Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreFinancial Consolidation Tools

Financial Consolidation Definition

Financial consolidation is a critical process in corporate finance, enabling organizations to present a unified view of their financial health by combining data from various subsidiaries and departments. This process ensures compliance with accounting standards and provides stakeholders a comprehensive understanding of the company’s financial performance. Continue reading to learn about the tools used in the financial consolidation process.

Financial Consolidation Tools FAQs

What are Financial Consolidation Tools?

Financial consolidation tools are specialized software solutions designed to automate and streamline the financial consolidation process. They integrate financial data from multiple sources, perform necessary adjustments, and generate consolidated financial statements. These tools are essential for organizations with complex structures, multiple subsidiaries, or operations across different regions and currencies.

Financial consolidation tools for businesses

How Do Financial Consolidation Tools Work?

Financial consolidation tools function by automating several key steps in the consolidation process:

- Data Integration: They collect financial data from various sources, such as enterprise resource planning (ERP) systems, spreadsheets, and databases.

- Data Mapping: The tools map different charts of accounts into a unified structure, ensuring consistency across the organization.

- Currency Translation: For multinational companies, these tools handle currency conversions to present financials in a single reporting currency.

- Intercompany Eliminations: They identify and eliminate intercompany transactions to prevent double-counting.

- Adjustments and Eliminations: The tools apply necessary adjustments, such as minority interest calculations and eliminations of intercompany profits.

- Financial Reporting: Finally, they generate consolidated financial statements and reports in compliance with accounting standards.

How are Financial Consolidation Tools Used?

Organizations utilize financial close and consolidation software to:

- Accelerate the Close Process: By automating repetitive tasks, these tools reduce the time required to close books.

- Enhance Accuracy: Automation minimizes human errors associated with manual consolidation.

- Ensure Compliance: They help maintain adherence to accounting standards and regulatory requirements.

- Improve Transparency: Consolidated reports provide a clear view of the organization’s financial status.

Who Uses Financial Consolidation Tools?

Financial consolidation tools are primarily used by:

- Large Corporations: Companies with multiple subsidiaries or international operations.

- Financial Departments: Teams responsible for financial reporting and analysis.

- Accounting Firms: Professionals managing financial consolidation for clients.

What are the Advantages of Using Financial Consolidation Tools?

The benefits of financial consolidation tools include:

- Time Efficiency: Automation speeds up the financial consolidation process.

- Accuracy: Reduces errors inherent in manual processes.

- Consistency: Ensures uniform financial reporting across the organization.

- Scalability: Can handle growing data complexity as the organization expands.

Enterprise financial consolidation tools

What are Examples of Financial Consolidation Tools?

The benefits of financial consolidation tools include:

- Planful: Planful’s comprehensive financial performance management platform offers financial consolidation, reporting, and planning, empowering teams to drive financial success.

- SAP: SAP provides enterprise performance management solutions, including financial consolidation.

- Oracle Financial Consolidation and Close (FCCS): Oracle offers a broadly used tool for financial consolidation and reporting.

Take time to research and select the best financial consolidation tools to fit the needs of your organization.

Financial Consolidation Tools Summary

In today’s complex business environment, financial consolidation tools are indispensable for organizations aiming to streamline their financial reporting processes. By automating data integration, currency translation, and reporting, these tools enhance accuracy, ensure compliance, and provide valuable insights into the organization’s financial health. Selecting the best financial consolidation software for your organization’s needs is crucial for achieving these benefits and supporting informed decision-making.

Does Planful Offer Financial Consolidation?

