Why is Budget Burn Rate So Important to Your Marketing Team?

The last thing your marketing team wants is to overspend. It causes P&L issues, can disrupt the marketing cadence, and can create chaos across the business.

But an area that gets less attention, and is equally damaging, is marketing underspend.

What makes underspending a problem for marketing teams?

Marketing needs to spend 100% of its budget on time and in alignment with the overall business goals. This might seem obvious, but coming in under budget is often mistakenly viewed as a win.

However, when marketing underspends, that’s a sign a team has likely failed to deliver on its commitments to brand awareness, pipeline, and revenue support.

How can your marketing team get more visibility into its budget?

The first step is to invest in a marketing performance management platform, like Planful. This will involve migrating marketing’s data into a cloud-based software that allows your team to plan and budget in real-time and in alignment with your finance team.

As a result, you and your finance counterparts will gain improved visibility into planned, committed, and invoiced expenses. You can also reconcile your numbers with Finance’s once their reports land in your inbox.

What is budget burn rate, and how is it used in a Marketing budget?

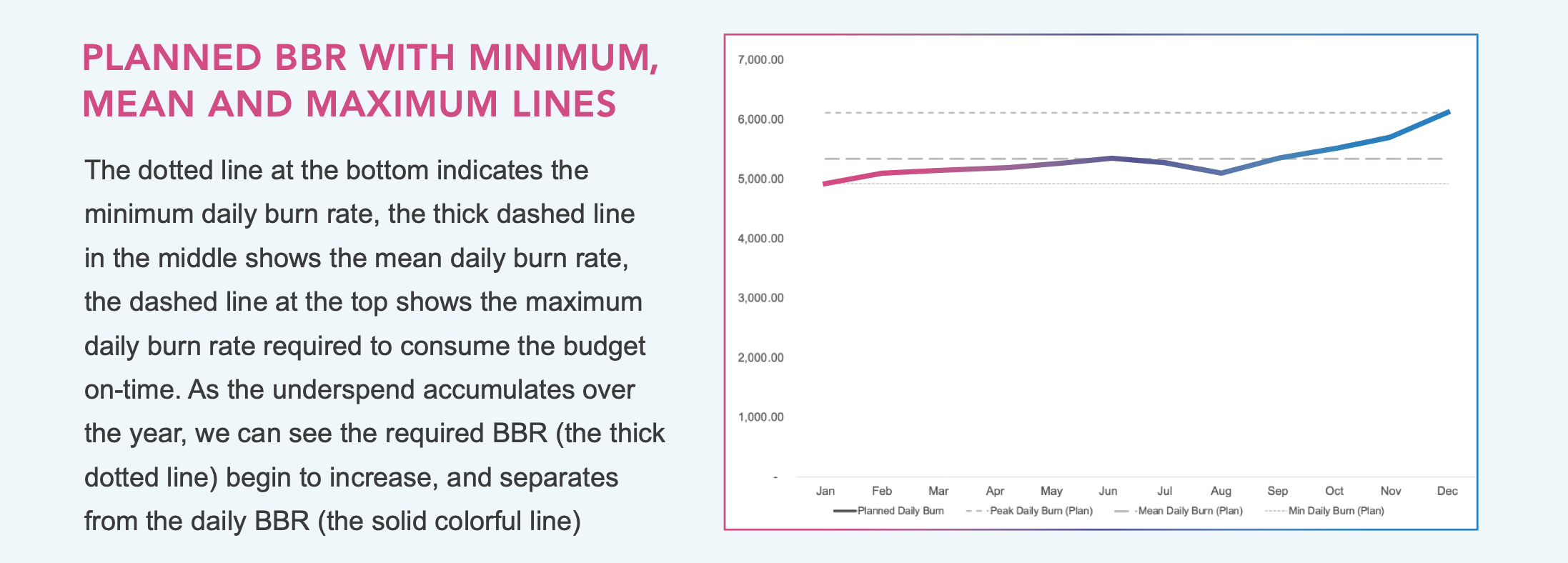

Another key step is to understand budget burn rate (BBR). Budget burn rate is the pace at which you need to spend to fully consume your budget by year-end. Like miles per hour, budget burn rate measures spending velocity. Specifically, it calculates how much budget you need to spend per day (or week/month) to stay on track.

