If marketers can’t frequently and accurately reconcile actual costs against their planned investments, they’ll inevitably over or under-spend, and they will inevitably be unable to deliver their plan goals. In an increasingly real-time, high-precision business environment, marketing needs to keep pace with other business functions or anticipate negative changes.

Lessons from Mint

In the first decade of the century, personal budget management was revolutionized by the launch of mint.com, which delivered consumers a simplified way to manage their costs and align spending with their longer-term goals. Today, mint.com continues to provide thought leadership and value to individuals managing their personal finances. In this blog, they provide best practices for individual budget management, many of which translate to the business context, including.

• Know your income (or, in marketing, know your available budget at all times)

• Keep receipts and review them weekly (in marketing, reconcile your planned vs actual expenses)

• Set goals ( for marketing)

• Build an emergency fund (in marketing, reserve budget for experiments and unforeseen costs)

• Identify necessary expenses… (know your obligations before you plan discretionary spending)

• Involve the whole family (involve the whole team in planning and execution of the budget)

• Use software and/or apps to help you. (we agree! ✊)

Much of this we have covered in previous blogs, especially in this blog on

building a perfect marketing plan. This particular blog focuses on the critically important topic of reconciling expenses. In the same way that, as individuals, we need to review our receipts and balance our budgets accordingly, marketers need to have accurate, up-to-date views of what has been spent, what is planned, and how much is still available.

Is Marketing doing better than individuals?

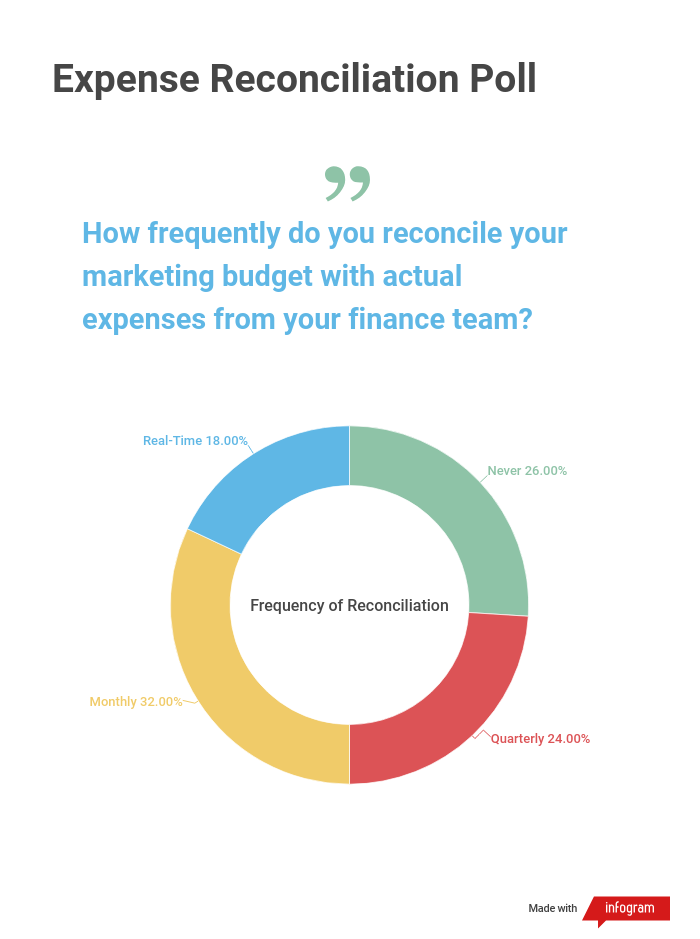

We suspected anecdotally that there was a problem with timely expense reconciliation, but because we’re nerds, we wondered if marketing teams were doing this better than individuals. According to a 2019 debt.com poll, 67% of American consumers manage a personal budget. Are more than 67% of marketing teams regularly balancing their budgets? We decided to get some data through a poll, and here’s what we found:

Given that the vast majority of budgets are being run off disconnected spreadsheets, we don’t believe true real-time reconciliation can be happening as much as 18% of the time (i.e. as the expense is released by finance it is immediately updated in the marketing system of record). Even if we stretch the interpretation to mean “more frequently than monthly”, it’s just a small proportion of all marketers that has a close-to-current view of budget availability.

Conversely, 82% of marketers are reconciling expenses at a monthly or slower pace. While we expected to see the majority of the market fall into the monthly and quarterly segments, we were surprised to see 26% reporting that they never reconcile their actual expenses with their planned expenses. That is truly driving blindfolded.

