Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreFinancial Reporting and Analysis

Financial reporting is an accounting process of communicating an organization’s financial performance to internal and external stakeholders.

Financial Reporting and Analysis Definition

Reporting on financial health is required by law for public and private companies, but the requirements for those reports may differ.

Proper financial reporting and analysis provide shareholders, investors, executives, and boards of directors with a clear picture of a business’s trajectory and growth. It also empowers these leaders to make accurate decisions to improve a business’s future performance and growth.

Manual FP&A processes for financial analysis and reporting are no longer the norm. These time-consuming practices are now replaced with cloud-based financial performance management (FPM) tools designed to automate reporting and make the information in reports more accurate.

Financial Reporting and Analysis FAQs

What is Financial Reporting, Analysis, and Forecasting?

Financial reporting

Financial reporting is a formal process that an accurate picture of a company’s finances for both internal and external stakeholders.

The foundational documents that make up a financial reporting process include:

- An income statement

- A balance sheet

- A cash flow statement

- A statement of changes in equity

Together, these documents provide a holistic and detailed look into a company’s financial health.

Financial analysis and financial forecasting

Financial analysis involves reviewing a company’s financial statements and data to get a clear picture of its financial position.

Financial forecasting leverages past financial data to predict future performance.

Financial reporting and statement analysis are also legal requirements for most companies. These requirements are designed so that companies provide accurate and transparent financial information to investors and other stakeholders.

The type of financial planning and analysis (FP&A) reports that a company uses should align with its management structure and culture. Reports must provide the information that decision-makers need.

What are the Four Main Types of Financial Reporting?

When it comes to financial reporting, there are four core types of documents that make up the foundation of most reporting processes.

Various types of financial reporting serve different purposes. Some of the most common ones include:

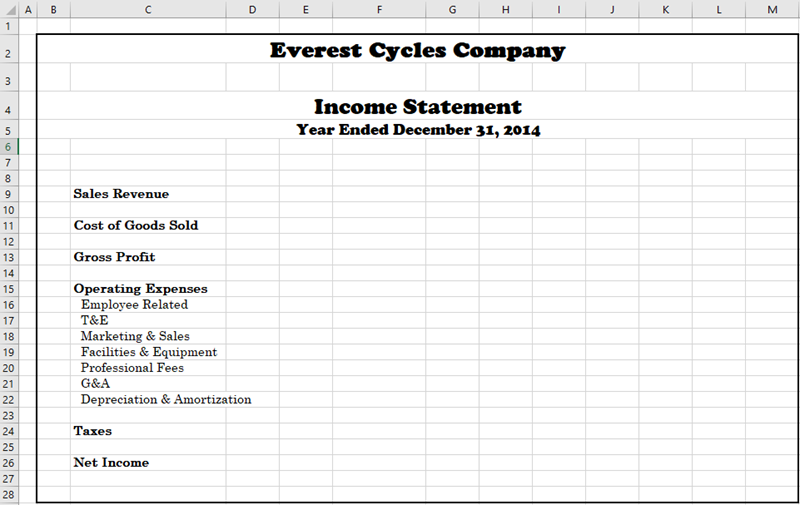

Income statement

Also known as profit and loss or P&L report, an income statement is a financial analysis report that reveals incomes and expenses for the business over a given period of time with a focus on expenses, revenue, gains, and losses.

The primary goal of an income statement is to clearly assess profitability by summarizing key production costs, sales activities, and other operational expenses during an accounting period to determine profit and loss. Investors and creditors often combine information from the income statement with data from other financial statements to assess the risk of offering financial assistance.

Balance sheet

A balance sheet is a type of financial statement that offers a summary of financial health based on a detailed overview of liabilities, assets, and stockholder/owner equity.

This document is commonly used internally by stakeholders to assess progress and direction, or externally by anyone interested in the company’s available resources and investing in them.

Cash flow statement

A cash flow statement shows how much cash the company generates (i.e., cash received) and what costs the cash is spent on (i.e., cash paid).

This document includes elements of both the balance sheet and the income statement, offers insights into solvency and liquidity, and is critical to good business management.

More specifically, a cash flow statement usually shows:

- Operating cash flow: Expenses, gains, revenue, and losses

- Investment cash flow: Cash from equity and debt sales and purchases

- Financial cash flow: Loan and equity payments such as company stock sales and other long-term liabilities

The cash flow statement also helps investors and lenders determine repayment potential.

