Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreAI Tools for Finance

AI Tools for Finance: An Overview

Finance teams are increasingly leveraging artificial intelligence to gain sharper insights, reduce manual effort, and react quicker to dynamic market shifts. From automating reconciliation to enhancing forecast accuracy, AI tools for finance are transforming the role of finance from reactive reporting to strategic leadership.

In this overview, we explore what AI in finance really means, who’s using the tools, where they are making an impact, and why it matters more than ever.

AI Tools for Finance FAQs

What is AI for Finance?

AI for finance refers to the application of artificial intelligence technologies, like machine learning, natural language processing (NLP), and predictive analytics, to financial workflows, decisions, and systems. It’s about augmenting human expertise, not replacing it. Whether identifying patterns in large datasets or flagging anomalies before they become costly errors, AI in finance and accounting is helping teams focus on what matters: strategic decision-making.

In the corporate finance context, AI in finance improves visibility, accelerates planning cycles, and helps teams respond in real time to changes in the business. Rather than relying solely on historical data, finance leaders can now simulate different scenarios to lead with more confidence.

What are AI Tools for Finance?

AI tools for finance are software applications or platforms that incorporate artificial intelligence to support tasks like financial budgeting, financial forecasting, financial planning, auditing, and analysis. These tools are purpose-built for finance and accounting teams, providing enhanced automation, deeper insights, and better risk management.

For example, some AI tools for finance professionals use predictive algorithms to improve cash flow forecasting. Others can automatically categorize expenses or detect anomalies in journal entries. AI is also enhancing scenario modeling and enabling real-time updates to financial plans as new data flows in.

The best AI tools for finance are embedded directly into financial performance management platforms like Planful, allowing teams to access insights and automations within the tools they already use.

AI Tools for Finance > Error Detection

Who Uses AI Tools for Finance?

Finance professionals at all levels are adopting AI tools, from CFOs seeking more strategic insights to analysts drowning in spreadsheets. But adoption isn’t limited to the office of finance.

Here’s who’s putting AI in finance to work:

- Corporate finance teams leveraging AI to strengthen forecasting and scenario planning.

- FP&A professionals using AI to automate data consolidation and trend analysis.

- Sales operations teams using AI to forecast bookings, pipeline conversions, and optimize territory planning.

- Controllers and accountants who rely on AI to reduce time spent on reconciliations and compliance.

- Marketing leaders integrating AI-driven ROI analysis to inform spend forecasts and campaign planning.

- Revenue leaders leveraging predictive insights to adjust quotas, incentive plans, and headcount forecasts in real-time.

- HR and workforce planning teams using AI to forecast hiring needs, retention risks, and compensation scenarios.

- Supply chain and operations teams applying AI to anticipate demand, align inventory with sales forecasts, and reduce disruptions.

- CFOs and finance executives looking for faster, data-driven decision-making.

As the future of AI in finance evolves, adoption will likely become less about cutting-edge innovation and more about meeting expectations for speed, accuracy, and agility.

What are Some AI Tools for Finance Use Cases?

Using AI in finance spans a wide range of practical applications:

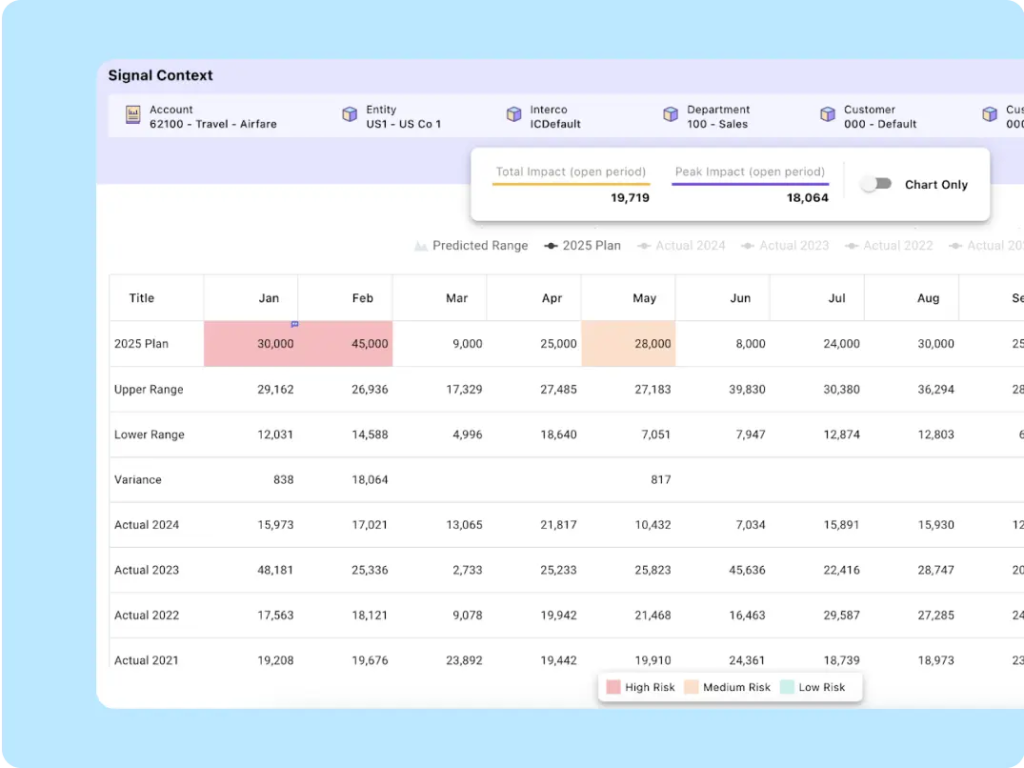

- Forecasting and planning: AI models can evaluate the data from historical, current and different forecast scenarios to predict future revenue, expenses, or cash flow. Planful’s Predictive Forecasting capabilities support this dynamic planning by leveraging both historical trends and scenario-based projections.

