Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreFinancial Budgeting

Financial Budgeting Definition

Financial budgeting is the process of planning company expenses and revenues for a time period. Budgets set forth the plans of management in financial terms. This includes allocating financial resources and identifying available cash flows for required spending.

A budget and financial planning strategy detail a company’s expectations for what it aims to achieve for the current, upcoming year or another timeframe. For example:

- Expense and revenue estimates

- Cash flows expected

- Debt reduction expected

- Comparison of actual versus projected business financial budget, calculation of variances between them

Financial budgeting represents the overall financial position, goals, and cash flow of an organization. This regular practice of timely operational and financial budgeting creates a baseline for comparison to see how actual results vary from expected performance.

Basic corporate financial budgeting process steps for an annual budget usually take between three to six months to complete. The components of this process, which remains confidential, might include:

- Establish and communicate management targets and goals

- Develop the detailed, final budget to directly support those targets and goals, and attach financial documents such as the balance sheet, income statement, and cash flow statement

- Finalize employee compensation plans (usually this is part of the process)

- Compile and adjust budget model and measurement metrics so management can assess progress

- Review and make final changes

- Approval

- Disseminate subordinate and/or line of business budgets across the organization

Financial budgeting enables a team to implement a business plan tactically to achieve corporate goals based on a detailed and descriptive roadmap using set metrics. This allows for careful monitoring of performance over time and the ability to make changes while in progress to eventually achieve the desired goals.

Financial Budgeting FAQs

What is Financial Budgeting and Forecasting?

Financial budgeting and financial forecasting help organizations plan where and how to evolve. The financial budget helps the business with the plan itself and the financial forecasting helps the team assess the current financial situation and whether the organization is moving in the right direction financially. The two tools are used in tandem, but they are distinct.

Budgeting quantifies the projected finances a business will be working with during a period. It sets the company’s financial direction for that period and sets expectations for income and revenue.

In contrast, financial forecasting estimates how much income or revenue will be achieved in a future period. This projection helps determine whether the company is meeting goals, allocating funds properly, and going in the right direction.

Budgeting serves as a baseline for comparison; this way management can see how expectations differ from actual performance. Management uses financial forecasting to analyze historical trends and company data to determine how to allocate the budget for the future.

In brief, financial forecasting:

- Does not engage in the historical analysis of the difference between actual performance and past forecasts like budgeting

- This is the future-facing assessment of how to allocate the budget for a future period

- Updated regularly, periodically, month-to-month or quarterly, as inventory, operations, or the financial budgeting plan change

- Can be short-term and/or long-term and can be updated with new data; for example, quarterly revenue forecasts might need to be updated based on changes to customer roll-up

- With forecasted data, a management team can take immediate action

Why is Budgeting Important for Financial Planning?

There are several reasons why financial management is important:

Greater resource availability. The primary function of financial budgeting is to ensure core resources are available as needed to implement plans and achieve business goals. Advance planning of financials allows leadership to determine which initiatives and teams require more or fewer resources.

Inform financial goals. Financial planning and budgeting can help set metrics for internal financial goals and record progress against them. Budgeting for any given period involves assessing how much revenue is needed to meet company-wide and team financial goals, not just allocating spend. Financial goals should be evidence-based and achievable enough that they inform other budget allocations.

Prioritize projects and initiatives. The value proposition of financial budgeting techniques is that prioritizing projects and initiatives is a natural byproduct of the process. When prioritizing each project, consider how it aligns with company values, the potential return on investment (ROI), and the extent it might affect broader financial goals. Determine each line item’s value to the organization and compare them.

Optimize financing opportunities. Documented budgetary information is particularly important for anyone potentially seeking funding or financing, such as a startup seeking outside investors, or an existing company needing a loan. Investors value detailed information about past, current, and predicted financial performance highly. Offering budgeting and financial reporting documents for previous periods demonstrates the ability to manage the finances of a business and allocate funds, and in some cases is required.

Achieve optimal flexibility. Ideally, everything goes to plan and all predictions are accurate. But as things like the coronavirus (COVID-19) pandemic in 2020 show us, this is rarely the case for organizations in the real world. Executives must often rework budgets thoughtfully and rapidly to account for safety concerns, major losses, and potential reputation damage. A budget is a plan to start with, and an agile mindset and the right tools enable leadership to adjust the plan as needed.

Business financial management is important because it helps organizations improve their profitability, extend their mission, save money, remain economically stable, and increase in value over the long haul.

Types of Financial Budgets

There are several types of financial budgets. Each approaches financial planning prioritizing different factors. Here are some common types:

Zero-based budgeting. At the start of each planning period, each item is set at zero dollars before reallocating. This approach is often used by organizations in financial distress, allowing them to start over each period.

Activity-based budgeting. Works backward from the company’s goals to determine the cost of achieving them and can be used to improve efficiencies and cut costs, especially in a large business.