Statement of changes in equity

Some businesses may include a statement of changes in equity.

This document reports to stakeholders on factors that change equity during the accounting period. The statement includes transactions not recorded in a company’s income statement and balance sheet, such as dividend payments and equity withdrawal, and helps investors and shareholders make smarter investment decisions.

Whatever your company’s financial goals, adhering to a data-driven, analytical approach to the basics of financial reporting and analysis using financial accounting information can significantly accelerate business growth.

What is the Financial Reporting and Analysis Process?

The role of a corporate financial reporting and analysis team is forward-looking, strategic, and influential. Applying best practices to financial reporting and analysis can improve data quality and serve business needs more effectively:

- Leverage a single source of truth

- Group audiences by roles or report types

- Automate standard reports

- Allow business users to self-serve data and reports

Leverage a single source of truth

As a business grows, analysis and reporting of financial data becomes a more complicated process involving more systems.

It is crucial to visualize all relevant financial data, such as procurement, expense, customer relationship management, and payroll, together to accurately analyze it. Examining data that is segregated into different systems is difficult, and it increases the likelihood of errors or missed information.

Many businesses capture and track primary financial transactions with a financial performance mangement (FPM) platform like Planful. These organizations also use various external applications for tasks such as payroll, expense reporting, and purchasing.

Financial reporting and analysis software is designed to serve as the ultimate single source of truth for all company operational and financial data and deliver all the holistic insights that follow from that source.

Group audiences by roles or report types

Financial analysis and reporting and the FP&A team serve as central subject matter experts on the company’s financial outlook.

But, to offer financial insights to the different parts of the business, they must understand the reporting needs of all users. Grouping stakeholders by either report type or user type simplifies this process.

For example, a user type group might include executive (board and CEO) or financial (VP Finance, CFO, accounting). Grouped by report type, you might divide up summary reports (board and CEO) and financial reports (VP Finance, CFO, accounting) and arrive at similar results.

Understanding what data is needed, when, how often, and in what amount of detail helps suggest scalable solutions for various users.

Automate standard reports

Generate frequently used reports with automation, especially those that go out regularly, such as weekly, monthly, and quarterly reports. This reduces costs and manual labor.

Allow business users to self-serve data and reports

In situations when automated reports are insufficient, allowing users to run reports can reduce the burden on the FP&A team. Leveraging filtered data from a single source of truth can ensure reliable results for all business users and allow them to customize their view of results.

Adhere to international standards

There are three main regulations that standardize financial reports working with EU-based data include:

The GAAP (Generally Accepted Accounting Principles) system is used in the United States almost exclusively.

The IFRS (International Financial Reporting Standards) system is used in over 110 countries worldwide, including Australia, Canada, China, and India, (although the IFRS is a bit different in China and India).

The GDPR (The General Data Protection Regulation) modernized personal data protection laws, and touches on businesses handling sensitive financial data of any kind.

What is Included in Financial Reporting and Analysis?

Let’s look at five use-cases for an organization to build an effective financial reporting and analysis process:

1. When a stock purchase is wise. Financial reporting and analysis enables users to conduct due diligence before investing in a company on behalf of an organization. This can also help determine how a company is priced in the stock market.

2. When determining if a business is or will be profitable. The detailed financial statements express the overall profit and loss of the company, and the direction of its progress for shareholders.

3. For understanding how much cash is in the business. Solid financial accounting reporting and analysis can ensure a business is ready to meet payroll and other obligations while remaining financially solvent.

Even when things are very steady and going well, it is wise to engage in financial accounting reporting analysis and decision-making as a worst-case scenario exercise regularly to expose risks.

4. To have sufficient capital to fund projects. Some companies may sit on massive amounts of cash, but more often companies invest their money if they can while staying financially healthy. For example, they may need to upgrade equipment regularly, a good long-term investment, but a massive short-term expense.

5. When assessing the health of a vendor relationship. Supplier, client, or vendor relationships are closely linked to a company’s ongoing financial health. Inefficient, strained, or fraught vendor or supplier relationships can damage brand reputation, productivity, and profits.

Benefits of Financial Reporting and Analysis

At a minimum, public companies are required by law to submit quarterly financial and annual reports, while most also perform internal measurements monthly.

However, the main goal of financial analysis and reporting is to help business partners, department heads, financiers, and stakeholders make strategic decisions about business growth, operations, and future profitability based on its overall stability and financial health.