If people ran their household budgets on similar timeframes, there would be many more bounced checks and overdrawn fees, and more importantly, people failing to achieve their goals. It would seem to be a fruitful area to improve marketing operationally by

- ensuring that expenses are reconciled

- the expenses are reconciled frequently

- the expenses are reconciled quickly (even automatically)

What’s in the way of reconciling expenses the right way?

1. Data mismatch.

Marketers don’t (and shouldn’t) think of

marketing expenses in terms of GL (general ledger) codes that the finance team might use in its accounting system. For example, most finance teams group together similar types of expenses and treat them as a category, such as “Advertising”, “Travel”, “Outside Services” and so on.

This approach poses challenges for marketers, because they need to think in completely different terms. Imagine a marketing team that allocates $200K to a re-branding campaign. Within that campaign, they may need to carry out multiple types of advertising (print, billboard, digital…), they may need to travel to meet with customers and consultants, and they may have multiple outside services that they call on (brand consultants, creative agencies, video services, and so on).

All of these diverse expenses under advertising are just lumped into “Advertising” in the finance system, along with all the other advertising costs from all other campaigns. The disparate consultants and contractors are lumped into “Outside Services”.

The budget of the re-branding campaign can’t be accommodated in the finance system – in other words, it doesn’t exist in a system of record outside of marketing, and maybe not even there. This type of scenario is almost universal, in which marketing apples don’t look like finance oranges.

2. Manual Reconciliation

When the finance team provides an expense report from the finance system to marketing, it is very difficult for the marketing team to translate the line-item expenses back into their view of the world. It’s normally a manual process where individuals have to read the report, interpret what they think it means, then search through their spreadsheets to find the corresponding expense in their marketing plan.

This routinely costs days of effort every month according to our customer interviews. Even if the finance team delivers a monthly report, the expenses are often not reconciled for an additional week or two because of the manual, error-prone effort. Given the velocity of modern marketing it is not tenable to operate a high-performing team with a 6-week lag in visibility of expenses. To date, the methods that have been implemented to automate expense reconciliation are astoundingly expensive and entail custom, lengthy systems integrations.

3. Inability to connect actual expenses to planned expenses

It’s possible to argue that this is a subset of point one above, but it’s important enough to call out as a standalone point. We have seen examples of companies who have the right data in their systems of record to identify expenses for reconciliation (for example, PO Numbers), but they do not provide that information in the finance reports that are sent to marketing. This means that marketers have a much harder time identifying the specific expenses: rather than searching for the PO number, they have to apply a heuristic mental algorithm to match vendor names, timeframes, amounts, etc.

4. An operational mindset in the Marketing team

As is so often the case, culture drives behavior. If the marketing team is committed to visibility, transparency, and operational detail, then expense reconciliation tends to happen more promptly and more accurately (even if it is still a tough, manual process). If not…those companies are most likely in the 26% of Never-Reconcilers. This matters for everyone in the marketing team, as we shall see below.

Consequences of poor expense reconciliation

1. Missing your target budget

We’ve covered the main one: if you don’t reconcile your marketing expenses, you don’t know what has been spent, and you therefore can’t know what remains. If you over-spend, then marketing places unplanned duress on the corporate P&L. If you under-spend, then you’re not maximizing the contribution of the marketing team to delivering value to the company.

Every penny you don’t spend that you could have spent on marketing campaigns to deliver business metrics is a lost opportunity. Leaving money on the table is the last thing marketing should do since it normally needs to invest to deliver the campaigns that drive business value.

3. Reduction in marketing budget in subsequent years

The message sent to the company when marketing underspends is that it either does not have the capacity to spend the entire budget (in which case the budget is right-sized to the perceived capacity) or it does not have the right operational capability (in which case trust in the organization is reduced, and budget levels tend to correlate with trust levels).

4. Team and/or structural changes

If the team culture doesn’t demand operational precision but the corporate culture does, then marketing leaders who are aligned with the company culture will be installed. Alternatively – and we are starting to see this phenomenon – marketing is moved under a different function.

Typically, it is either consolidated with sales under a CRO, moved under sales entirely, or split into disparate functions. This has just been demonstrated at McDonalds, where marketing was recently split into 2 teams: marketing technology and marketing. The company will continue without a CMO. We’re obviously

not arguing that this change was brought about by slow expense reconciliation. But we do see connective tissue between operational precision and velocity and the credibility of marketing as a function in the boardroom. Close, frequent

management of marketing expenses to plan is one of the strands of that connective tissue.