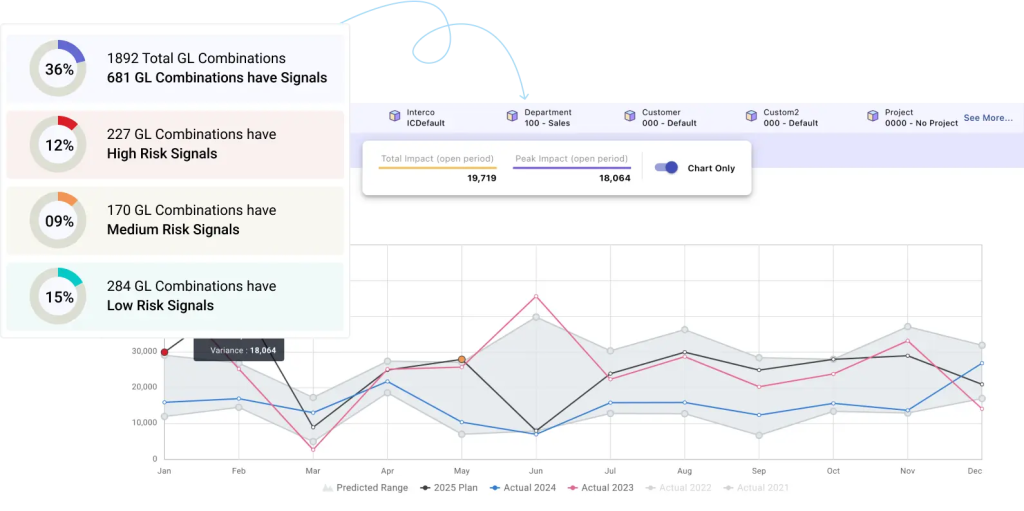

- Anomaly detection: Machine learning algorithms flag unusual transactions or errors in real time, supporting fraud detection and compliance.

- Expense management: AI automates expense categorization, flagging outliers or non-compliant spending.

- Natural language queries: Teams can ask finance-specific questions and get accurate, real-time answers, eliminating complex data pulls.

- Scenario analysis: AI supports faster creation and comparison of multiple financial scenarios, empowering strategic what-if modeling.

AI Tools for Finance > Anomaly Detection

These AI applications in finance reduce human error, eliminate tedious work, and provide deeper insights faster. These gains free up teams to deliver more value by allowing them to increase focus on strategic decision-making.

What are the Benefits of Using AI Tools for Finance?

The benefits of AI in finance go beyond efficiency. Here’s what organizations are seeing when they invest in the use of AI in finance workflows:

- Speed: AI dramatically reduces the time to collect, process, reconcile and analyze data.

- Accuracy: Machine learning models improve over time, resulting in more accurate forecasts and insights.

- Agility: With real-time insights, finance teams can respond to change immediately.

- Scalability: AI tools grow with your data, enabling more complex analysis without extra headcount.

- Strategic focus: By removing manual burdens, AI frees teams to focus on business-critical work.

Whether your goal is to optimize working capital or support board-level decision-making, AI in corporate finance provides the tools to elevate your impact.

AI Tools for Finance > Actuals Dashboard

AI Tools for Finance Summary

The future of AI in finance isn’t hypothetical, it’s already reshaping how teams plan, analyze, and execute. With the right tools, finance and accounting teams can operate with greater clarity, faster cycles, and stronger strategic influence.

If you’re just getting started with AI tools for finance and accounting, focus on use cases where automation delivers immediate ROI. Think cash flow forecasting, anomaly detection, and automated reconciliation. From there, expand into more advanced predictive analytics and scenario modeling.

Choosing the right AI tools for finance means aligning capabilities with your team’s needs, and embedding those tools into platforms you already trust.

Does Planful’s Financial Performance Management Platform Include AI Tools for Finance?

Absolutely! Planful AI delivers built-in AI tools for finance that work seamlessly across forecasting, planning, and analysis. With predictive insights powered by machine learning, finance teams can spot risks, uncover trends, and optimize performance without switching systems.

Through innovations like Planful AI, AI Labs, and continuous investments in explainable AI, Planful is helping redefine the intersection of AI and finance. And the results are real: customers are seeing faster close cycles, more accurate forecasts, and impactful, value-add decisions.

Explore how AI-enhanced finance is shaping tomorrow’s finance teams in our on-demand webinar or check out the AI for Financial Planning eBook to go deeper.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?