Regular valuation of a company’s financial stability and performance has several long-lasting benefits:

1. Improve business performance. Accurate analysis and tracking of a business’s finances improve performance. Financial statements include detailed information on expenses, revenues, capital, profits, and cash flow teams may use to identify key areas of spending, track historical performance, enhance communications, and create forecasts. Financial reporting and analysis also offers high visibility of debt, liquidity, risks, trends, obstacles, and opportunities for investment and growth on the horizon.

2. Maintain transparency. Open access to a company’s financial data helps build trusting business relationships. It also helps improve interactions between teams and departments, and helps business leaders at all levels plan budgets, make decisions, and track results based on financial data—all in plain view.

3. Ensure compliance. Compliance with all core investor, accounting, and industry rules and guidelines is a core pillar for any good finance team, and critical to the trustworthiness of financial statements.

Each document generated with financial reporting and analysis software complies with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) or both based on the demands of regulatory institutions such as The Financial Accounting Standards Board (FASB). Financial reports must also comply with tax regulations criteria for financial reporting established by the Internal Revenue Service (IRS). Publicly traded companies must file and publish quarterly and annual results with the Securities and Exchange Commission (SEC).

4. Identify trends. Regardless of the type of financial activity the user chooses to track, financial reporting and analysis helps identify past and current trends, and as a result make improvements.

5. For improved internal vision. Financial reporting and financial statement analysis offers a cohesive, accurate, and broadly accessible way to share crucial financial data throughout an organization. Financial analysis and reporting help to answer vital questions about every aspect of a company’s financial activities.

6. For performing audits and raising capital. Advanced financial reporting and analysis assists organizations, regardless of industry, in raising funds precisely and managing them compliantly. Financial analysis and reporting also facilitates statutory audits.

Who is Responsible for Financial Reporting and Analysis?

Financial reporting and analysis serves and informs a variety of stakeholders, both external and internal.

External stakeholders may include bankers, investors, owners, markets, regulators, and boards of directors. These external stakeholders must understand the business’s financial performance to ensure compliance, levy taxes, guide investment decisions, and advise executive management.

Internal stakeholders can include the CEO, CFO, senior-level management, and management across the enterprise. Internal stakeholders are typically most interested in the consolidated enterprise income statement, as well as profit and loss reports for their department.

Financial reporting of this kind goes beyond reporting of data to include financial analysis, which may include:

- Comparisons between the original budget and financial results showing positive and negative variances for analysis.

- Comparisons against prior period performance.

- Comparisons of expenses, revenue, and profit/loss across product lines, departments, business units, or subsidiaries.

The importance of financial analysis and reporting may vary slightly depending on the context of the internal and external stakeholders. However, each of the various stakeholder groups benefits from financial analysis and reporting:

- Regulatory institutions. Various governmental entities, including tax agencies, collect financial data to monitor compliance. Financial reporting and analysis solutions provide an organized, unified view of total liability in one place that complies with all current laws and regulations.

- Lenders, investors, and shareholders. Lenders use financial reports to ensure borrowers can repay loans and interest. Investors and shareholders use financial reports to assess how the company is generating a profit and the state of its investments.

- Business managers. Managers may benefit more than any other stakeholder from an efficient financial reporting system that tracks performance on a deeper level and enables users to create data-driven strategies.

- Employees. Modern financial reporting empowers employees with financial data for making informed decisions and measuring performance.

- Consumers or customers. Transparency from accurate financial reports builds stronger customer relationships and demonstrates a commitment to open communication about earnings, investments, and other financial activities.

Does Planful Help With Financial Reporting and Analysis?

Successfully growing a business demands being agile, forward-looking, and proactive. Leveraging financial reporting technology empowers users with better data for smarter decisions. This difference in vision helps drive business and financial transformation.

