Marketing and Finance Should Be Friends. Here’s How.

In 2019, Gartner’s CMO Spend Survey found that marketers view Finance as the “top organizational inhibitor” to executing on marketing strategy. It doesn’t have to be this way.

Marketing and Finance should be two sides of the same strategic coin—but too often, they end up working at cross-purposes.

Different systems, different language, different goals. And when those disconnects show up in the budget, the impact is real: missed opportunities, accuracy issues, and a whole lot of frustration on both sides.

In this blog post, we’ll break down why these disconnects happen, what they cost the business, and how teams can create better alignment.

How are marketing and finance related?

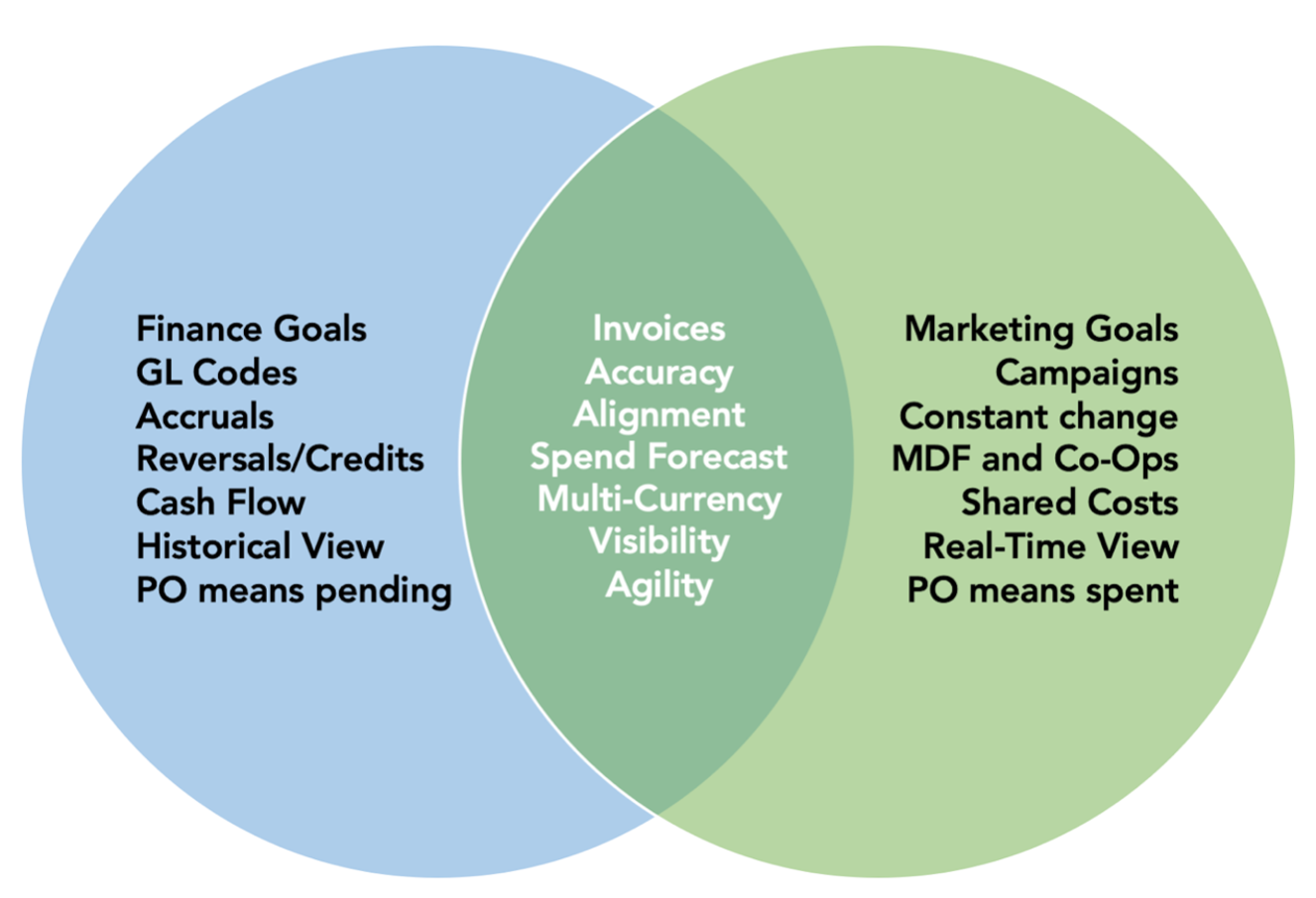

Marketing is as preoccupied with costs and cost management as any non-finance function. That’s not surprising since marketing typically commands the company’s largest discretionary budget. However, as we see below, the financial concerns of the marketing and finance functions are overlapping but not identical.

The Venn diagram below shows how marketing and finance are related. Finance perspectives and activities (as they relate to the marketing budget, at least) are shown in blue, Marketing’s shown in green, and shared elements are shown in the intersection.

What are the symptoms of dysfunction between Marketing and Finance?

The distinct needs and approaches of managing a marketing budget by marketing and finance can create dysfunction with severe consequences. Neither likes being forced to become fluent in the language of the other, and they shouldn’t have to.

Symptoms of dysfunction between marketing and finance can include:

Inability to forecast marketing expenses accurately

Among the large array of financial responsibilities are accurate tracking and reporting of expenses, both forecast and actual. Yet, because of how marketing budgets are typically created (annually) and managed (spreadsheets), this is something marketers struggle to deliver accurately and consistently.

Poor communication between Finance and Marketing

Finance needs to see financial data in GL codes. Marketing manages its spend according to channels and campaigns and, as a matter of routine, needs to share costs dynamically across teams to achieve its campaign goals. There is no marketing benefit to organizing, managing, or tracking its budget according to GL codes.

This means that what finance captures in the books does not accurately reflect how funds were used by marketing. That makes communication and planning inherently more difficult. If the CMO manages the marketing budget by GL code, the marketing plan becomes incoherent and impossible to measure by marketing ROI and campaign.

