Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreFinancial Planning and Analysis (FP&A)

FP&A Definition

Financial Planning and Analysis (FP&A) is central to developing a company’s financial strategy. It encompasses processes that help businesses plan, forecast and budget. In combination with performance analysis, FP&A empowers businesses to make well-informed financial decisions, enhance operational efficiency, and strengthen overall financial health.

FP&A FAQs

What is FP&A?

FP&A includes the processes, tools, and strategies that finance teams use to analyze financial data, plan for the future, and support business decision-making. FP&A teams play an essential role in budgeting, forecasting, performance monitoring, and financial planning. Unlike traditional accounting, which primarily focuses on historical reporting, FP&A is forward-looking, helping companies anticipate market changes and financial risks. The FP&A process involves gathering financial data, analyzing trends, creating forecasts, and generating reports.

What is FP&A Used For?

FP&A processes accomplish several key functions, including:

Budgeting and Forecasting

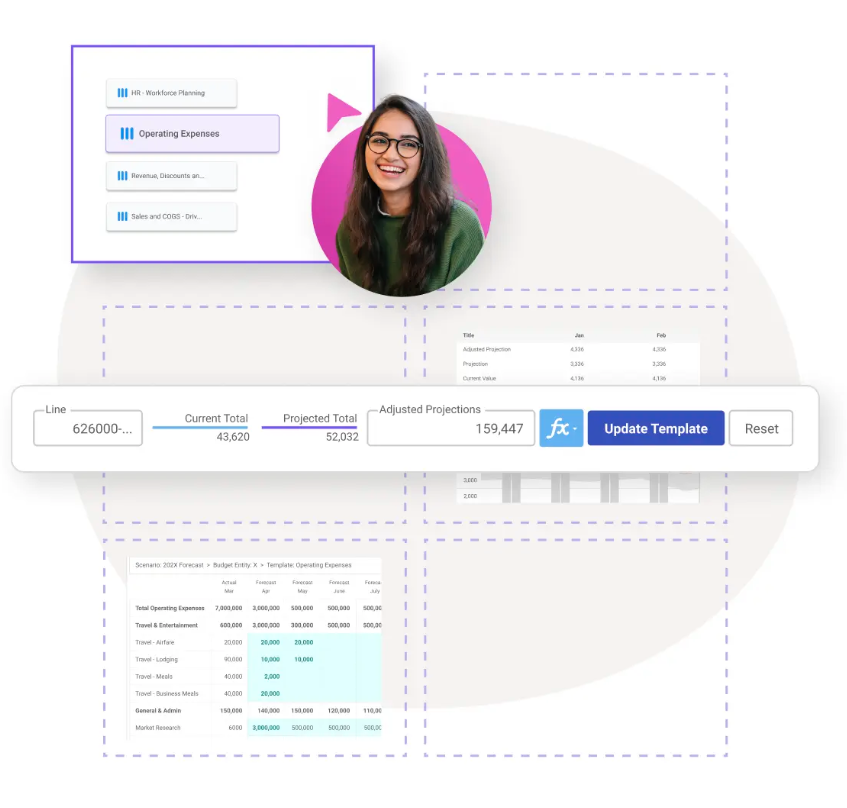

FP&A teams create financial budgets and forecasts based on historical data and future projections. Financial budgeting and forecasting help businesses allocate resources effectively.

Financial Analysis and Planning

FP&A functions provide insight into revenue trends, cost structures, and profitability drivers through financial modeling.

Performance Monitoring

FP&A software helps track financial KPIs, comparing actual performance against forecasts to identify gaps and opportunities.

Strategic Decision-Making

Businesses rely on FP&A reporting to guide investment decisions, mergers and acquisitions, market expansion, and budget optimization.

Risk Management

FP&A solutions help identify financial risks and develop contingency plans, ensuring business resilience in uncertain markets.

