Meet Planful’s Analyst Assistant — your trusted AI-powered partner for finance, always ready for you.

Learn moreBudgeting and Forecasting

Budgeting and Forecasting Definition

Budgeting and forecasting are critical processes to help organizations reach their financial goals. By implementing budgeting and forecasting best practices, businesses can improve decision-making, optimize resource allocation, and ensure long-term financial stability.

Budgeting and Forecasting FAQs

What is Budgeting and Forecasting?

Budgeting and forecasting often go hand-in-hand, but it’s important for financial teams to have a clear understanding of their distinctions and how they relate.

What is Budgeting?

Budgeting is a financial management process to create a financial plan for a business’s revenues and expenditures, typically over a fiscal year. Businesses use this financial planning to set revenue targets and spending limits to ensure they are operating within their financial resources.

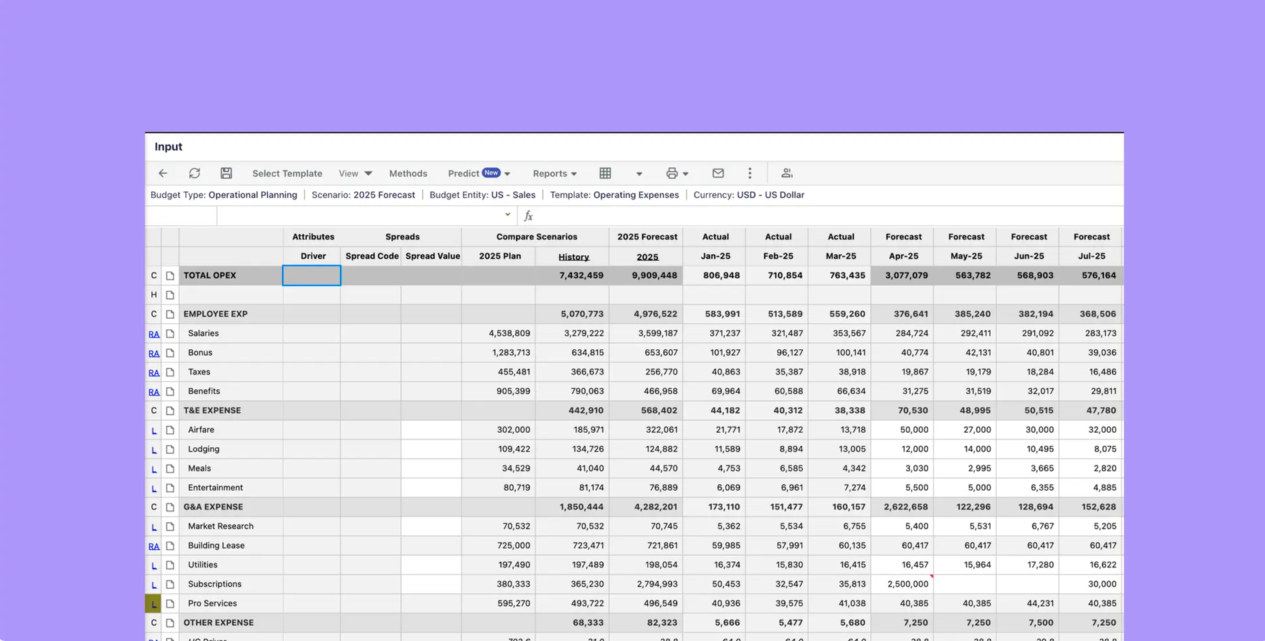

Financial Budgeting and Forecasting Dashboard

What is Forecasting?

While budgeting revolves around known financial factors, forecasting on the other hand predicts the unknown. Forecasting speculates on future financial outcomes based on historical data, current market trends, and anticipated changes in the business environment. Budgeting involves static financial information while forecasting takes dynamic information into account, thus forecasts can change over time.

Budgeting and Forecasting Rolling Forecasts

Why are Budgeting and Forecasting Important?

Budgeting and forecasting processes provide numerous advantages to businesses. Some of the most important include:

- Strategic alignment: Stakeholder alignment about the financial plans to reach key objectives is core to achieving them.

