How to Effectively Track Your Marketing Expenses

A marketing expense is a marketing expense, right? In the sense that they all hit your budget, yes. In most other respects, not really.

The team dinner check, the hotel block-booking for a trade show, the rush print job for the key customer visit, the dreaded expense that’s transferred in from another department, the CRM subscription. Different types of expenses have very different lifecycles. Some of them you can (and should) plan for, and you will need to account for them in your financial planning.

In this blog post, you’ll learn how to identify your marketing expenses. Then, you’ll explore a full lifecycle of a typical marketing expense and the different expense categories that fit within it.

What is a marketing expense?

A marketing expense is the amount of money spent in promoting, advertising, or marketing a business and its products, services, or solutions. These expenses are costs that directly contribute to the performance of marketing activities and overall efforts.

Marketing expense categories:

Today’s expenses cover everything from digital and social media advertising to marketing automation platforms. Here is a breakdown of how marketing expenses are typically categorized:

- Salaries, benefits, and other costs for marketing employees

- Software, tools, and automation platforms

- Outside vendors, agencies, and consultants

- Advertising expenses

- Public relations costs

- Events/trade-show costs

- Team trainings, conferences, and corporate outings

- Travel expenses

The marketing expense lifecycle:

Think of every marketing expense as moving through a predictable lifecycle.

Understanding these stages helps you manage your budget more confidently, spot issues sooner, and make better decisions with your team.

Once you know how expenses flow from idea to actual spend, you can look at your plan with a fresh eye and treat each line item in the way that’s most useful for planning and accountability.

The four key stages of your marketing expense lifecycle:

