Measure Marketing Return as Business Value

What is the business value of the last marketing campaign you ran, in dollars and cents? Few marketers can answer this question. Currency is the vernacular of business. Not being able to describe the business value of marketing in normal business terms continues to be a fundamental challenge for the marketing function.

The consequence of marketing’s weakness in describing the business value it creates is that business stakeholders have a hard time understanding, and therefore believing in, the value of marketing. For marketers, it results in credibility issues, constant funding battles, and career churn. Marketing can add value to all stakeholders, it’s just a matter of how it’s communicated.

Communicating Marketing Value to Stakeholders

How can you communicate the value marketing provides to stakeholders? This is a solvable problem that requires a few steps:

- Understand the key measures of marketing success

- Measure at the right level – the campaign vs. the channel. Channel orientation is easy to fall into, given the proliferation of channel-specialized tools, however, it will cause downstream issues by artificially elevating the value of the channel relative to the offer, the marketing mix, target audience, and key messages.

- Measure aggregate marketing campaign value – and eschew deal-level attribution. Deal-level attribution should be avoided because it has no predictive value and is inherently inaccurate. Rather than retrospectively attributing won deals to marketing touchpoints, it is far more persuasive and compelling to the business if you prospectively attribute projected business value to your marketing campaigns and then track it and deliver on it.

Key measures of marketing success

Everyone has heard of return on investment (ROI). Many have heard of cost per outcome (CPO). Relatively few marketers describe their activities to stakeholders in terms of business value. We should briefly cover what each measure communicates, and what they are useful for:

CPO (Cost Per Outcome)

Cost per outcome is a measure of execution efficiency. It describes how much is being spent to achieve a metric. For example, what is the cost per lead generated? Customer acquisition cost (CAC) is a CPO measure. CPO does not communicate business value, but it is useful to measure because it will tell you if your marketing activities are becoming more or less efficient at generating certain metrics. CPO may increase if your keywords become more expensive or competitive. CPO may decrease if you hone messaging to a target audience and conversion rates increase. CPO is driven by the “I” part of the ROI metric.

ROI

Return on investment is a measure of investment efficiency. For every dollar invested, how many dollars are returned? Tracking marketing ROI is useful for explaining the relative effectiveness of different marketing investments (i.e. Campaign A has more leverage than Campaign B, but it tells us nothing about the absolute business value generated by a campaign.

Business Value

This is the financial business value of your marketing campaign: the R part of the ROI calculation. It is a currency amount. It is useful as a standalone metric because it tells us whether a campaign will have a meaningful impact most transparently. It is intuitive: if I tell you that a $100,000 campaign will generate $400,000 of value, that is easier to understand than if I tell you that the campaign has an ROI of 3.0. It is helpful for me to know which campaigns are generating the highest business value. Campaigns with high ROI may have low business value and vice versa.

Defining Business Value of Marketing

Don’t confuse marketing metrics with business value. Here is a small sample of marketing metrics that do not communicate business value: reach, likes, registrants, views, visits, downloads, logins, and positive press coverage. That is not to say that these shouldn’t ever be tracked. But they do not communicate business value, especially to people outside the marketing organization. At best, they are business-value-adjacent or proxies for some downstream business value that should not remain unquantified.

Business value means money. For most companies, business value to stakeholders is some version of profit (contribution margin, gross margin, operating margin, EBITDA…pick your poison). So can you look downstream from those tractable marketing metrics and see them culminating in financial benefit to the company in the future?

The good news is, if you can measure your pipeline reasonably accurately, you’re only a hop and a step away from profit. And if you’re measuring revenue, you’re just one step away. In any event, the team should standardize on a consistent financial measure so that it can compare contributions by marketing campaign management, and monitor performance over time.

As long as your definition is measured consistently, you can compare the relative merits of different projects and leave the rest to the accountants. Task one is to pick a definition of business value that you can track, and which must be expressed in monetary terms.

How to Measure Marketing Return in Terms of Business Value

What is the return of content syndication? What is the return of positive press hits? What is the return of (gulp) rebranding? To calculate that, we must deal with two critical elements: the marketing funnel and averages.

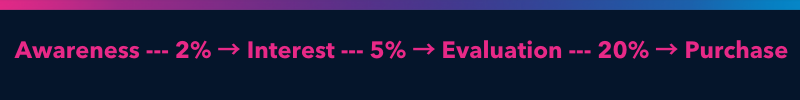

First, locate your marketing activity’s metrics in your conversion funnel. Use the funnel that makes the most sense for your business. For illustration purposes, we will use this one:

One of the most common concerns we have heard from marketers is that they want to ascribe business value to their marketing activity but they can’t see how to do so. “What’s the ROI of a white paper?”, we were asked. It’s a fair question, and the answer is there probably isn’t one, at least directly. You shouldn’t even try to measure the ROI of a white paper. The white paper is probably part of a broader campaign, maybe a thought leadership campaign.

What’s the goal of that campaign? To move people from interest to evaluation? To overcome late-funnel customer objections and get people from evaluation to purchase more quickly?

