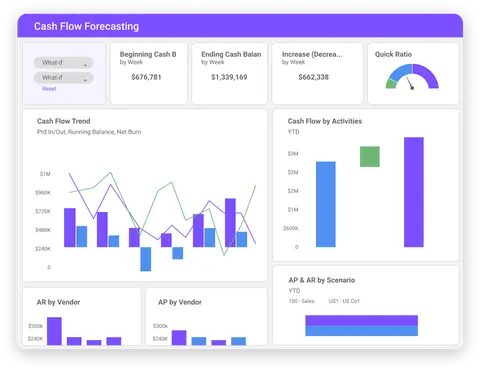

Cash Flow Forecasting

Optimize cash, manage for the short term, invest in the long term.

Cash Flow Forecasting

1,300+ Customers Trust Planful

Plan Often and Accurately to Keep Up with Change

Cash flow is the most critical aspect for protecting and growing your business, especially now. But pulling different levers to understand their impacts on cash should not be a manual, time-consuming process. Ambiguous projections and an outdated, inaccurate view of your cash hinder your ability to provide clarity to the business.

Optimize cash, shore up your capital position, and extend your runway to build business resilience. From a 13-week cash flow, to planning long term organic and inorganic growth, Planful provides driver-based cash flow forecasting and scenario analysis to fit your requirements.

“Being able to reforecast quickly and efficiently in the next 12 months is going to be hugely helpful for us as we pivot and redirect the ship with COVID-19”

How Planful Helps You

Gain control and visibility over your cash to understand the impact of decisions. Provide clarity to key stakeholders on short-term liquidity and long-term positioning.

Recognize trends and understand the levers to reallocate cash. Adjust investment opportunities by mitigating cash flow risk.

Collaborate from a single, centralized platform to move faster and act with more precision. Better engage with cash managers, controllers, and business leaders to turn plans into action.

Adjust Key Drivers To Manage Your Cash Position

Use driver-based cash flow forecasting to address assumptions across the business. Build scenarios on how cash is paid and received down to the dollar.

Learn more

Customize and Adjust To Current Market Dynamics

Choose the Direct Method or Indirect Method and tweak assumptions at any level. Plan for 13-weeks or use long-term cash flow models. Adjust forecasts instantly with breakback calculations applied across the business or to a specific unit.

Learn more

Bring Your Data and People Together

Automate and integrated financial statements to increase their impact with the business. Track submission status, assign responsibilities, stay ahead of deadlines, and collaborate with cash managers.

Learn more