Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreConsolidation Accounting Software

Consolidation Accounting Definition

Consolidation accounting is the process of unifying the financial results of multiple entities within a parent company into a single set of consolidated financial statements. These statements provide a holistic view of the financial health and performance of the entire organization, regardless of how many subsidiaries or business units it contains.

The process involves eliminating intercompany transactions, aligning different fiscal calendars or accounting standards, and ensuring accuracy across multiple ledgers. It’s a high-effort process that adds pressure to an already intense financial close cycle.

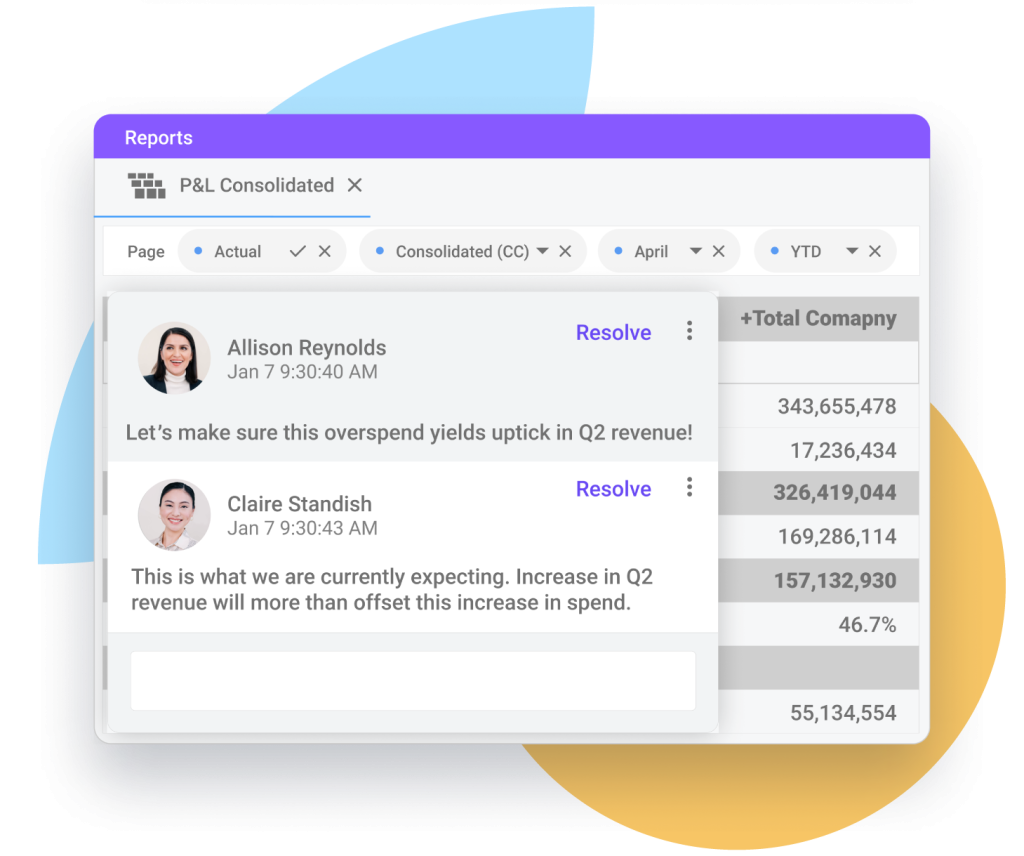

Financial Consolidation Report

Consolidation Accounting Software FAQs

What is Consolidation Accounting Software?

Consolidation accounting software automates and simplifies the complex process of combining financial data from multiple sources. More than just a data aggregator, consolidation software serves as a comprehensive platform for financial consolidation, consolidated financial reporting, and compliance.

Also referred to as financial consolidation software or consolidation software, it integrates with ERP systems, accounting platforms, and spreadsheets to bring together disparate financial data into one place. It automates eliminations, currency conversions, ownership adjustments, and other key steps in the financial close and consolidation workflow.

Financial consolidation solutions are purpose-built to accelerate the close process, eliminate errors, and improve visibility for finance leaders.