By contextualizing the white paper within the campaign, the impact will emerge. If it doesn’t, it’s probably worth reassessing why you’re creating the white paper. In short, not every tactic is measurable or describable in terms of ROI or business impact so don’t try to do that. Instead, zoom out to the campaign level and track the business results of the campaign. Fewer things to measure, more useful measurements.

Once you have your conversion funnel, spend some time really thinking through the conversion rates from one stage to the next. This is important because if you capture the conversion rates well, you will be able to forecast the business value of marketing activities accurately.

Recall above, when we said how important the notion of averages is to this practice? Here is the first example of that. The average conversion rate is something important to measure, and then track over time, as it will definitely change. There will be factors that cause conversion rates to fluctuate up and down. You will control some of those (e.g. messaging, price) and some you won’t (e.g. seasonality, competitor moves).

If you don’t know your averages, then spend some time calculating the best estimate you can and iterate quickly to calibrate your conversion funnel to something reasonably reliable. If you are a multi-offer company, you may need more than one funnel. Here’s an example of the funnel with conversion rates:

Once you have agreed on your conversion metrics, everyone must use them for all marketing campaigns related to that offer. Consistency is key.

- The goal of an awareness campaign is, obviously, to put people into the Awareness stage of the funnel.

- The goal of a thought leadership campaign may be to move people from Awareness to Interest

- A sales enablement campaign should move people from Evaluation to Purchase. (Sidenote – sales are unlikely to give you credit for the purchases. If you want to show marketing made a difference, see if you can affect a change in conversion rate with your campaign and measure the value of that).

For ease of measurement and communication, it will most likely be logical to group marketing activities into higher-level campaigns. This will enable you to manage a smaller number of high-impact campaigns, making communication of the business impact of marketing more relevant to stakeholders in the company. It will also release the team from unanswerable and low-value debates about what the value of a piece of content is, a website visit, or a click.

Define your campaigns such that the metric is a quantifiable, measurable, number of people or businesses either appearing in your pipeline or progressing to the next stage in it. You can put a value on that.

Note, measuring by channel will be less effective as an organizing principle than measuring by (potentially multi-channel) campaign, as we have written about in The Next CMO, and in our blog. It creates the false impression that channels are deterministic of marketing success (vs. offer, message, and target audience), and it encourages silos within your organization.

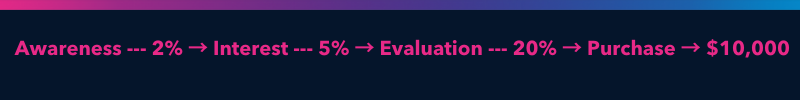

Now, agree upon a realistic average lifetime value of a purchase. There are those averages again. The business value should ideally be expressed in terms of profit, but if you can’t get that, use revenue. Just be consistent across your campaigns. Example:

Now you have the fundamental ingredients to (1) describe the financial impact of your marketing campaigns and (2) set justifiable targets for your campaigns.

Example: Ellen wants to move 1,000 people from the Awareness phase of the funnel to the Interest stage. In her company, they call that generating 1,000 MQLs. What would 1,000 MQLs be worth, in business terms, given an LTV of $10,000?

Awareness — 2% → Interest — 5% → Evaluation — 20% → Purchase → $10K

1000 X 5% = 50 X 20% = 10 X $10K = $100K

What’s the average value of an MQL in business terms? $100 ($100K of business value, divided by 1,000 leads).

If a colleague asks Ellen what the value of her campaign is, she can tell them with confidence that it’s approximately $100K. And using this method, she can compare the business value of her marketing campaign to other campaigns.

Note, that this is sometimes more important than knowing the ROI of a campaign. You could have a fantastic ROI from a campaign with a low overall business impact, and an okay ROI from a marketing campaign with a high business value. If you only track ROI, you may find that you don’t spend enough on the highest impact campaigns.

Dealing with Timing

We often talk with marketers whose offerings have long deal cycles. If your business has a 12-month sales cycle, it can be challenging to tie today’s activities to a financial outcome. However, suppose you can construct a marketing funnel that flows all the way through to deal closure and map your campaign metrics into that funnel. In that case, you can calculate a projected business value for your marketing activities even if they are at the top of the funnel, and won’t generate business value until the next fiscal year.

Sometimes people feel uncomfortable with investments in one budget year that won’t yield a benefit in the same financial year. If you have a sense of the timing of your marketing funnel, then you are well equipped to show stakeholders why investments this year are required for next year’s growth.

Conclusion: Measuring the Business Value of Marketing

There are three measures of marketing campaign value:

- Business value (what is the financial benefit to the company of a campaign)

- ROI (what is the investment efficiency of a campaign)

- CPO (what is the spend efficiency within a campaign)

We believe that the first of these, business value, is under-represented and that it will benefit businesses and marketers to focus as much on return in terms of business value as they do on ROI and CPO. The framework we’ve presented here to estimate return in terms of business value is tractable.

At Planful, we believe it will strongly assist marketers in explaining the impact their activities are projected to have on the business, and what they actually deliver, in plain English that is understood outside marketing. We also believe it encourages marketing teams to measure marketing performance at the right level, which is at the campaign level.

Learn more about Planful’s marketing planning software, including our marketing performance dashboard.

Latest Posts

Blogs

Interviews, tips, guides, industry best practices, and news.