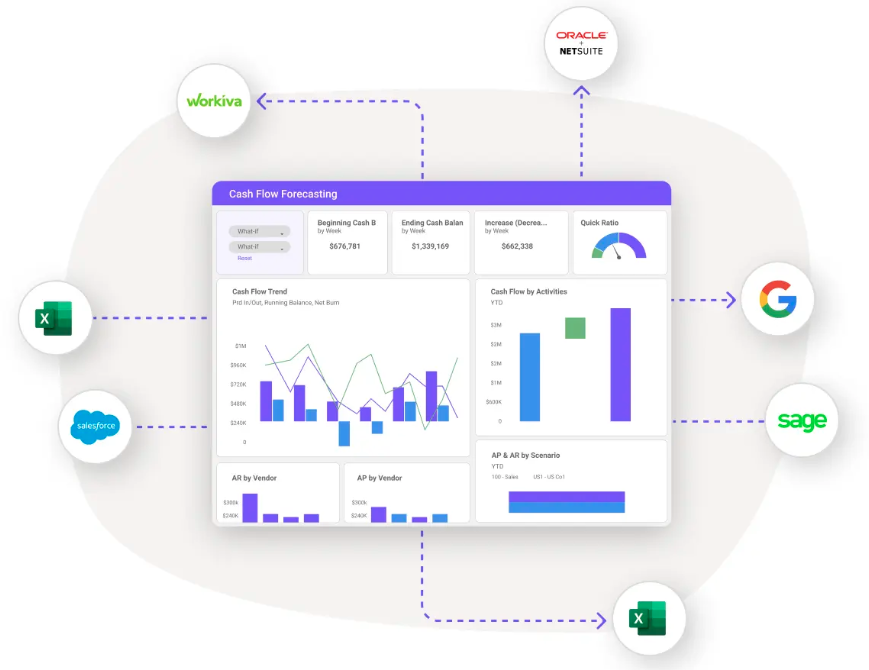

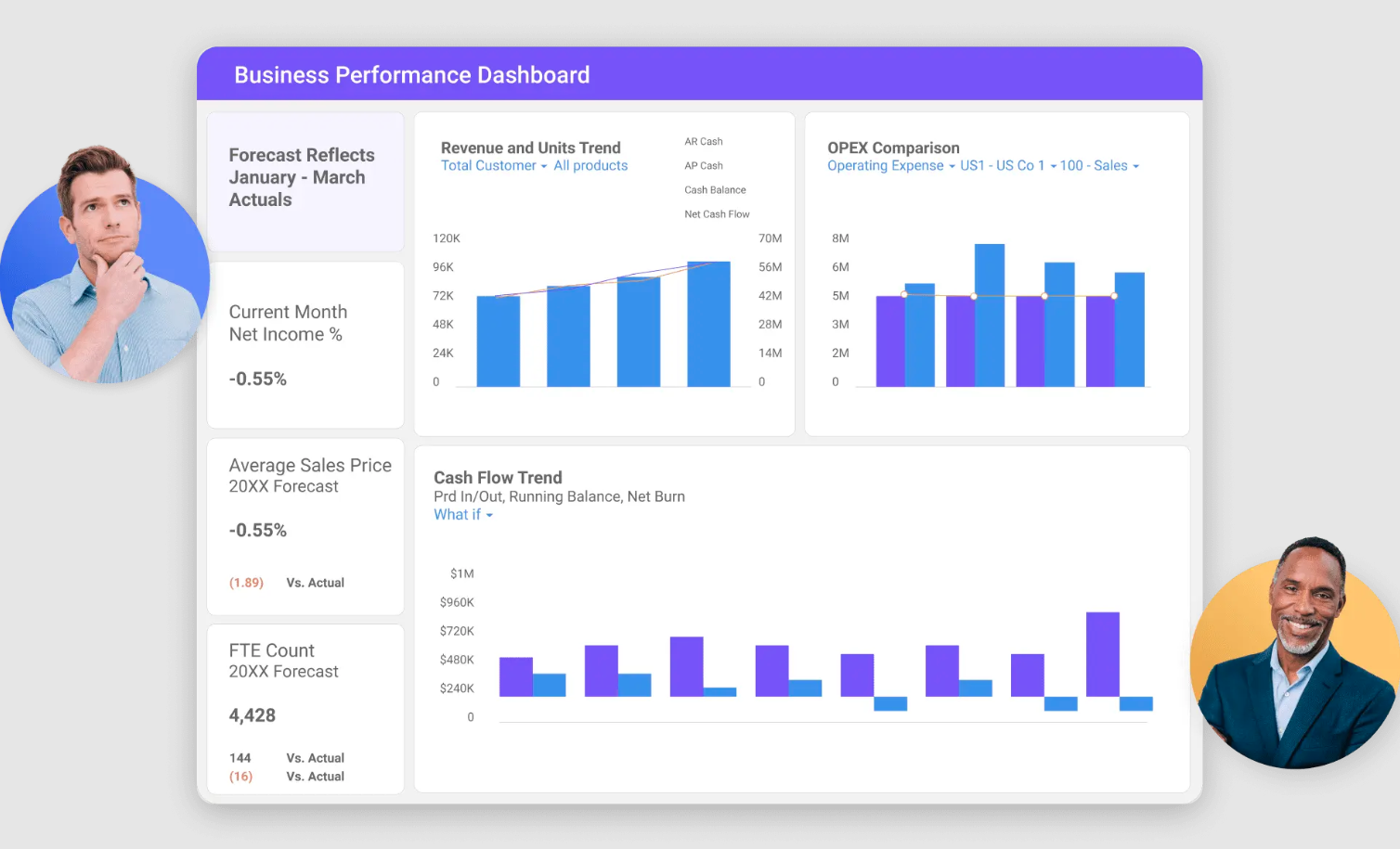

FP&A Dashboard

Who Uses FP&A Tools?

Various teams across an organization use FP&A tools. FP&A managers and analysts oversee financial planning, develop forecasting models, and provide strategic insights. CFOs and finance leaders use FP&A platforms to align financial planning with business objectives and to drive decision-making. Department heads and business unit leaders leverage FP&A reporting to manage budgets and track key performance metrics. Additionally, investors and stakeholders analyze FP&A reports to assess a company’s financial health and potential for growth.

Financial Planning and FP&A

What are the Benefits of Using an FP&A Platform?

A financial planning and analysis platform provides several key advantages:

- Data-Driven Insights – Companies gain real-time visibility into financial performance and market trends.

- Improved Accuracy – Financial planning and analysis software automates calculations, reducing errors in budgeting and forecasting.

- Enhanced Efficiency – Automation and FP&A solutions streamline data collection, analysis, and financial reporting.

- Scalability – FP&A tools support businesses of all sizes, from startups to large enterprises.

FP&A for Enterprises

What are some Examples of FP&A Tools and Applications?

Here are a few examples of solutions that enhance FP&A processes:

Planful

Planful is a cloud-based FP&A platform that streamlines budgeting, forecasting, and reporting. Planful’s financial performance management solution provides intuitive dashboards and real-time data analytics, enabling finance teams to collaborate effectively and make data-driven decisions.

SAP

SAP provides financial planning and analysis tools that integrate financial planning with analytics. Its solutions support strategic planning, budgeting, and forecasting, helping organizations align financial goals with operational strategies.

Oracle NetSuite

Oracle NetSuite offers FP&A applications for financial modeling, scenario planning, and performance reporting. Its cloud-based platform can scale for businesses of all sizes.

What is xP&A?

Consider xP&A (Extended Planning & Analysis) as the evolution of FP&A, extending financial planning beyond finance to include other business functions like sales, marketing, and HR. Unlike traditional FP&A, which focuses solely on financial data, xP&A integrates cross-departmental planning, enabling organizations to develop more holistic strategies.