Static budgeting/Incremental-based budgeting. Creates the budget for the upcoming period by adding or subtracting a percentage from the previous period using historical data. This model is usually best for businesses with highly predictable revenue and expenses that don’t fluctuate much.

Performance-based budgeting. Performance-based budgeting focuses on cash flow per unit toward programmatic results. It is often used by governments and nonprofits that need to keep an overall focus on their mission.

Value proposition budgeting. Assumes only line items that directly provide value to the organization should be included in the budget. This is another approach to government spending and sometimes to larger businesses taking an aggressive approach to spending.

Trialing various financial budgeting and forecasting techniques is one way to determine which is best suited to your organization; the right type of financial budget varies by situation and company.

What is the Financial Budgeting Process?

There are multiple steps in the process of creating a budget. Keep budgets as detailed and thorough as possible. Typically, a financial budget should include:

- All predicted revenue—including the value, types of revenue, and when it is expected

- Fixed expenses for the organization (employee salaries, insurance, property taxes, rent, utilities, etc.)

- Variable costs (maintenance, professional services, supplies, vehicle and travel expenses, etc.)

To create a budget, consider these financial budgeting tips:

- Review, collect, and comprehend all of the required budgetary inputs

- Analyze historical data, including previous budgets, to determine revenue and expense expectations by each fiscal period and year

- Collaborate with a cross-functional team of stakeholders, including budget owners, C-suite executives, and sales leaders to formulate the plan

- Identify any required capital expenditures such as infrastructure, equipment, or property that are required during the period

- Prepare financial statements with budgeted numbers including balance sheet, cash flow, and income statement

- Identify KPIs to measure progress

- Review the final budget for strategic growth opportunities such as adding equity or reducing debt, or other investment and divestment opportunities

Always monitor progress throughout the budgeted period, based on performance against budgeted goals, and update forecasts periodically.

Generate reliable financial forecasts as follows:

- Identify key metrics to focus the forecast such as marketing expenses or sales volume

- Input the latest actuals into the forecast template

- Determine the forecast time frame, typically to the end of the budgeted period

- Calculate trends based on year-to-date and historical actuals

- Apply trend calculations to real-time numbers and forecast results

- When updating the forecast, consider any variables such as geopolitical conditions or business situations, like a merger, that could skew the forecast

Periodic forecasts typically only project to the end of the current fiscal year. Instead of projecting to the end of the fiscal year, rolling forecasts are generated monthly, quarterly or weekly to help plan for a specific period beyond the annual budget—the coming six quarters, for instance. The forecast actualizes a unit, whether it’s a fiscal month or quarter, and then “rolls” to the next period. This enables the leadership to keep sight of long-term business strategies.

What is Included in a Financial Budget?

A financial budget offers a strategic overview of how a business manages cash flow, assets, expenses, and income. It establishes a comprehensive overview of revenue from core operations relative to spending via a comprehensive documentary picture of a company’s financial health. Financial budgets typically include a balance sheet, budgeted income statement, capital expenditures budget, and cash budget.

Benefits of Financial Budgeting

Financial budgeting enables an organization to chart its path and empowers the management team to engage in strategic enterprise budgeting and planning. The financial budgeting process delivers a clearly defined plan that reflects organizational goals for operations and finances. Financial budgets offer critical guidance for the year’s goals.

Other key benefits of financial budgeting include:

- Close examination of financial activities

- Expenses are more likely to be assessed for viability

- Detailed documentation of all the uses and sources of cash is required, ultimately allowing for accurate anticipation of cash flows by management

- Cross-functional stakeholders involved in budgeting create a sense of ownership and motivate team to achieve budgeted goals

- Budget, forecasts, and up-to-date financial results can always be compared for real-time insights into performance, and offer a chance to adapt

- Clarifies internal hierarchies and individual responsibilities

- Clarifies where and when financial resources are allocated and needed

Remember, budgets can become outdated as they are prepared in advance and based on a number of assumptions, so forecasting is also important—especially when questions are time-sensitive.

Other benefits to forecasting include:

- Forecasting identifies trends that may require a strategic adjustment

- A well-informed prediction of how, when, and why future costs may fluctuate enables simpler management of capital requirements and cash flows

- Reliable forecasts may open up more opportunities for financing with investors

- Forecasted numbers offer a logical starting point for the next budget

- Forecasting offers smart short-term focus for managers

Who is Responsible for Enterprise Financial Budgeting?

The budget owner is the person who is ultimately responsible for ensuring that the budget is followed. Budget owners are usually the operational directors and managers of companies who must ensure that the company follows whatever budget is laid out for them. The shareholders, owners, or the board of directors tasks the budget owner with this one, overarching duty.