Once your annual plan and budget are finalized, your team needs the resources—headcount, agencies, tools, etc.—to execute that plan over time. If there’s a mismatch between your budget and your resources, problems will follow. Knowing your budget burn rate will eliminate them before they have a chance to emerge.

Imagine you have a budget of $1,800,000 for a fiscal year. Regardless of how you intend to allocate the money across campaigns and channels, that’s the amount you need to spend over the next 365 days. On day 1 of your fiscal year, your required average BBR is $1,800,000/365 = $4,932/day.

Let’s assume that you decide to amortize your budget or allocate your budget equally across the year.

‘

‘

After January, there are 334 days left, and if your entire $100k budgeted for January has been spent, the budget burn rate for he remainder of the year is now ($1,800,000 – $100,000)/334 = $5,090/day.

If your budget is spent perfectly, the curve of your daily budget burn rate will remain relatively flat:

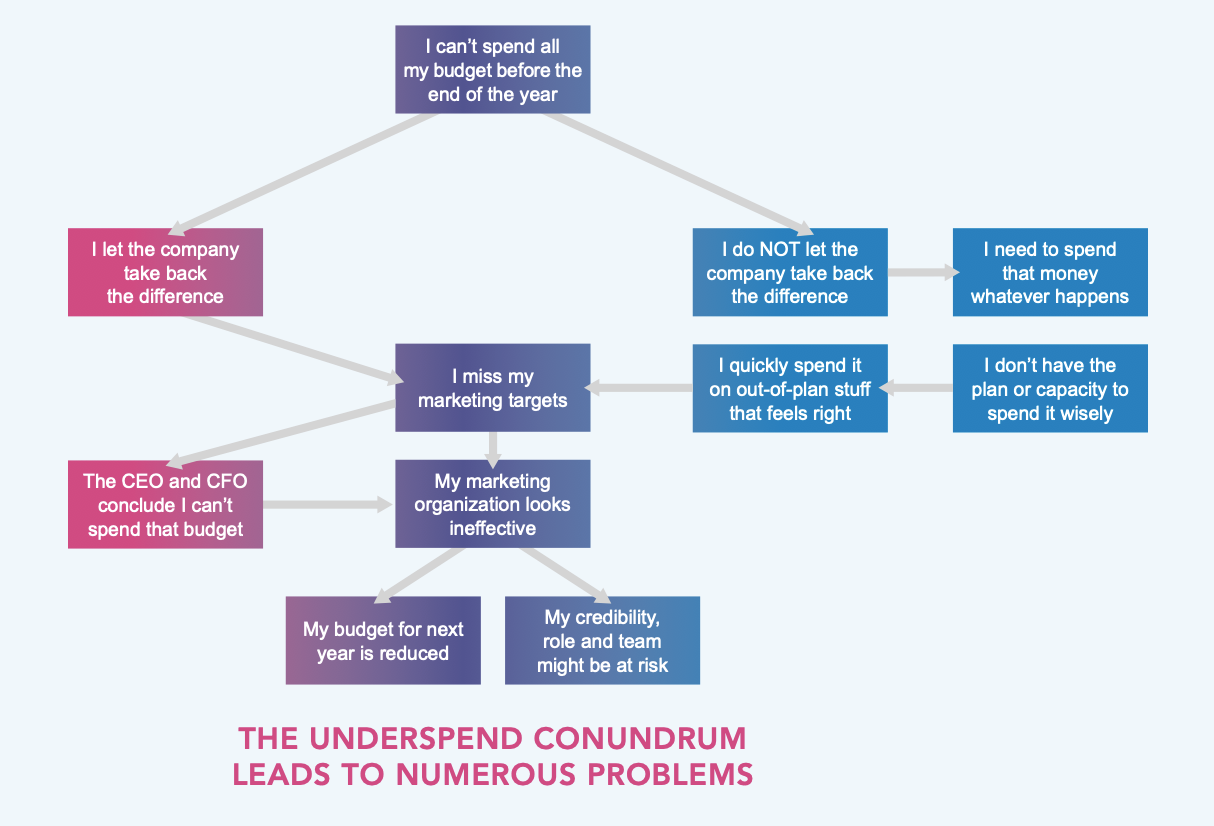

What is the hidden risk of underspending?

If the underspend piles up each month, the required budget burn rate accelerates away from the planned budget burn rate. Eventually, you’ll reach a point where you have too much budget left and not enough time (or resources) to use it properly.

If you are a CMO running this budget and you are constantly underspending, there are a few options available to you:

- You can rush spending, which is often inefficient.

- You can cancel strategic efforts that require extra time from your team.

- You can lose your unused budget at the end of the year.

None of these options is particularly valuable for your Marketing team.

Marketing teams find themselves in this position all the time. Luckily, though, this problem is preventable.

Budget burn rate helps you course-correct early

The biggest benefit of knowing your budget burn rate is that you’ll see exactly when the gap begins to widen, instead of being surprised at year-end.

Perhaps you need to hire additional contracted support or apply more resources to your digital campaign. The remediation is case-dependent, but the value of bringing the current and planned budget burn rate into alignment is clear: it means you can finish the year spending your money intentionally, phased appropriately over time, and in accordance with your strategic goals.

Budget burn rate is your strategic advantage

