Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreEnterprise Accounting Software

Enterprise Accounting Software Definition

Enterprise accounting software comprises a set of tools used by organizations to provide visibility into the organization’s financial transactions and data. Finance departments use enterprise accounting software to view financial data and manage finance-related processes including accounts receivable and accounts payable, billing and payroll, and general ledger. Enterprise accounting solutions also provide visibility into the organization’s historical financial performance, allowing finance teams to identify business and market trends, plan for seasonal fluctuations, and help in predicting future business scenarios.

Enterprise Accounting Software FAQs

What is Enterprise Accounting Software?

As a centralized platform, enterprise accounting software provides finance departments the ability to access and visualize financial data for the organization. Enterprise accounting software is also a critical tool for maintaining the security of sensitive financial data, as well as maintaining financial regulation compliance.

Accounting software for large enterprises generally offers a set of customizable dashboards and modules that accounting and finance teams utilize to view and manage payroll, billing, accounts receivable and payable, general ledger, and more. Organizations rely on business accounting software for accurate and precise audits and reporting, which can be generated quicker than manual processes, and without human-error.

Enterprise Accounting Software

What is Enterprise Accounting Software Used For?

Accounting and finance teams use enterprise accounting software to view and manage the organization’s finances. Traditionally, these processes were manually executed, requiring dedicated time and resources from finance departments, and were unavoidably prone to human error.

Today, businesses can use enterprise-level accounting software to automate many of these financial processes and reporting tasks, more accurately and in reduced time. Finance leaders and C-level executives benefit from more comprehensive financial insights and more time to dedicate to business strategies.

Finance teams use the dashboards, modules and report data provided by the software to view business insights and manage financial processes including:

- Workforce planning – Workforce planning software allows organizations to plan and report their headcount, salaries, and benefits.

- Expense tracking and budgeting – Financial accounting tools facilitate the processing and organizing of a business’s expenditures, equipping finance teams with reliable data for streamlined financial budgeting.

- Financial forecasting – Enterprise accounting facilitates financial forecasting by analyzing trends in market and historical data and predicting future financial trends that leaders can adapt to.

- Maintaining regulatory compliance and security – Accounting platforms typically offer a high level of security for sensitive financial information, as well as robust measures for complying with industry regulations such as GDPR, CCPA, and HIPAA.

What are the Benefits of Using Enterprise Accounting Software?

Efficient financial management is essential for business success, and enterprise accounting software streamlines operations with improved visibility, accuracy, and automation. The right business accounting software ensures compliance, enhances forecasting, and drives profitability.

- Enhanced Financial Visibility – Clear visibility into all accounting transactions and financial data is essential for running an efficient and profitable business. Enterprise accounting software provides a centralized view of financial information, allowing authorized managers and executives to access real-time data. This level of transparency ensures organizations meet regulatory compliance requirements while improving decision-making.

Enterprise Accounting Software Finance Team

- Greater Reporting Accuracy – Traditional manual accounting methods and outdated software solutions often lead to errors, increasing the risk of inaccurate financial reporting. These errors can result in regulatory violations, legal consequences, and costly fines. With enterprise accounting software, businesses benefit from accurate, consistent, and reliable financial records—ensuring compliance while improving operational efficiency.

- Improved Financial Forecasting – One of the key advantages of using business accounting software is enhanced financial forecasting. Companies can leverage accounting software for financial planning and analysis, utilizing real-time data from the general ledger, accounts receivable, and accounts payable. This enables better decision-making and more accurate projections of future financial performance.

- Automation and Process Consolidation – Enterprise accounting software automates critical accounting functions, including financial reporting, cash management, and consolidation. By eliminating manual processes, businesses reduce errors, streamline workflows, and accelerate time-consuming tasks like closing the books. With automation, organizations can enhance productivity and focus on strategic financial management.

Investing in enterprise accounting software ensures businesses maintain accurate financial records, improve compliance, and optimize financial operations—leading to long-term success and profitability.

What are Examples of Enterprise Accounting Software?

Selecting the right enterprise accounting software is essential for managing financial operations efficiently. Below are three popular solutions that accommodate different business needs.

Oracle NetSuite

A recognized leader in enterprise accounting, Oracle NetSuite offers a cloud-based solution with advanced features for financial management, reporting, and compliance. It provides real-time visibility into business performance and automates key accounting processes, making it ideal for growing and large enterprises.

QuickBooks Enterprise

Designed for mid-sized businesses, QuickBooks Enterprise combines ease of use with powerful accounting tools. It offers inventory tracking, advanced reporting, and payroll management, making it a great choice for companies looking to scale while maintaining accurate financial records.

Planful

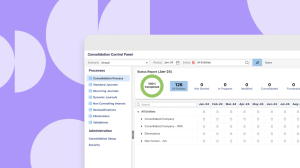

Planful specializes in financial performance management, helping mid-sized and enterprise businesses with budgeting, forecasting, and financial consolidation. Planful integrates with accounting systems to enhance data-driven decision-making for enterprises.

Each of these enterprise accounting software solutions offers unique benefits, allowing businesses to streamline financial processes, improve accuracy, and ensure regulatory compliance.

Enterprise Accounting Software Summary

Enterprise accounting software is a vital tool for organizations aiming to streamline financial management, improve reporting accuracy, and maintain regulatory compliance. These platforms provide finance teams with real-time visibility into financial data, automate key processes like invoicing, payroll, and forecasting, and ensure secure handling of sensitive financial information.

By leveraging accounting software, businesses can reduce human errors, accelerate financial reporting, and make more data-driven decisions. Popular solutions like Oracle NetSuite, QuickBooks Enterprise, and Planful cater to various business needs, offering scalable features for accounting, budgeting, and financial planning. Investing in the right business accounting software helps organizations optimize financial operations, maintain compliance, and drive long-term profitability.

For more insights, explore Planful’s enterprise accounting software and learn how enterprise accounting can transform your organization’s accounting strategies. Take a tour with an interactive demo to see Planful in action.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?