How You Can Solve the 10 Most Common (and Costly) Marketing Budget Issues

We’re on a quest to improve marketing budget and planning. After reviewing over 1,000 marketing plans, we’ve broken down how outdated tools can add up to big issues, plus a list of the most common problems marketers encounter in their budgeting plans.

It all has a tangible impact on the effectiveness of your marketing investments, so read on to learn how to make your budgeting and planning easier and more accurate.

The primitive tools of the trade

A marketing plan is a superset of a marketing budget. For a slightly deeper discussion on that topic, read our blog post that describes the difference between a plan, a budget, and a strategy.

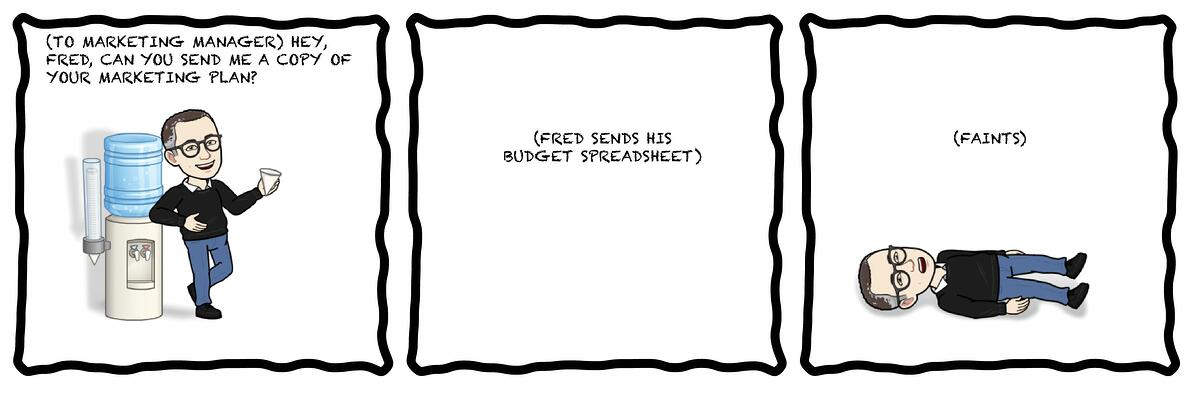

We’ve illustrated the high points in the cartoon below:

For the purpose of this article, we are going to focus primarily on budgeting tools since they are the cause of most of the issues. While most budgeting tools are built into spreadsheets, they take on different forms:

The blank sheet

There’s nothing like a pristine sheet of empty rows and columns to inspire dread at the beginning of your planning cycle. You start by deciding whether you want to budget by month or quarter. Do you add quarterly subtotals? How do you break down the budget into segments? Do you use campaigns, departments, expense types, GL Codes, or something completely different?

Starting with a blank sheet creates a lot of potential issues, including the high likelihood that you will forget something important, and the almost certainty that your data will have to be reformatted to roll up to the corporate plan.

The template from days gone by

You can tell that you have this kind of template when nobody in the company remembers where it came from. For all you know, it could have been written on VisiCalc or Lotus 1-2-3<. It is distinguished by its inconsistent formatting and untraceable formulas. Because these tools are often modified as they are passed through an organization, they are riddled with errors and bloated with extra tabs and features that you don’t need.

The “1 am the night before it was due” downloaded template

Admit it. You’ve been here. Your budget was due the following day, so you searched for a template online to start from.

The biggest problem with these templates is that they are either so generic that you will leave things out, or they are designed for a different type of business and won’t be relevant. In most cases, you don’t know the origin and may be faced with bad formulas or inconsistent logic.

The NASA template

We all have seen this template too: it’s the most complicated spreadsheet known to man. It auto-categorizes expenditures, automates workflows with macros, and even creates fancy reports.

The problem? They’re so complex that they make budget managers’ jobs harder than they need to be. And because spreadsheets can be easily changed by users, the macros, formulas, and other automations are brittle and can easily break.

The finance-centric template

Of all the templates that we see, this is the most common one. The finance team often develops a template for the marketing budget that is consistent with the templates for other functions.

The problem is that marketers don’t budget the same way as Finance, HR, or IT budgets. You don’t think in GL codes and departments; you think in campaigns and goals.

“It’s not you, it’s the tools…”

The point of listing all the different (and flawed) tools used for marketing planning and budgeting is to highlight the fact that it is difficult for anyone to build a successful plan with these primitive tools. There are smart, experienced marketers who have great execution skills and a deep understanding of marketing management, but they don’t have the right tools and systems to successfully navigate this complex process of managing a complete marketing plan and budget.

The 10 most common issues

With all of that context in mind, here are the most common errors that we see in marketing plans.

1. Formula errors

When we onboard customers at Planful, we see formula errors more than 80% of the time. The most common cause of formula errors is adding a row of data without updating the formula that sums up that row. We often see formulas break when people pass along templates through the ages at a company.

2. Formula complexity

Another common budgeting issue often appears in the “NASA template” that we described above. As formulas grow in complexity, they become more brittle and error-prone–and they are difficult to debug when problems arise.

For example, one customer had a worksheet that automatically added up certain expense types and categorized them into the finance template. The only problem is that the individual budget owners didn’t understand the logic, so the formulas did not count $180,000 of the budget that the individual managers were planning to spend. That error alone represented nearly 10% of his overall budget.

