, reporting, and planning, all in a single system. No silos, no rebuilds, just one continuous workflow.

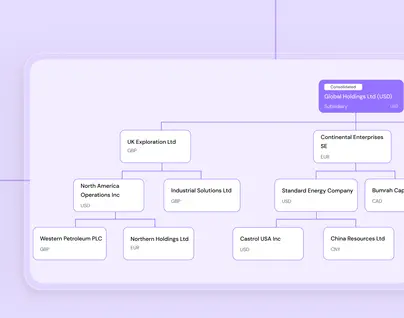

Purpose-built for finance and accounting teams, not IT. Intuitive to configure, with workflows to keep you on track, dynamic org charts to visualize change, and audit trails accountants can rely on.

Go beyond automation with AI skills that automate repetitive tasks, surface anomalies, and give accounting a faster, smarter way to spot issues before they become problems.

More speed. More accuracy. More impact.

Planful transforms the office of the CFO from a back-office function into a strategic business partner that speeds up the close, builds confidence in the numbers, and connects accounting to planning and execution.

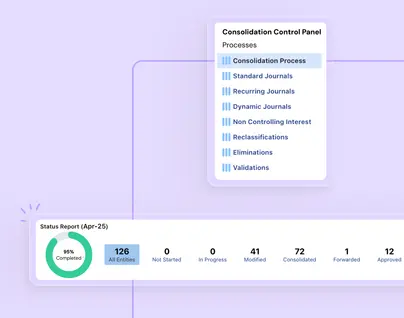

Planful accelerates every step of the month-end close—from journal entries and account reconciliations to eliminations, consolidations, and reporting. By automating manual tasks and giving deeper visibility into progress, teams cut days off the cycle and free time for higher-value analysis.

With built-in audit trails, automated FX, NCI, and equity pickup, and system-driven controls, Planful ensures complete transparency. Accounting teams deliver numbers they can defend, and finance leaders gain the confidence to act faster.

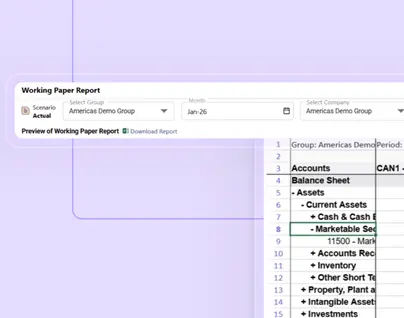

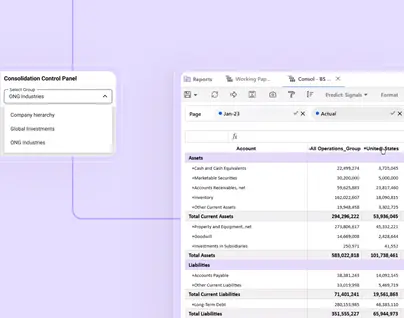

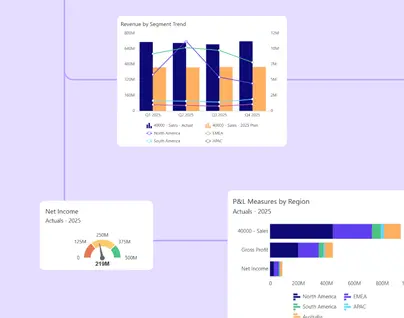

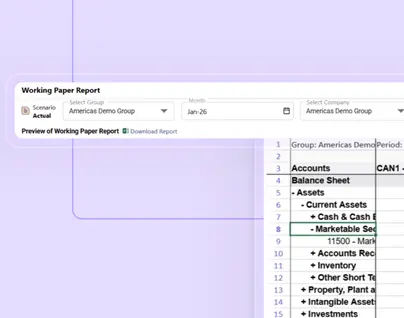

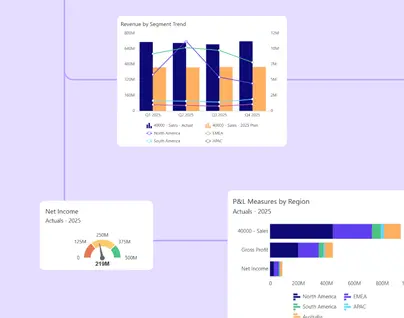

Planful lets you create multiple reporting “books” from the same data: GAAP, IFRS, statutory, management, or tax. Drill into results with full traceability and deliver insights that FP&A can use immediately.