How Planful can help

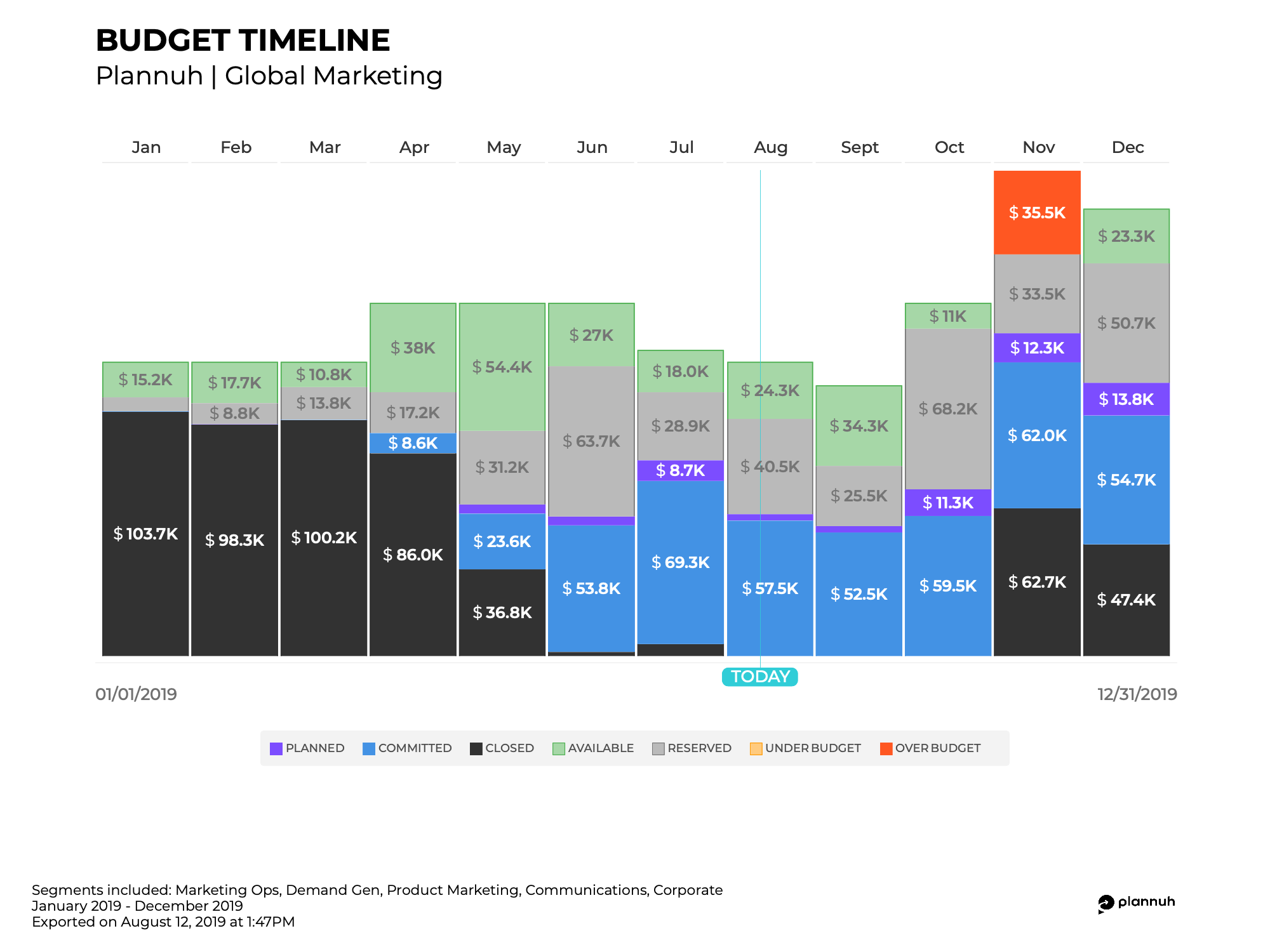

Planful was designed to provide great visibility into expenses, how committed they are, and what’s available – and to make changes easily. Today, you can create and update expense values easily, and change the level of commitment of expenses from reserved, to planned, to committed to closed. Planful’s

marketing budget management software shows you in real-time what’s committed and what’s available:

In the next few weeks, we are releasing a brand new user experience – a fourth tab – that will simplify and transform how expenses are managed inside our

marketing performance management software, enabling our customers to much more simply track, manage, and reconcile expenses as a team throughout the year. And shortly after that, we’ll be releasing our AI-powered automatic expense reconciliation, so you can have up-to-minute visibility into what has been spent and what’s available without all the manual legwork.