Budget burn rate is about planning, visibility, and control. By tracking how your actual spend aligns with your plan, you gain the insight needed to stay agile and deliver on your marketing commitments.

Before you go, remember these 3 things…

- Budget burn rate (BBR) helps you see trouble in your marketing budget before it hits. BBR shows how much you need to spend every day to stay on pace. Tracking it consistently allows you to proactively adjust spend, avoid year-end panic, and stay aligned with your original marketing plan.

- Underspending is just as risky as overspending. Consistent underspend jeopardizes pipeline goals, brand growth, and strategic alignment. Spending thoughtfully and fully is a sign of operational excellence, not excess.

- The earlier you act, the more control you keep. Waiting until Q4 to fix underspend means you’re fighting time and team capacity. Measuring BBR early and often allows you to course-correct in real time.

Take control of your marketing budget before it controls you

See how Planful’s marketing budget management solution helps teams stay aligned, avoid underspend, and optimize every dollar with real-time visibility and control.

FAQs

What’s the difference between budget burn rate and budget pacing?

Budget burn rate (BBR) measures the average amount that must be spent per day (or other time unit) to fully utilize a set budget by year-end. Budget pacing typically looks at whether you’re spending “on schedule” based on time elapsed, but doesn’t always consider cumulative underspend. BBR is more dynamic—it adjusts based on how much time and budget remain, giving you a clearer picture of future spend pressure.

How can I fix marketing budget underspend without wasting money?

The key is to reallocate strategically before underspend becomes a crisis. Use BBR to identify how far off-track you are, then phase in new campaigns, increase digital velocity, or temporarily scale external support. The goal isn’t to spend faster—it’s to spend smarter, and earlier in the year when you have more flexibility.

Does Planful help track budget burn rate automatically?

Yes. Planful gives marketing and finance teams real-time visibility into planned, committed, and actual spend, so BBR is always measurable. Unlike spreadsheets or disconnected tools, Planful aligns spend tracking to strategy, helping teams course-correct proactively instead of reactively.

Latest Posts

Blogs

Interviews, tips, guides, industry best practices, and news.