Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreFinancial Consolidation

Our guide will teach you about Financial Consolidation and answer FAQs: What are the Benefits of Financial Consolidation and the Financial Consolidation Process, etc.

Financial Consolidation Definition

Financial consolidation is the process of combining financial data from multiple business entities or departments within an organization, typically for reporting purposes.

The financial consolidation process includes importing and normalizing consolidated data, mapping general ledgers to a single chart of accounts, and producing consolidated financial statements. How frequently the finance department engages in financial consolidation varies and is often triggered by legal or regulatory requirements.

Although different teams use different financial consolidation methods, from spreadsheets to specialty software for financial consolidation, tools for consolidation such as Excel can lead to a high probability of errors because they demand so much manual input and don’t facilitate collaboration.

Financial Consolidation FAQs

What is Financial Consolidation?

Financial consolidation requires multi-entities and other organizations to present a consolidated financial statement. What is a consolidated financial statement? The consolidated financial statement presents the financial information of the parent company and all subsidiaries that report under the parent company’s umbrella. These combined financials are presented as the consolidated financial statement.

Regardless of niche or industry, financial consolidation is required for multi-companies. However, there are multiple approaches to financial consolidation accounting.

Here are some common approaches to the business financial consolidation process and financial consolidation methods. It’s worth noting there is no one-size-fits-all approach. Each method has its advantages and disadvantages.

- Spreadsheets. This common approach is a manual process for consolidating data in spreadsheets after it is exported from various financial systems.

The obvious advantages of this manual process for consolidating financial statements include its speed, low short-term costs, and ease of use to create products such as consolidated annual financial reports via a simple user interface. However, its disadvantages include version control issues and more long-term costs, as well as the greater chance of inaccurate data and administrative errors that are an inherent feature of consolidation of financial statements in high numbers. - Enterprise resource planning (ERP) systems. Companies may deploy the general ledger component of an existing ERP system, thus avoiding the need to retrain staff and leveraging existing technology. However, this approach has limited reporting capabilities and may be less effective for larger companies with multiple charts of accounts and ERP systems.

- Specialized tools. Consistent financial consolidation and reporting is more likely with specialized closing tools and financial statement consolidation software.

These tools offer quick and straightforward integration with other ERP systems, rapid out-of-the-box functionality, and flexible reporting capabilities. On the other hand, it can take time to select the best financial consolidation tools.

What is Financial Consolidation and Close?

A critical piece of the organizational enterprise performance management (EPM) cycle includes the financial consolidation and close process. Any organization’s decision-making ability benefits from a capacity to disseminate timely, accurate information to stakeholders.

Some believe only large organizations need a formal financial consolidation process and system. However, specific business needs are more determinative than company size, and many small and mid-sized organizations may benefit from a more formal financial consolidation system.

An organization may benefit from a more detailed process if:

- They must gather data from multiple ERP or GL systems

- An organizational change process, such as an acquisition strategy, is underway

- There is a need to manage the complexities of international expansion, such as intercompany eliminations across subsidiaries and divisions and currency conversions.

- There is an external audit or an IPO that demands financial statements.

The financial consolidation and close process crosses various departments, systems, and locations. The financial close and reporting process can consume a lot of resources and time.

Companies with a fast close process can spend more time on decision-making and value-added analysis to rapidly deliver information to internal and external stakeholders. Shaving time spent on external financial reporting and the financial close process improves overall performance.

What are Consolidated Financial Statements?

Consolidated financial statements are the financial statements of multiple entities collectively presented as those of a single economic entity.

These consolidated financial statements help assess the financial position of commonly-owned businesses and indicate the group’s overall financial health. Consolidated financial statements also exist for portions of a group of companies, such as entities owned by a subsidiary or a subsidiary itself.

Consolidated vs Combined Financial Statements

Combined vs. consolidated financial statements offer insight into the financial health of an organization.