3. Over-writing formulas

As spreadsheets get passed along, we often see users typing numbers over formulas in non-protected cells, destroying the logic in the worksheet. This can happen when a user pastes data into a worksheet from a different source. In many cases, you wouldn’t be able to tell that a formula was replaced by a number unless you inspected every single cell of a worksheet.

During one onboarding, we couldn’t figure out why Planful was showing a different budget total than the customer’s worksheet. After inspecting hundreds of individual cells, we discovered someone had pasted a number in a cell that was supposed to total a row. The end result was a $75,000 mistake in their budget.

4. Bad data

Incorrect data can easily creep into a plan when combining data from multiple sources. In some cases, we see data being rekeyed from one source into another, and transposition errors can occur. In other cases, we see numbers copied and pasted from presentations or documents into spreadsheets, and they are entered as a text string instead of a number. When that happens, the spreadsheet doesn’t recognize the number and will under-represent the budget.

5. Poor visibility and forecasting

Even if you have an error-free budget, most marketers struggle with visibility into their actual spending vs. their plan. The problem is exacerbated when you distribute budget authority across an organization. Without an accurate view of the actual spending vs. plan, most marketers have to spend conservatively to make sure they don’t exceed their budget.

We have seen some pretty extreme cases of this budgeting issue with our customers (before they turned to Planful). For example, we have seen companies spend their entire budget in 9 months, not realizing that they would be deficit spending for the last quarter of the year. We have seen cases where a third of the annual budget is unspent in the last month of the year, resulting in underspending and non-strategic spending.

Related: Creating a Marketing Budget That Can Be Justified

6. Not balancing your budget

Most people don’t balance their checkbooks because they track all their spending online via credit card transactions, ATM withdrawals, digital payments like Venmo, and maybe the occasional check.

When you are dealing with a marketing budget, a lack of alignment between marketing and finance can cause huge problems. Timing of the accounting of expenses can cause huge differences in your view of the actual expenditures vs. the finance view. And incorrect coding of expenses to the marketing department can cause further lack of alignment. You can quickly get out of alignment without reconciling your expenses with the finance view.

7. Productivity loss from reconciling numbers

With marketing expense management, reconciling your expenses with finance is a good idea, but it can be a hugely complex administrative task. We recently worked with a customer who had a marketing operations staff member spending a full day a week reconciling expenses with finance. Not only is this budget issue a huge cost for a well-compensated professional, but it was an awful job that created turnover because nobody wanted to do it.

8. Trapped budget

One of the biggest areas of waste in a budget is what we like to call a “trapped budget.” You trap budget in your plan when you estimate the cost of a campaign or expense conservatively and never recoup the difference. You also see departments underspend because they can’t forecast well, leaving budget on the table. We typically see more than 5% (and often more than 10%) of the budget lost to being trapped in your plan.

9. Non-strategic or misaligned spending

It’s common to see a lot of non-strategic spending when people try to use their budget. If they had $50,000 planned for a campaign and only spent $45,000, what happened to that $5,000 (see the “trapped budget” above)?

In many cases, the marketing manager will spend the remaining budget on something that was not directly related to driving the business, like getting more swag for the next trade show.

10. Rush charges and lack of negotiation

If you are trying to figure out how to spend that remaining budget before the end of the quarter, you will probably not get the best possible deal. And in some cases, if you don’t have good advance planning, you will have to pay rush charges to get the work done so it can be billed in the period when you have the remaining budget.

The bottom line: marketing budgeting issues

When you add up the economic impact of all these issues, you typically get a pretty big number. Rakuten Marketing did a survey of CMOs and they estimated that 26% of their budget was wasted due to poor planning. Our experience with hundreds of real-life budgets is consistent with that view.

For example, we have found spreadsheet errors that add up to an average of 8.2% of our customers’ budgets. We see another 10% of the budget lost to poor forecasting, and anywhere between 5% and 24% of trapped budget in the plan. That already gets to the number reported by the Rakuten study without considering non-strategic spending or rush charges.

In other words, primitive tools of the trade create a huge amount of waste in marketing plans.

Before you go, remember these 3 things…

- Outdated templates waste budget. Spreadsheet errors can cost marketers a large chunk of their budget every year.

- Marketing doesn’t budget as Finance does. Tools built for GL codes and departments don’t support campaign-based planning.

- Better tools drive better results. Modern marketing teams use real-time platforms to prevent trapped budget and misaligned spend.

Your marketing strategy doesn’t have to be weighed down by budgeting issues.

See how Planful gives you the power to track every marketing activity.

FAQs

What are the most common marketing budget planning mistakes?

The most common marketing budgeting issues include spreadsheet formula errors, overwritten cells, trapped budget, and misaligned spending. These mistakes often result from using outdated templates or manual tools that lack real-time visibility and collaboration.

How do marketers and finance teams approach budgeting differently?

Marketing teams budget by campaigns, channels, and goals, while finance teams typically budget by GL codes and departments. This disconnect can lead to confusion, misreporting, or an underutilized budget if the tools aren’t built for both perspectives.

What’s the best way to modernize marketing budget planning?

Replacing spreadsheets with a collaborative, real-time platform designed for marketers is the fastest way to improve accuracy and agility. Planful makes this easier by aligning marketing needs with financial oversight, thereby bridging campaign planning and corporate goals within a single unified system.

Latest Posts

Blogs

Interviews, tips, guides, industry best practices, and news.