- Performance monitoring: Comparing actual financial performance against forecasts and budgets, organizations can assess performance, identify variances, and implement new strategies and financial processes as needed.

- Risk Management: Anticipating upcoming financial circumstances and engaging in scenario planning allows organizations to identify potential pitfalls and develop plans to mitigate risk.

- Data-driven decision-making: Accurate financial budgeting and forecasting provides management and executive teams the insights required to make strategic decisions regarding cost management, investments, and growth planning.

What are the Benefits of Budgeting and Forecasting?

Budgeting and forecasting benefits can be found in many areas of the business. These processes give organizations a clear picture of their financial position, enabling strategic decision making regarding cash flow and expenditures. They also ensure that financial plans are aligned with strategic goals, leading to more efficient allocation of resources, reduced waste, and maximized returns.

Additionally, effective budgeting and forecasting enhance an organization’s ability to adapt to market fluctuations while fostering greater confidence among key stakeholders, including investors, employees, and business partners.

What are the Best Practices in Budgeting and Forecasting?

To streamline budgeting and forecasting, organizations use specialized software solutions that offer seamless data integration, real-time analytics, and collaborative planning features. These tools help businesses adhere to budgeting and forecasting best practices while optimizing financial processes for greater efficiency and accuracy.

Key best practices in budgeting and forecasting include data integration, process automation, and cross-department collaboration. Regularly updating forecasts, engaging in scenario planning, and adopting advanced financial tools are essential for maintaining agility and improving financial accuracy.

Seamless data integration ensures that all relevant financial information is readily accessible and up-to-date, enabling informed decision-making. Automating manual processes reduces errors, accelerates the budgeting cycle, and allows finance teams to focus on strategic analysis rather than routine tasks. Cross-functional collaboration ensures that budgets and forecasts incorporate insights from all areas of the organization, leading to more accurate financial planning.

Regularly updated forecasts allow businesses to maintain agility by incorporating new data, market trends, and internal changes, enabling proactive management and timely decision-making. Scenario planning prepares organizations for potential market shifts, helping them navigate uncertainties and make informed strategic choices.

By adopting advanced budgeting and forecasting software with real-time data analysis, predictive analytics, and user-friendly interfaces, organizations can enhance efficiency, improve financial accuracy, and drive more effective business planning.

What is the Future of Budgeting and Forecasting?

Budgeting and forecasting processes and tools continue to evolve as new technologies become available to finance teams. Some of the latest trends in budgeting and forecasting include:

- Artificial Intelligence and Machine Learning: The integration of AI and ML into financial planning tools enables predictive analytics, anomaly detection, and more accurate budget and forecast models. These technologies can analyze vast datasets to identify patterns and provide deeper insights.

- Cloud-Based Solutions: The shift toward cloud-based platforms offers enhanced accessibility, scalability, and collaboration, allowing teams to work together in real-time from different locations.

- Enhanced Data Integration: Future budgeting and forecasting tools will offer more seamless integration with various data sources, providing a holistic view of the organization’s financial health and facilitating more informed decision-making.

- User-Friendly Interfaces: As the demand for self-service financial planning grows, tools are becoming more intuitive, enabling users from all areas of the organization (not just finance) to participate in forecasting and budgeting processes.

Budgeting and Forecasting Summary

In summary, budgeting and forecasting are essential components of enterprise financial planning. Leveraging advanced tools enhances these processes by improving decision-making, ensuring strategic alignment, and maintaining financial stability. By adopting best practices and modern budgeting and forecasting solutions, organizations can increase the accuracy and efficiency of their planning, budgeting, and forecasting processes, enabling them to adapt to an ever-evolving business landscape.

Does Planful Offer a Budgeting and Forecasting Solution?

Finance teams are often challenged with inefficient, manual processes when it comes to budgeting, planning and forecasting. Planful addresses these challenges and pain points with a streamlined solution that enhances your strategic capabilities.

Empower your financial performance management and plan at any level with Planful. Our platform is tailored to fit your business needs, offering:

- Pre-built templates

- Customization and flexibility

- Collaboration features

Learn how Planful can help Finance drive peak financial performance. Schedule an interactive demo to see Planful in action.

Get Started with Planful

- How much time will you save?

- How will your finance team evolve?

- Where will technology support you?