By leveraging FP&A tools that support xP&A, businesses can achieve more accurate company-wide forecasting, stronger collaboration between finance and other departments, and real-time scenario analysis for agile decision-making. This broader approach allows organizations to align their financial and operational planning, ensuring better decision-making and improved business performance.

What is the Future of FP&A?

The future of FP&A will no doubt be shaped by advancements in AI and a greater emphasis on strategic partnerships within organizations.

Key FP&A trends include:

- Artificial Intelligence and Machine Learning: Leveraging AI and ML to enhance predictive analytics and automate routine tasks.

- Real-Time Data Analytics: Utilizing real-time data to make agile, informed decisions in dynamic markets.

- Cloud-Based FP&A Platforms: Cloud adoption increases accessibility, scalability, and security.

- Collaborative Planning: Fostering cross-departmental collaboration to create cohesive financial strategies.

As FP&A continues to evolve, it will become increasingly critical in guiding financial decisions in all business areas.

FP&A Summary

FP&A (Financial Planning and Analysis) processes are essential for businesses looking to optimize financial performance, forecast with accuracy, and support strategic decision-making. FP&A software automates budgeting, forecasting, and reporting, allowing finance teams to focus on insights rather than time-consuming tasks. Solutions such as Planful, SAP, and Oracle NetSuite provide advanced capabilities to streamline the FP&A process and drive business success. With emerging technologies like AI and xP&A, the future of FP&A is well-positioned for greater efficiency, automation, and strategic impact.

Curious to learn what else Planful can do to help your team learn how to get more out of financial planning and analysis? Get up and running with Planful’s financial performance management platform in no time and without the need for IT support.

Learn how Planful can help Finance drive peak financial performance. Schedule an interactive demo to see Planful in action.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?