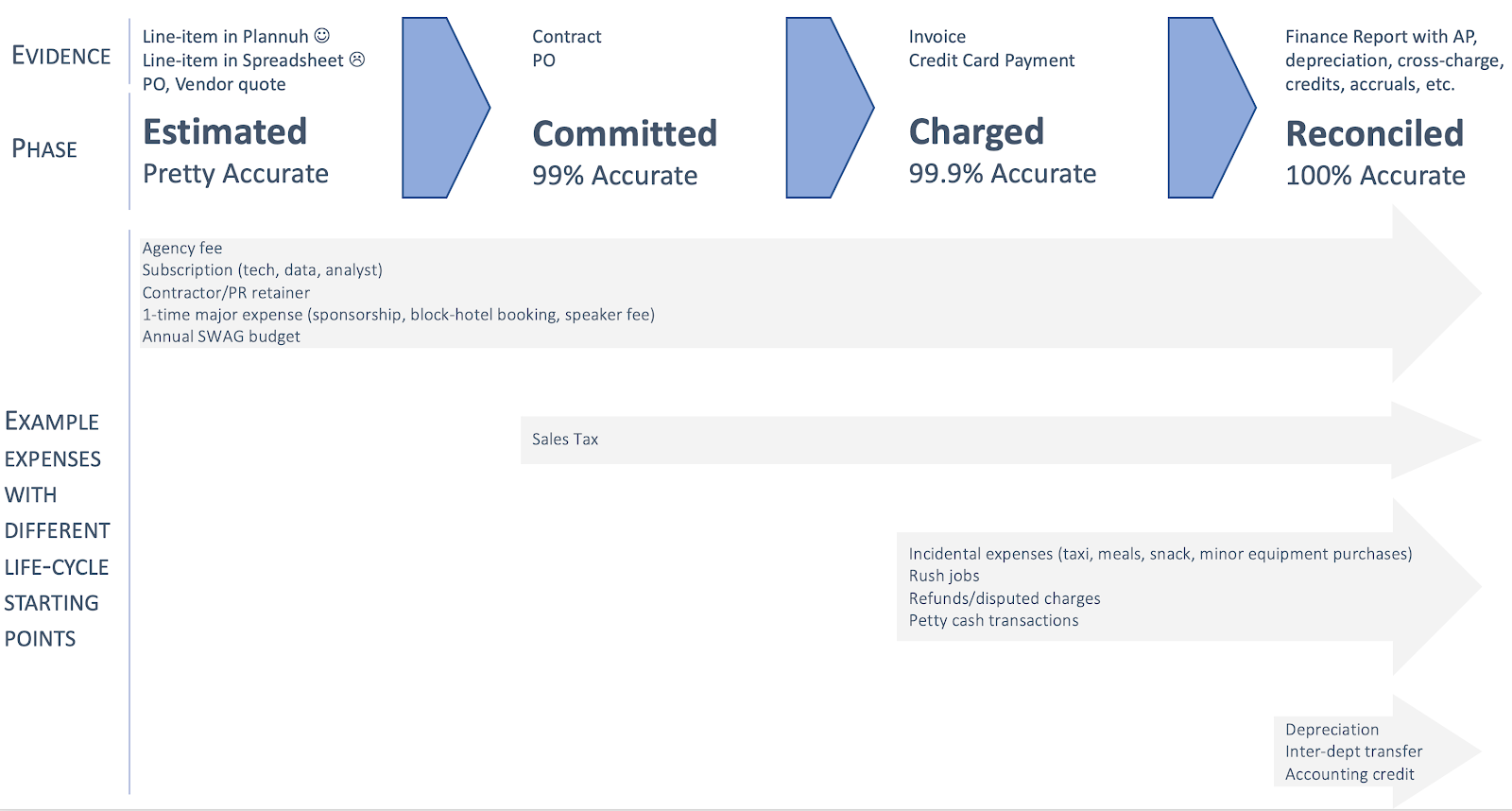

Estimated→ Committed → Charged → Reconciled

Together, these stages give you a full picture of where your budget stands—not just what you think you’ll spend, but what you’ve already promised, what has actually hit the books, and what’s truly final.

Let’s look at each of these four stages in detail.

Estimated expenses

We have to estimate expenses all the time: we know we’re going to need to book some rooms and pay for some meals at that upcoming event; we’re going to need a creative agency for our upcoming campaign; we’re going to publish some billboards downtown.

When we know about these expenses in advance, we should estimate them. Planned marketing expenses should have estimated amounts.

Committed expenses

Some marketing expenses will be large enough and far enough in the future that we decide to negotiate the price with a vendor. We may sign a contract to lock in that price along with other terms. For example, you might outsource an advertising agency for a social media campaign, a creative agency to help you prepare for an event, or a new technology platform to automate some of your marketing processes.

Once you’ve signed the contract, you have a more precise view of the cost than your initial estimate, and you know you’re on the hook to pay that money (unless the vendor somehow breaches the contract). You haven’t been invoiced, and the service hasn’t been delivered, but you know you will pay a precise amount in the future. Negotiated expenses should have very accurate cost estimates.

Charged expenses

From the marketers’ perspective, expenses are charged once the service has been delivered or once an invoice has been sent. It’s worth noting that the expense should be marked as charged regardless of whether or not it has been paid by finance. Marketing teams should first care about how much budget has been consumed and how much is left.

Surprisingly, we have frequently met marketers concerned about when and whether a bill has been paid. When a bill is charged against your financial budget from a marketing perspective, it’s spent, which is important to understand.

But when a bill is paid is the finance team’s concern, which does not affect how much marketing budget is left. We recommend you treat invoicing as the trigger to mark an expense as charged. Likewise, you should treat credit card expenses as charged.

Reconciled expenses

Most marketing teams receive a periodic report from their finance counterparts that includes the accounting system’s view of all the paid bills charged to marketing.

Most of the time, this will contain line-by-line confirmations of what you already know and have in your plan. However, the final accounting of marketing expenses may well contain changes that you need to know about and pay attention to.

For example:

- You didn’t anticipate the sales tax for your finally negotiated price, and the cost that finance has to account for is a little higher than you thought

- Finance has charged something to marketing that surprises you – it wasn’t in your plan. This might include some credit card expenses that you didn’t know existed until now, an expense transferred in from another department, or a change of date to an expense due to accruals-based accounting

To stay aligned with Finance, you need to bring your marketing plan in line with their official reports. That’s how your accurate view of charged expenses ultimately makes its way into the system of record.

The catch? You can’t wait weeks or months for those reports. If you do, you’re flying blind, and it becomes almost impossible to spend confidently or manage your burn rate. That’s why Marketing needs its own real-time view of charged expenses.

When everyone on the team keeps their numbers up to date, you can make fast, fact-based decisions without waiting on Finance.

Now that we’ve covered the model and the stages, we can look at the different types of expenses and how to manage each one.

Not every expense moves neatly through the full lifecycle—some skip stages or show up right at the end. In the next section, we’ll walk through those variations and bring them together in one simple model.

Carried-over expenses

When you enter your budget year, your budget should contain at least many estimated, committed, and possibly even charged and reconciled expenses.

Examples of these expenses include:

- Marketing campaigns that cross fiscal year boundaries

- Annual events

- Subscription fees for data or technology

- Open POs for contractors, agencies, etc.

- Corporate allocations

- Depreciation

Many of these marketing expenses will be at least charged and often reconciled on day 1 of the fiscal year.

What’s the difference between planned and unplanned expenses?

Though there are expenses that can be planned for, there are many unplanned expenses that will crop up throughout the year. The more thoroughly you can add your planned expenses to your budget, the better your visibility into what remains to be spent and how close to over budget you are. Keep reading to learn more about planned versus unplanned expenses.