As organizations grow more complex, Planful scales with you. Handle new entities, reorganizations, or acquisitions with flexible sub-consolidations and multi-view reporting—all without lengthy rebuilds or IT-heavy projects.

Validated actuals flow directly into forecasting, planning, and scenario modeling in Planful. Accounting isn’t just closing the books, it’s driving strategic conversations with finance and the business.

“It used to take us 20 working days for global consolidation. Planful enables us to reach the draft global consolidation by working day seven and a hard close by working day 12. That’s across 140 entities. Planful is just amazing for speed and accuracy.”

May Xu,

Ready To Streamline Your Month End Close and Consolidation Processes?

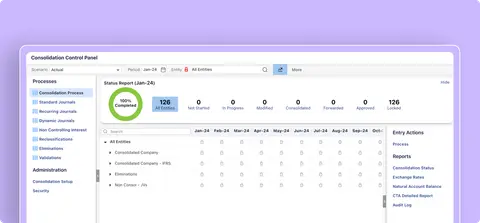

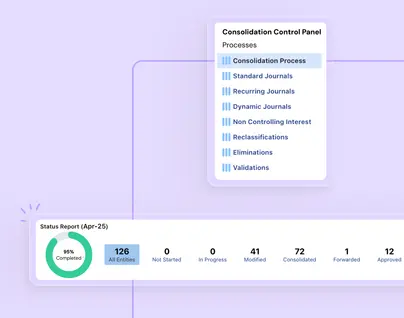

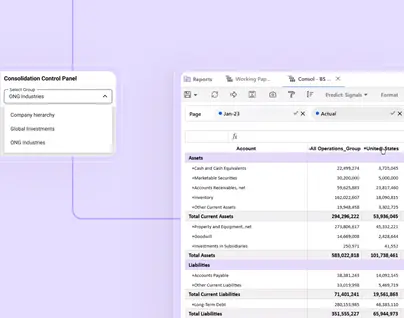

Manage Complex Consolidations with Ease

Consolidate by statutory, management, region, or business unit. With groups and sub-consolidations, you gain more flexibility, speed, and control that empower you to adapt quickly to acquisitions or global expansion.

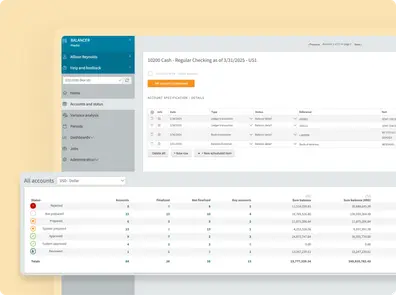

Modernize Account Reconciliations with Precision

Eliminate manual spreadsheets by automating account reconciliations as part of your financial close. Planful provides a single place to prepare, track, and review reconciliations alongside consolidations and reporting, giving finance teams greater visibility, accuracy, and control throughout the month-end process.

Deliver Accurate GAAP, IFRS & Management Reports

Produce statutory and management reports in one platform. Layer views across legal, regional, or management structures to deliver audit-ready results without manual workarounds.

Streamline Close Management Every Month-End

Coming soon: A one-stop hub to manage every step of the month-end with full visibility and control. From account reconciliations to consolidations, you’ll use automated tasks, dashboards, and collaboration tools to keep teams aligned. Calendar views will track key dates, while progress charts highlight roadblocks early, helping you continuously improve the close process