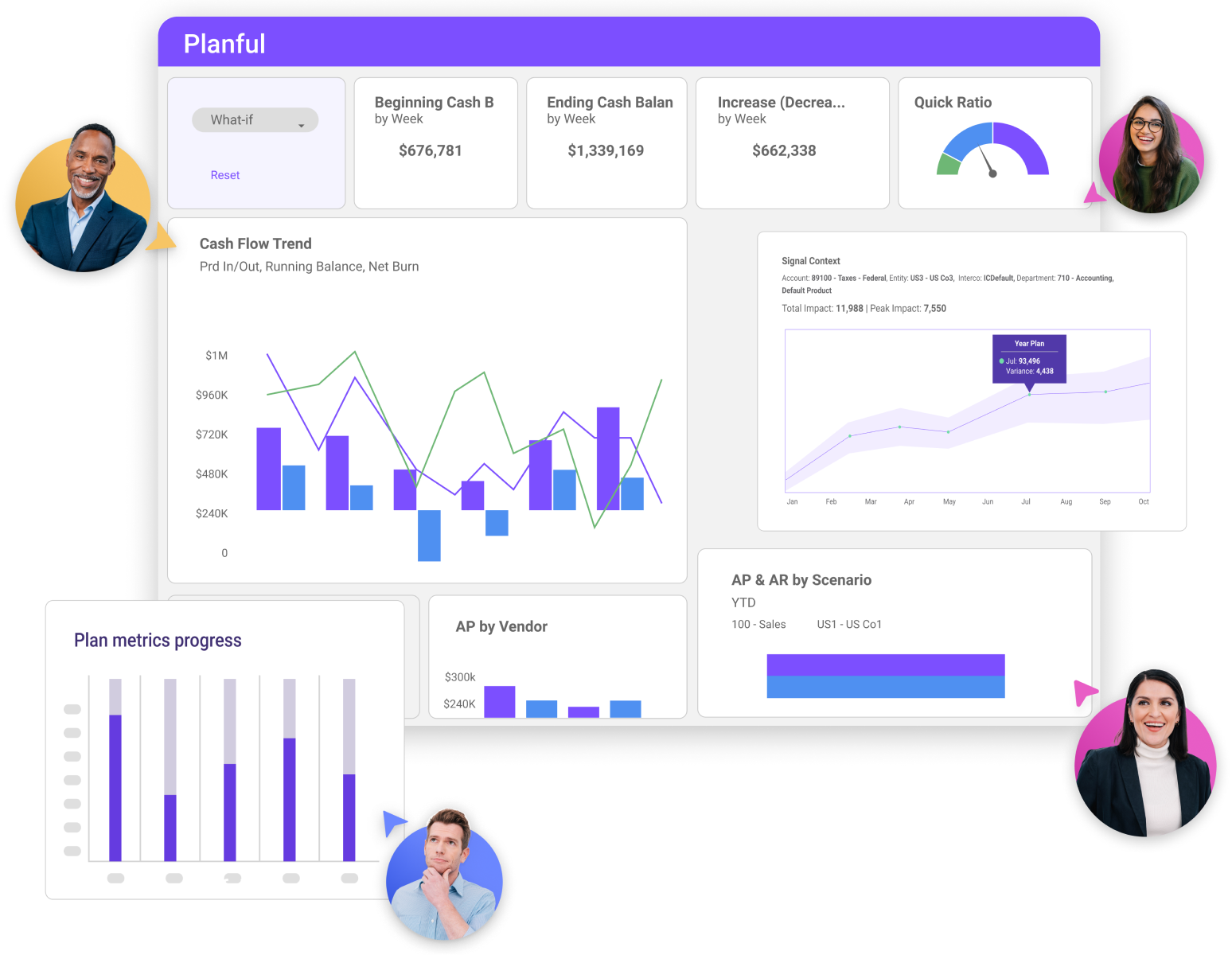

Planful’s financial reporting and analysis software unites finance teams and aligns the business with financial and corporate goals. Our platform enables high growth, speedy movement, and agile teams with advanced real-time analytics and predictive accounting capabilities. Users eliminate manual processes, save costs and time, and help proactively identify opportunities to improve performance, business operations, and collaboration with Planful.

Reporting in the Planful Platform is like having an automatic guide to financial reporting and analysis, keeping the reporting process pain-free and letting you focus your time and energy on generating new insights and turning them into action.

Planful gives you a robust library of report templates to build the foundation of GAAP and IFRS-compliant income statements, statements of cash flow, balance sheets, and other financial and statutory reports. It integrates with other cloud-based and on-premise business systems and ensures every bit of data is up-to-date. Always pulling directly from a single source of truth,

Planful automatically includes any last-minute changes or updates, and lets users create unique reports without coding or help from IT.

As you go, Planful tracks the entire reporting process to reduce compliance and audit costs, highlight potential risks, and improve efficiency and accuracy. Planful Reporting has even reduced reporting times by 90% for some customers—a massive but easily attainable result.

Curious to learn what else Planful can do to help your team learn how to do financial reporting and analysis more effectively?

Watch our on-demand demo for a deep dive into our automated financial reporting and analysis services.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?