Misalignment on the meaning of a closed expense

Finance cares about cash flow and accruals. Marketing cares about how much budget is left to spend. Once funds are committed via a contract, a PO, an invoice, etc., they’re gone from a marketer’s perspective, even if they are not currently identified in the finance system.

Time lag

The CMO and the CFO always have different perspectives on the current state of the budget. Finance’s view is historical, while Marketing’s view must be real-time. Both views must match up in the end.

Confusion surrounding accounting

Finance cares about accruals timing, which has no benefit to or impacts marketing goals and outcomes. From a budget perspective, Marketing cares about what funds have been used and what remains. The expense-reverse+credit-expense accounting process is confusing for marketers but critical for finance.

Difficulty adjusting the budget

Finance needs all functions to be responsive to cost optimization programs, but marketing finds it difficult to comply with these projects because its spend is dynamic and virtually impossible to track accurately in spreadsheets.

Difficulty in managing multiple currencies

Marketing often needs to create expenses in multiple currencies and understand their impact on the overall budget in whatever its base currency is. This is not something marketers typically have expertise in, but it is critical from a corporate perspective, and it can significantly affect budget actuals.

Platform inequality

Finance can easily generate detailed reports in a familiar format to show its view of the marketing budget because it has a corporate finance system like QuickBooks or NetSuite. Marketing typically scrambles to assemble custom reports from its disparate tech stack and spreadsheet collection, burning hours and missing the various silent errors and inconsistencies in its spreadsheets.

What are the consequences of dysfunction between Marketing and Finance?

The consequences of dysfunction of the relationship between marketing and finance can be severe and can include:

- Frustration. The CMO doesn’t get value from the finance view of the world, and the CFO doesn’t get value from the marketing view.

- Loss of trust. The CMO’s competence is questioned because Marketing can’t present its plans and activities in a way that makes sense to the finance team and the corporate team (“Everyone else can do it. Why can’t you?”).

- Low agility. Difficulty making purchasing decisions because the CMO doesn’t know what is really available.