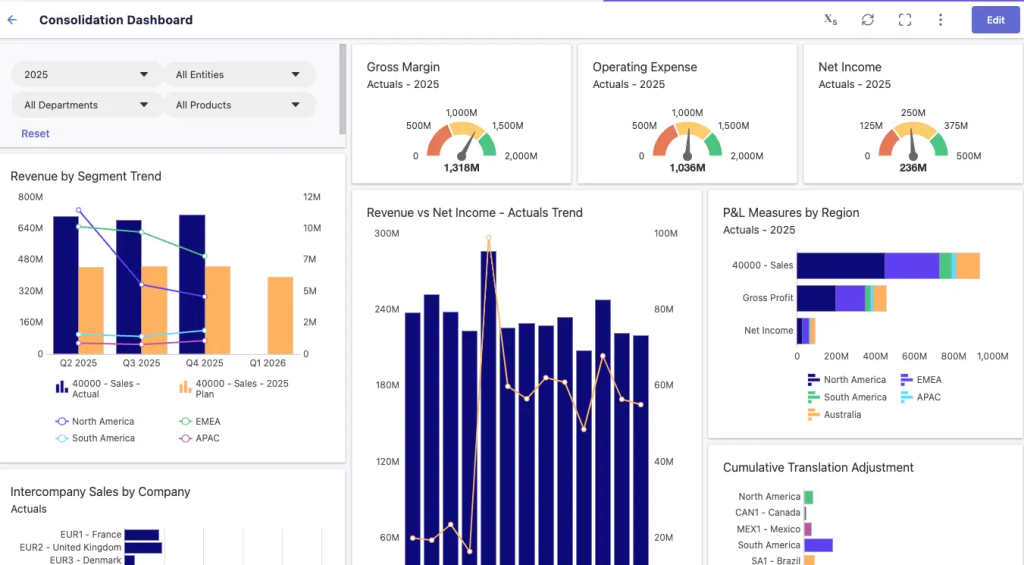

Financial Consolidation Software Dashboard

Who Uses Consolidation Accounting Software?

The users of consolidation accounting software tend to fall into a few key categories:

- Corporate Controllers and Accountants: They are often the primary users, relying on the software for faster, error-free consolidation and reporting.

- Finance and FP&A Teams: Use it for more accurate forecasting and scenario planning based on consolidated data.

- CFOs and Executives: Depend on the output for strategic decision-making and investor communications.

- Auditors and Compliance Officers: Leverage the audit trails and compliance features to ensure the company meets regulatory requirements.

Companies that are multi-entity, global, or acquisitive are the primary beneficiaries. However, even mid-sized businesses preparing for growth or IPOs increasingly turn to financial consolidation tools to future-proof their reporting.

What is Consolidation Accounting Software Used For?

At its core, consolidation software is used to streamline and automate the financial consolidation process. Key use cases include:

- Generating Consolidated Financial Statements: Unified comprehensive financial reports including income statements, balance sheets, and cash flows, created for the consolidated entity

- Intercompany Eliminations: Adjustments for balances and transactions between subsidiaries to avoid double-counting.

- Currency Conversion: Executing foreign currency translation to consolidate international entity results into a single reporting currency framework.

- Ownership Adjustments: Reporting minority interest and joint ventures accurately in consolidated results.

- Regulatory and Management Reporting: Ensuring reports are GAAP- or IFRS-compliant and informative for internal stakeholders.

Advanced financial consolidation tools also support collaboration, workflow management, and version control, making the entire process faster and more transparent.

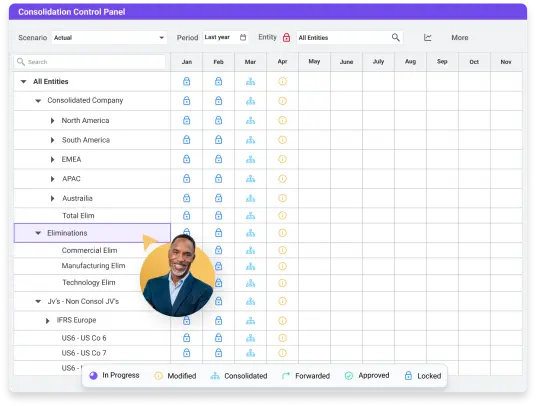

Financial Consolidation Software Control Panel

What are the Benefits of Using Consolidation Accounting Software?

The shift from manual spreadsheets to automation unlocks a number of tangible advantages:

1. Time Savings: Automating repetitive tasks like eliminations and currency conversion can significantly reduce close timelines freeing teams to focus on analysis, not admin.

2. Improved Accuracy: By reducing reliance on spreadsheets and manual data entry, organizations can reduce risk and improve the quality of their consolidated financial statements.

3. Audit Readiness: Built-in workflows, logs, and controls improve auditability and regulatory compliance, crucial for public companies or those preparing for IPO.

4. Real-Time Insights: Some platforms offer near real-time consolidation capabilities, enabling dynamic scenario planning, faster reactions to market changes, and more agile strategic planning.

5. Scalability: As businesses grow, the complexity of financial consolidation scales. A solid software foundation ensures your reporting systems can keep up.

6. Unified Platform: Solutions like Planful’s consolidation hub unify budgeting, forecasting, and reporting in a single platform, eliminating silos between accounting and FP&A teams.

Consolidation Accounting Software Summary

Consolidation accounting software for enterprises is more than a reporting tool, it’s an essential system for finance leaders managing complexity, risk, and growth. By automating the financial consolidation process, aligning global operations, and generating reliable consolidated financial reporting, consolidation software helps companies close faster, plan smarter, and scale confidently.

For teams juggling spreadsheets, late nights, and last-minute audit surprises, adopting financial consolidation software isn’t just a smart move, it’s a strategic necessity.

Explore how Planful’s consolidation solutions can streamline your financial operations and set your business up for long-term success.

Does Planful Offer Consolidation Accounting Software?

Planful’s robust financial consolidation and reporting solution is integrated with modeling and financial planning applications and is used by hundreds of organizations.

Planful users accelerate financial close and consolidation cycles by integrating data from various sources and consolidating the results based on applicable accounting standards. They also benefit from the automation of key processes such as intercompany eliminations, journal adjustments, currency conversion, and accounting for non-controlling interests.

Curious to learn what else Planful can do to help your team use consolidation accounting software more effectively? Contact us or explore an interactive demo.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?