Consolidated Financial Statements

A consolidated financial statement includes the financial results of all subsidiaries in one financial statement for the parent company as if it were one single entity. The subsidiaries operate separately, even as the consolidated financial statement reports on the financial picture of the parent company and subsidiaries together as an enterprise. A potential investor can confirm the economic wealth of the potential investment and organizations by looking at a consolidated financial statement.

A consolidated cash flow statement collects investing, financing, and operating activity cash flows from across all parent-owned companies that remain legally distinct businesses. This means that sole proprietorships and general partnerships, which are not legally separate, are excluded from consolidation.

As a financial consolidation example, in some cases, viewing the parent company and its subsidiaries together can improve the picture if the parent company brings in less money than its subsidiaries since the conglomerate will be worth more than the parent company alone.

Accountants use generally accepted accounting principles (GAAPs) to prepare consolidated financial statements. Any parent company accountant needs to know how to create a combined financial statement and how to prepare a consolidated financial statement.

Combined Financial Statements

A combined financial statement treats each subsidiary on paper as a separate entity as it is in life. In other words, it reports the finances of all subsidiaries and the parent company in one document but separately in their sections.

Generally, it is easier to prepare combined financial statements than consolidated financial statements. Combined financial statements offer a granular view of each company that is harder to get from a consolidated financial statement.

Which Type of Financial Statement to Use

Check with a lawyer or financial advisor about whether to file a consolidated financial statement or a combined financial statement.

Remember — anytime the parent company owns more than 50 percent of a subsidiary, it is mandatory to file a consolidated financial statement.

What is the Financial Consolidation Process?

Many businesses lack a formal financial consolidation process flow or financial consolidation solution, or prefer to avoid focusing on the need for financial consolidation. However, making do without a financial consolidation software solution can be challenging today.

The problem is that without a financial consolidation solution or strategy in place, the difficulties in the financial close become more acute. The limitations of financial consolidation solutions highlight the problem:

- A legacy, consolidation-specific application with specific, limited, proprietary functionality.

- A heavy-footprint consolidation application that often comes at a very high cost.

- A light-footprint CPM suite that’s fine-tuned for planning and budgeting with minimal consolidation capabilities.

- Standalone spreadsheets that offer no controls or governance and require extensive manual maintenance and set-up.

Clearly, traditional approaches to financial consolidation are limited. Fortunately, there are better, more modern options.

These include cloud-based, unified CPM application suites for financial consolidation and reporting. Few robust financial consolidation and reporting options exist in this category, but large multinational entities and many other growing businesses will find cloud financial consolidation essential.

Here are several signs that an organization will soon need robust and reliable financial consolidation and reporting software and other solutions—if it doesn’t already:

- Multiple transactional systems, general ledgers, or ERP systems

- A possible acquisition

- Preparing for an external audit or IPO

- Currency conversions

- Subsidiaries with partial ownership, intercompany transactions

- Rollup structures or alternate organizational hierarchies

Managing financial consolidations is an iterative process that typically requires many financial consolidation steps and involves using different currencies, charts of accounts, and business practices to collect financial results from multiple divisions, systems, and subsidiaries. The risk of missing deadlines and essential details is high, and the results are costly.

To consolidate financial results following US GAAP or IFRS guidelines, a financial consolidation software solution must have numerous capabilities:

- Currency conversions

- Complex intercompany reconciliation management

- Conduct thousands of account reconciliations

- Account for minority interests accurately

- Enter adjusting journal entries such as top-side accruals

- Review results for accuracy and completeness, make corrections, and reclassify expenses and revenue as needed

- Produce reliable financial statements for the CFO and CEO

- Ensure detailed audit trails for external and internal auditors

- Create accurate, complete, complex regulatory filings by deadline

Advantages of Consolidated Financial Statements

There are several benefits of consolidated financial statements:

- Accurate strategic mapping and forecasting of organizational goals

- Use key performance indicators to align entities

- Comply with accounting standards IFRS 10 and ASC 810

- Accurately portray overall organizational health

Convince strategic investors and other stakeholders

There are additional advantages that attach to using financial consolidation solutions. Here are some ways these solutions take on the most commonly encountered problems in financial consolidation.