Planned marketing expenses

If you have a new campaign, set of expenses, or an individual expense that you know is new for the fiscal year, you should enter it into your plan with the most accurate estimate of the expense that you can manage. It doesn’t matter if it’s imperfect–it’s much better to have something in your budget than nothing.

Examples include event expenses known in advance (e.g., block room booking, travel, meals, booth expenses, printing, agencies, etc.); a digital campaign with an estimated spend-per-day ceiling; technology and data subscriptions; contractor retainers, and so on.

Planned expenses may be large enough that you have to raise a PO and negotiate price and payment terms, or they may be small or fast-moving enough that they are charged to a credit card without a PO or contract.

Planned expense buckets

You may plan an aggregate cost for a group of expenses and reserve a budget for them. For example, you might budget an amount for travel every month even though you don’t know the precise makeup of taxi rides, train fares, airfares, and car mileage that will come in. Such expenses will likely be charged to credit cards – maybe even paid by cash – and won’t be explicitly in the marketing plan with line-by-line precision. When you see them as individual expenses, they will already be committed or even reconciled, and they should be charged to the marketing budget you reserved for them as they come in.

Unplanned marketing expenses

No one likes unplanned marketing expenses, but they happen all the time. We normally become aware of these expenses when we receive our finance report. What’s unpleasant about these costs is that they are often already charged and accounted for the first time you see them.

It makes a lot of sense to try to understand your surprise-expense run rate if you can. If you don’t know what it is, look at some historical data and try to find expenses like this: accounting reclassifications (for example, an expense is moved into your budget from another department); corporate allocation you didn’t know about; someone did something bad with the corporate credit card, and you have to eat the cost.

You may encounter surprise expenses from unforeseen issues. You may have unexpected PR costs from a crisis management project (e.g., customer, press, investor, and analyst communications after a data breach), for example, or you may have to make a major mid-year adjustment in your plan due to an external factor, like a natural disaster.

Disputed expenses

When you get a surprise expense, you may conclude it doesn’t belong in your budget. This is a common occurrence, and it pays to be diligent–you have enough to worry about paying another department’s bills.

Corporate and departmental budget allocations are frequent candidates to be disputed. You need to track the expense in your budget as if it will be paid by you until finance agrees to move it.

Moving expenses

You planned it. You know what date the invoice arrived and how much it was for. You know it belongs to marketing. So why can’t you find it in the expense report?

It’s important to understand how your finance team accounts for expenses. Otherwise, you may find that expenses you thought hit your budget in one time period were applied in a different time frame. This can lead to inadvertent underspending or overspending, even if you’ve diligently tracked your expenses before interlocking with the finance team.

Tracking expenses

The figure below is the unified expense model. It shows when different types of expenses may be initiated during the expense lifecycle, the evidence for their existence, and the phases they will occupy until they are reconciled. It’s possible that your expenses won’t work exactly like this. That will depend on the specific policies and practices adopted by your company.

What is important is that you and your marketing team understand how your expenses are handled for your company’s marketing budget. If you understand this well, you can plan and execute your spending accurately to achieve your marketing goals.

It’s time to invest in a marketing expense management solution

Diligent, accurate expense management is impossible in a spreadsheet. Planful’s marketing expense management solution is highly automated, clearly visible, and easily editable.

Before you go, remember these 3 things…

- Different expenses follow different paths, and understanding their lifecycle helps teams manage budgets more accurately.

- Planned expenses prevent budget surprises by giving teams early visibility into estimated and committed costs.

- Real-time tracking improves decision-making by helping marketers act quickly without waiting for finance reports.

It’s easier than you think to track, report on, and optimize your marketing spend

Explore our interactive demo to see how Planful helps you maximize every dollar of your marketing budget.

FAQs

What are considered marketing expenses in a budget?

Marketing expenses include any costs related to promoting a company’s products or services. Common examples are advertising, software tools, agency fees, events, and employee salaries tied to marketing. These costs should be categorized clearly to improve visibility and control.

How do you track marketing expenses effectively?

Tracking marketing expenses means monitoring them through every stage: estimated, committed, charged, and reconciled. A structured expense lifecycle helps marketers understand what’s already spent and what’s still planned. This clarity enables better budget pacing and reduces surprises.

What makes Planful’s approach to marketing expenses different?

Planful helps marketing teams manage expenses in real time instead of waiting for delayed finance reports. By giving teams full visibility into every stage of the expense lifecycle, Planful enables faster, more accurate budget decisions without relying on spreadsheets.

Latest Posts

Blogs

Interviews, tips, guides, industry best practices, and news.