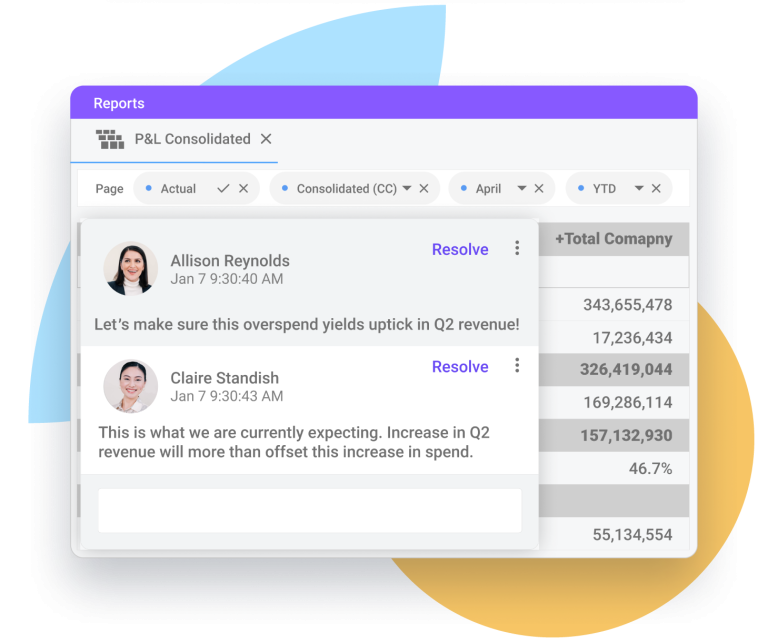

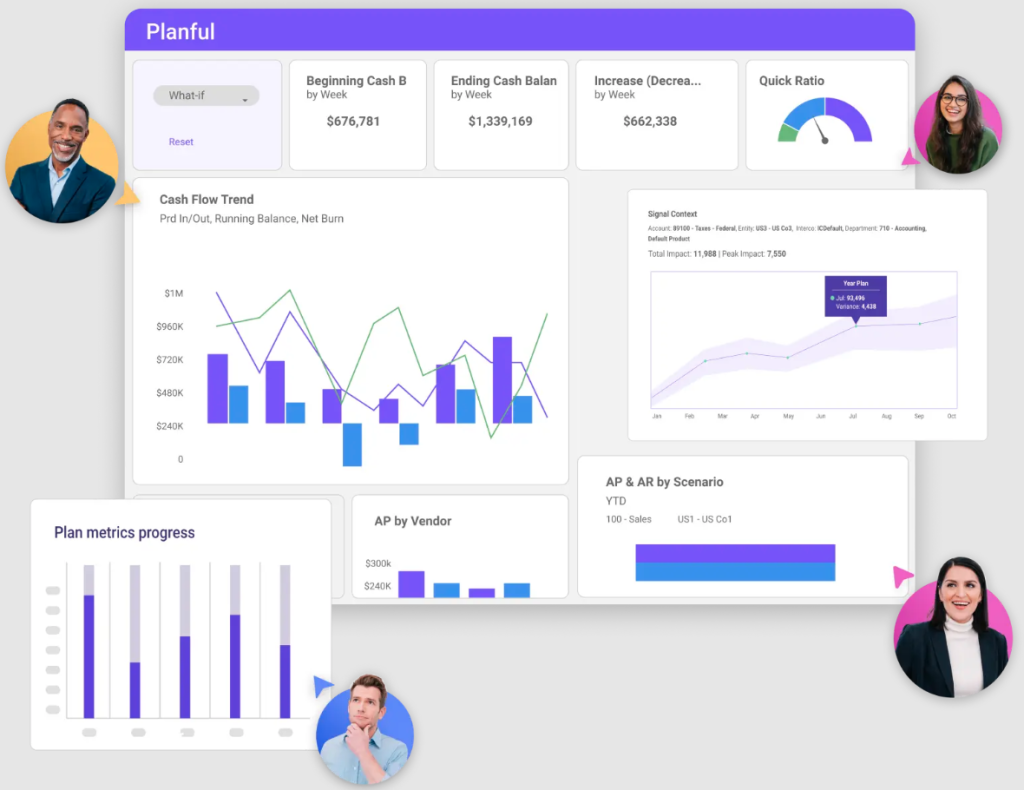

Planful’s robust financial consolidation and reporting solution is integrated with our modeling and planning applications and used by hundreds of organizations.

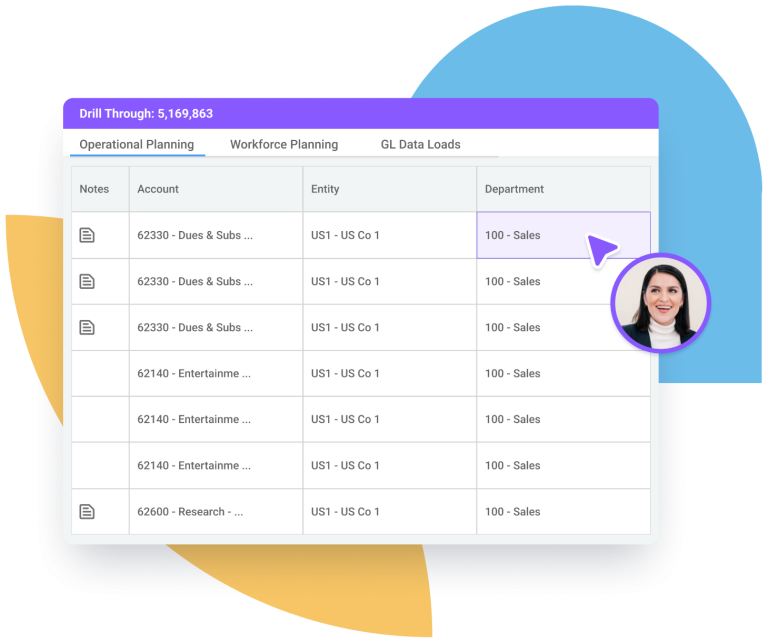

Planful users accelerate financial close and consolidation cycles by integrating data from various sources and consolidating the results based on accounting guidelines. They also benefit from the automation of key processes such as intercompany eliminations, journal adjustments, and accounting for non-controlling interests.

Financial consolidation dashboard

Curious to learn what else Planful can do to help your team use financial consolidation tools more effectively? Contact us for an interactive demo.

For more insights, explore Planful’s financial consolidation tools and learn how enterprise accounting can transform your organization’s consolidation strategies. Take a tour with an interactive demo to see Planful in action.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?