Manual reconciliation. The need to manually track down contracts, emails, prices, and other details in a spreadsheet causes errors and misunderstandings, creates cross-checking bottlenecks, and otherwise takes up excessive time while reducing quality.

Data quality. Data from multiple, disparate sources takes time to compile and verify for accuracy and quality. Simple errors can lead to compounded issues. For example, the finance team must convert data from an entity that uses a different currency, update the exchange rate, and re-check the dollar amount and local currency base in the final report.

Changing reporting requirements. As compliance regulations and statutory requirements become more complex and evolve, both from within the industry and due to changes from the government, these changes must be reflected in the financial consolidation reporting process.

Data manipulation. Spreadsheets are to be used, read, and edited, but this also means they are vulnerable to multiple types of data manipulation and fraud.

The right financial management software can resolve all of these issues. A well-matched financial consolidation solution stores all information to provide a single source of truth and allows the reporting and consolidation processes to occur in real time.

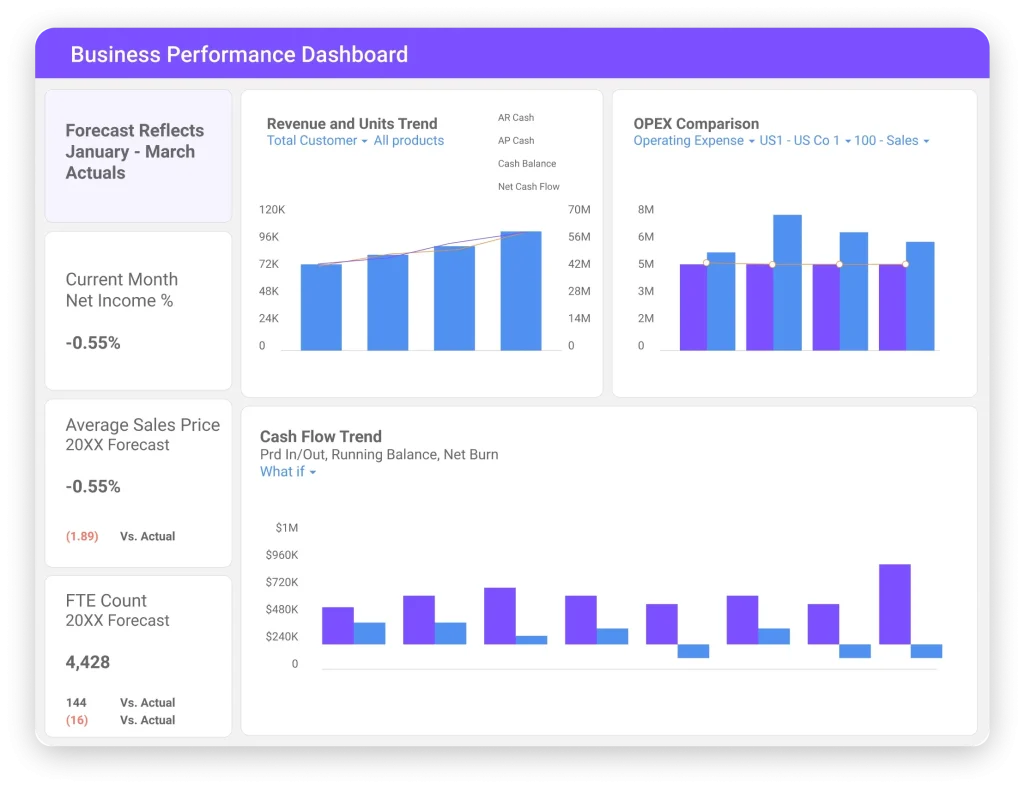

Advanced financial consolidation and close software can also significantly increase visibility by offering instant access to quality insights. For example, to ensure continuity in the year-to-year forecast or accurately reflect the business’s current financial position, it is easy to add mergers and acquisitions in the fiscal year to the system.