Many large companies employ a committee of multiple budget owners charged with ensuring that the budget is followed. Typically, the committee consists of directors and managers from various divisions and departments of the company. This is a more democratic but less efficient approach that can lead to indecisiveness and even infighting.

However, even a single budget owner does not work alone and instead has consultants, financial experts, lawyers, industry experts, and others working under them. The budget owner is ultimately accountable to the shareholders or owners.

Typically on the budget owner team:

Department managers. Mid-level department managers provide information to the finance and accounting department throughout the budgeting process, reporting revenue contributions and departmental expenses and providing the details needed to project future income and expenses.

Finance and Accounting team. Corporate finance and accounting teams manage accounts receivable, accounts payable, bookkeeping, and payroll. Senior associates might create sales and payroll reports, analyze input-cost trends, audit expense reports, or engage in other tasks as part of the budgeting process.

Corporate executives. Corporate executives at the top management level are directly accountable to the board of directors, manage the company’s finances, and present final budget proposals to the board. The chief financial officer (CFO) or equivalent executive is responsible for top-level budgets based on the finance or accounting team’s input. Sales directors forecast the next year’s sales trends. Chief operating officers (COOs) forecast future payroll and operating costs. Chief marketing officers (CMOs) forecast the next year’s expected market-share increase and marketing expenses, while chief technology officers (CTOs) forecast technology expenses.

Board of Directors. Corporate executives report directly to the board of directors who serve as the stockholders’ chosen representatives, and offer the final vote on proposed budgets. Board members answer directly to shareholders and company owners.

What are Financial Budgeting Tools?

There are a number of challenges that impede financial budgeting and forecasting efforts. Financial planning & budgeting software tools are commonly used to deal with these issues—because nearly all of them have to do with coping with data.

Disparate, wide-ranging sources of disconnected data collected. Data silos are a tremendous problem for finance and budgeting teams. Trying to extract data from siloed sources reduces the time spent on real analysis. It slows down the financial budgeting and forecasting cycle and makes it tougher to adapt to rapidly changing market conditions.

Manual processes and inaccurate data. While many finance teams still use offline spreadsheets and similar analog tools for financial budgeting and other core FP&A activities, they are slow, labor intensive, and impossible to manage across large businesses. Something like an Excel spreadsheet lacks the version control and data integrity solutions of corporate financial budgeting software with database capabilities.

Time-consuming data collection and input automated. Many contributors spending time editing many spreadsheets means that aggregation and data entry will be lengthy, error-ridden tasks. Finance automation tools render this manual sorting of budgeting data unnecessary.

Difficult collaboration simplified. The old-fashioned way of collecting data for the budgeting process from various departments is difficult. Spreadsheets are inflexible, and it’s not easy to aggregate, manipulate, retroactively change, and/or share budgeting data. An FP&A platform such as Planful makes data sharing and work between cross-functional teams simpler, and lends visibility to processes with current, accurate data.

Insights made relevant. Real-time tracking of forecasting and financial budgeting KPIs are the key to regulating the financial health of a business. This kind of agile budgeting and financial planning process keeps companies profitable and competitive.

The role of data-driven platforms is to remain responsive, and rapidly help the user share insights. They can generate accurate sales forecasts based on historical data, create projections for future sales, and predict fluctuations to help develop accurate budget plans.

Does Planful Help With Financial Budgeting?

How does Planful financial budgeting and forecasting software help with financial budgeting?

Planful financial budgeting and forecasting software helps by providing teams with audit trails, workflows, and data validation measures all in one place for confident financial budgeting and forecasting.

There are many reasons to automate data entries for financial budgeting and forecasting:

- Reduce budgeting and forecasting cycle times by up to 50% or more

- View forecasts, budgets, and actuals from the same template so you can more easily identify trends and variances

- Drill down into transaction-level details right from your budget and forecast templates

- Complete planning solutions don’t usually require maintenance or management from IT

- Cross-functional stakeholders can all work from the same connected template. Audit trails allow users to track, validate, and approve changes and add commentary

- Scenario modeling features make it simple to test forecasts and budgets against an unlimited number of potential future business scenarios

- Customizable workflows let you supplement the budgeting process with an additional executive review step

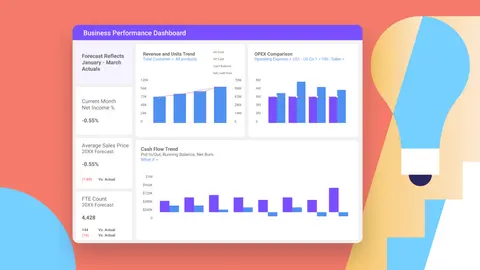

- Data visualization dashboarding helps stakeholders visualize where the business is headed

Curious to learn what else Planful can do to help your team learn how to do financial budgeting more effectively? Contact us for a demo of our automated financial budgeting services.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?