Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreAI in Finance

Our in-depth series on AI in finance was developed to provide strategic insights into the use of artificial intelligence in finance, highlighting its tools, real-world applications, business use cases, and expanding impact on the future.

This first article in the series presents a foundational overview of AI in finance and answers FAQs such as: What is artificial intelligence in finance? How are finance professionals and businesses using AI in finance? What are the best practices for successful adoption?

Learn more about AI’s broader impact on finance by reading other articles in our AI in Finance series: AI Applications in Finance, AI Use Cases in Finance, and the Future of AI in Finance. Continue reading below to get an overview of AI in finance and how finance professionals leverage this emerging technology to drive transformation across the Office of the CFO.

AI in Finance: An Overview

Professionals in the finance industry increasingly leverage artificial intelligence (AI) to analyze financial data and automate repetitive or routine tasks and time-sensitive processes. Foundational machine learning (ML) algorithms and models allow AI-driven solutions to continuously learn from historical and real-time data to improve their performance over time without explicit programming or human intervention.

Artificial intelligence and machine learning in finance aim to improve the accuracy and efficiency of financial processes. Applying AI tools enables finance teams to improve anomaly detection, strengthen risk assessment, and accelerate financial planning, budgeting, and predictive forecasting.

AI in Finance FAQs

What is Artificial Intelligence in Finance?

AI for accounting and finance streamlines financial processes and improves decision-making by rapidly delivering accurate insights. Modern finance professionals use various tools and applications that employ AI technologies. The most common are analytical, generative, and conversational.

Analytical applications of artificial intelligence in finance leverage AI algorithms that analyze past data to build accurate forecasts and budgets for a reliable baseline that accelerates financial planning cycles.

Generative AI models can create realistic financial reports or business forecasts for training. This kind of generative AI for finance augments limited datasets and enables more robust scenario model development and testing.

Conversational AI for finance, such as chatbots and virtual assistants, leverages NLP techniques. These tools automate routine basic tasks for humans, such as simple customer inquiries, and improve response times while enhancing customer service efficiency, which leads to higher customer satisfaction and retention rates.

Read more: How to Harness the Power of AI in FP&A

How do Finance Professionals Use AI in Finance?

Artificial intelligence for finance professionals works in several ways:

Pattern recognition to identify risk and opportunity

AI-powered systems can detect anomalies, trends, and outliers in large data sets that might go unnoticed by human analysts. This allows finance professionals to proactively spot potential risks or emerging growth opportunities before they impact the business.

Forecasting from historical and scenario data

AI leverages historical performance and real-time inputs to generate more accurate and adaptive forecasts. It also enables finance teams to model “what-if” scenarios quickly, so they can assess potential outcomes and plan for any market condition.

Fraud detection

AI in finance and accounting can detect patterns and behavior in financial data and alert financial teams to take action early to prevent financial losses.

Compliance and regulatory reporting

Automating data collection, validation, and reporting tasks to streamline compliance and reduce the risk of regulatory errors can also be a critical use of artificial intelligence in finance.

What are the Best Practices for AI in Finance?

Choose Strategy

When integrating AI into financial planning, start by defining a clear strategy. Align AI initiatives with your financial goals, ensuring AI tools support decision-making processes and enhance overall planning effectiveness.

Assess Risks

AI can offer significant benefits, but it is important to assess potential risks. For example, you must evaluate the accuracy of AI models and their impact on financial outcomes. Additionally, it is best practice to regularly review AI-driven predictions and responses to identify and mitigate any potential risks.

Establish Governance

Establishing governance is essential for managing AI in financial planning. Develop clear policies and protocols to oversee AI applications, ensuring transparency, accountability, and compliance with regulatory standards. Governance structures should also address ethical considerations in AI use.

Create Technology Infrastructure

A robust technology infrastructure is the backbone of successful AI implementation in finance. Investing in a scalable, secure AI-driven financial performance management platform is critical to achieving this success. It is also critical that your financial team and processes can support the sophisticated data analytics AI requires.

Monitor Development

Continuously monitor the deployment and utilization of AI tools and applications. Regular updates, testing, and performance reviews are essential to maintain the accuracy and reliability of AI tools in financial planning.

Safeguard Cybersecurity

Protecting sensitive financial data is paramount. Implement robust cybersecurity measures to ensure secure, reliable AI operations.

Does Planful Offer an AI in Finance Solution?

Yes, Planful delivers AI-enabled assistants as a service through our Platform, augmenting human effort, streamlining collaborative processes, accelerating cycles, and upskilling teams. With persona-based intelligence, Planful enables insight-driven planning decisions and drives financial and operational excellence.

Planful’s AI/ML capabilities reduce FP&A cycle times, identify anomalies in financial data, minimize manual effort, and increase trust in the data. This confidence boost allows finance teams to focus on delivering insights and guiding strategic business decisions.

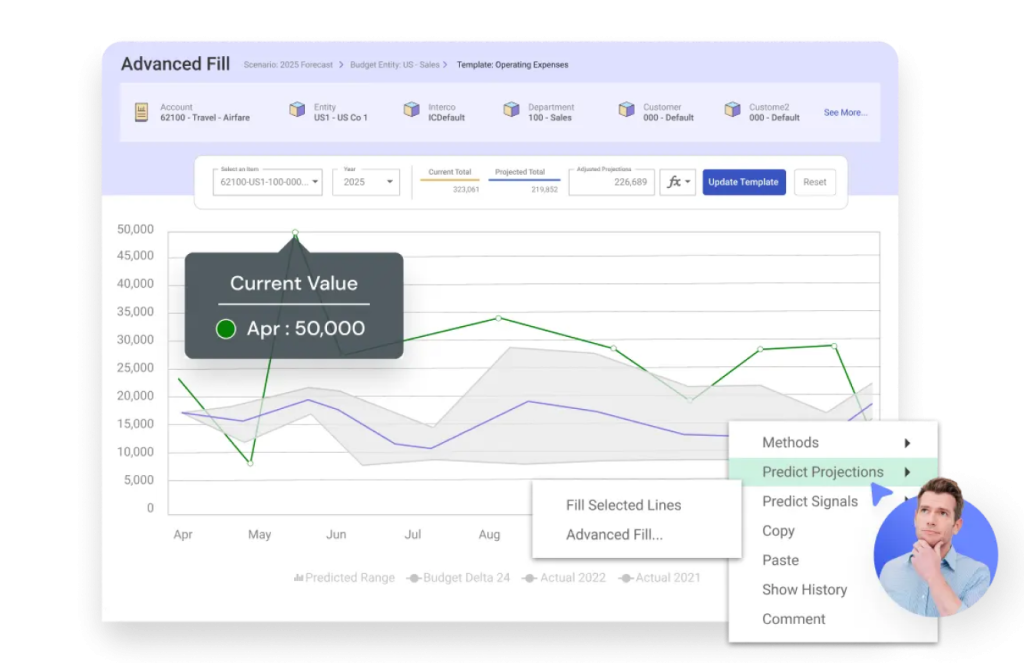

Planful AI – Detect identifies potential errors in data and creates hyper-accurate financial forecasts, enabling users to analyze historical data and highlight anomalies where inputs deviate from and historical trends. With Planful in the trenches, finance teams can focus on supporting growth with strong financial planning decisions.

Ready to transform your FP&A processes with AI? Take a tour of our Planful AI Labs video series for insights into how cutting-edge AI advancements are reshaping financial processes, or register for our on-demand webinar, “AI’s Impact on FP&A,” in partnership with the CFO Leadership Council.

You can also get an interactive demo to see Planful in action.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?