What are Financial Consolidation Tools?

Businesses handle financial consolidation and reporting in several ways.

The old-school method of carrying out the many financial consolidation steps with email and stand-alone spreadsheets is nearly impossible, especially in a multi-entity enterprise. The need to gather and consolidate many spreadsheets creates excessive risk for omissions and errors and adds considerable manual effort and time. Spreadsheets are also inadequate for auditing, needing more controls, security, and audit trails.

In contrast, a cloud-based CPM system is a purpose-built financial consolidation system.

It is a simple path to financial consolidation that offers a centralized server-side database, internal controls and audit trails, and secure governance based on US GAAP, IFRS, and other guidelines. This also saves between six to twelve months in installation and implementation time that on-premises financial consolidation applications usually require and eliminates the need for manual upgrades.

Financial Consolidation Features to Look For

Many financial consolidation companies and tools are on the market; how do they all compare? Here are some of the most critical financial consolidation and reporting features:

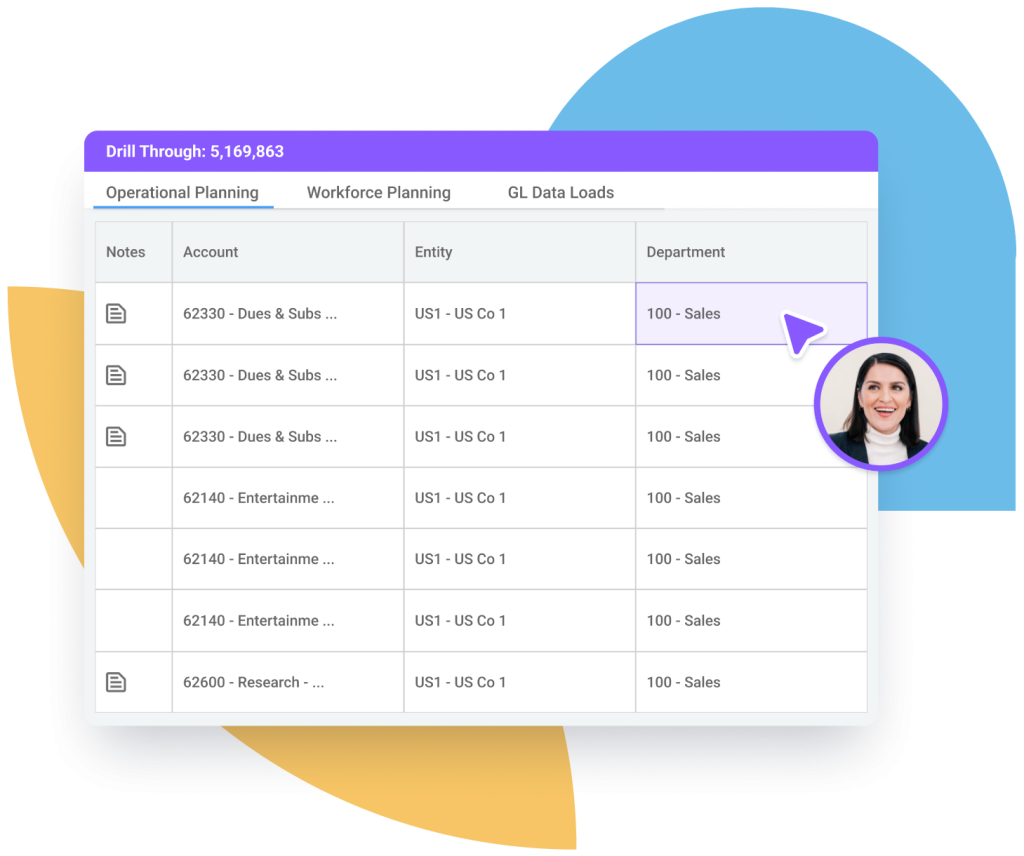

- Audit trails and journal entries/adjustments

- Consolidation, budgeting, and forecasting as part of a single database

- Support for alternate rollup hierarchies

- Workflow/data locking

- Automatic intercompany eliminations, intercompany matching reports, and management of complex intercompany reconciliations