- Loss of credibility. An organizational tolerance for inefficiency emerges because Marketing is deemed a problem child. A corporate perception that Marketing is operationally loose is pernicious.

- Marketing underperformance. Under-achievement of marketing goals because of poor visibility and, consequently, poor agility. This opportunity cost impacts sales performance, too.

- Operational inefficiency. If the company requires strong alignment between marketing and finance, the cost to achieve it manually runs high. If it doesn’t, that’s worse.

- Corporate underperformance. If marketing budget waste is significant (and it’s 26% on average_ the corporate P&L may be adversely impacted when it is too late to recover. Several small spreadsheet errors accumulate over the year to create a significant whole.

Examples

How do we know the results of dysfunction between marketing and finance are real? We see these issues every time we onboard a customer to Planful.

Below are a few anonymized examples from onboarding Planful customers:

- One company discovered in the last 2 weeks of its fiscal year that it had 23% of its marketing budget left and not much to spend on.

- Another discovered its budget for a key program had run out 2 months prior, and everything since that point, and for the remainder of the year, would be 100% over budget.

- A formula error meant a valuable MDF (marketing development fund) had been overestimated by 10%, meaning the company had to cover the difference from its own budget.

- A single expense was entered in the wrong currency, creating a $30,000 shortfall in funding due to foreign-exchange rates.

The list is practically endless because the platform inequality between marketing and other functions has become so severe that financially significant and performance-impacting errors stemming from the marketing budget are inevitable, not just possible. Finance has NetSuite, HR has WorkDay, Sales has Salesforce, Product Development has Jira, and so on. Most marketers have Excel, and it simply isn’t up to the job for either Marketing or Finance.

Managing an agile, fast-moving, digital, and traditional marketing budget from a spreadsheet is impossible. For all the reasons finance abandoned spreadsheets in favor of software platforms (removing multiple spreadsheets, avoiding silent formula errors, cascading errors, lack of history, lack of ownership, lack of visibility, lack of agility), the best way to align the relationship of marketing and finance is through a strategic, operational marketing platform like Planful.

Planful is your solution to align Marketing and Finance

At Planful, our marketing budget management software acts as the bridge between Finance and Marketing. It can show investments by GL Code and an integrated marketing campaign. It allows Marketing to operate with flexibility, confidence, and agility with an accurate forecast of what has been spent and committed and what remains.

Our platform makes it easy to true up to the finance team’s reality when the bills have been received and/or paid. It automatically builds reports for you from a single, common set of data. It doesn’t make formula errors. It doesn’t mess up international expenses. It speaks Marketing and Finance fluently, rather than forcing both teams to speak the same language. This is why we built Planful.

Before you go, remember these 3 things…

- Misalignment between Marketing and Finance leads to budget errors, delays, and credibility loss.

- Spreadsheets can’t manage dynamic marketing spend across currencies, vendors, and campaigns.

- Accurate, real-time budget visibility is critical for agile decision-making across departments.

Creating more control and precision for your marketing budget is easier than you think.

Explore our interactive demo to learn how.

FAQs

Why do marketing and finance teams often struggle to collaborate?

Marketing and Finance use different systems, structures, and success metrics. Finance tracks budgets by GL codes and accruals, while marketing focuses on campaigns, committed spend, and real-time agility. This disconnect creates reporting gaps and miscommunication.

What are the risks of managing a marketing budget in spreadsheets?

Spreadsheets are prone to formula errors, version control issues, and a lack of visibility. When used to manage dynamic marketing budgets, they often lead to overspend, underspend, or misallocated funds that impact business performance.

How can companies improve alignment between marketing and finance?

Alignment starts with shared visibility and a common understanding of how funds are tracked, committed, and reported. Real-time budget data, flexible reporting views, and integrated systems help bridge communication gaps. Tools like Planful provide a single source of truth that supports both marketing’s need for agility and finance’s need for accuracy.

Latest Posts

Blogs

Interviews, tips, guides, industry best practices, and news.