- Posting back to the general ledger

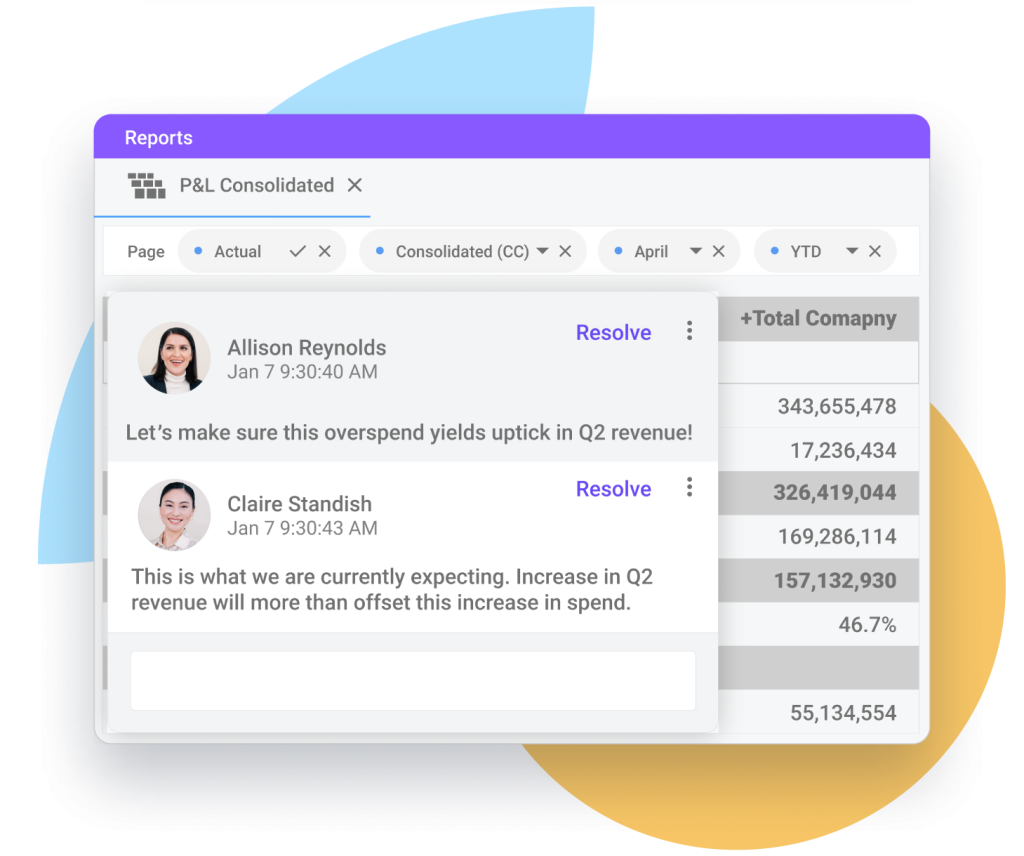

- Collaborative disclosure process

- Ability to perform currency conversions

- Ability to correctly account for minority interests

Does Planful’s Platform Help With Financial Consolidation?

Planful’s robust financial consolidation and reporting solution is integrated with our modeling and planning applications and used by hundreds of organizations.

Planful users accelerate financial close cycles by integrating data from various sources and consolidating the results based on accounting guidelines. They also benefit from the automation of key processes such as intercompany eliminations, journal adjustments, and accounting for non-controlling interests.

Planful’s consolidation module also helps document each step in the process with all of the proper controls and audit trails to generate a broad range of financial statements, reducing the cost of compliance. The platform also delivers a single version of the truth and boosts confidence in results, with workflow and process controls to verify that all required tasks are done.

Close & Consolidation with Planful

Curious to learn what else Planful can do to help your team learn how to do Financial Consolidation more effectively? Check out a demo.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?