6 Types of Financial Reports Every FP&A Team Should Be Using

“Heavy is the head that wears the crown.” That line, adapted from Shakespeare’s play “Henry IV, Part 2”, could easily be used in reference to FP&A professionals and the huge responsibilities they carry.

FP&A managers are charged with examining, analyzing, and evaluating the entirety of an organization’s financial activities and mapping out its financial future. They then must clearly explain specific financial concepts in language relevant to busy executives, craft and tell a story that illustrates financial results, and provide guidance on how to stay on track with the overall plan.

To do this, the Office of the CFO must work with their team, department heads, and business leaders to keep everyone focused on the company’s financial performance. Finance teams can do so by leveraging the six essential types of financial reports found below.

6 FP&A reporting types

1. Budget vs. Actual Reports

Every department in a business is responsible for a budget. Throughout the month, department managers need help from the FP&A team to understand how budget actuals are tracking against their budget targets. It is incumbent upon FP&A to monitor departmental actuals against budgets, capture commentary from department managers to explain any variances, and communicate the status to the executives, all while tracking to the broader goal of the operating plan or budget throughout the year.

By sending out monthly department budget vs. actual (BvA) reports (also known as actual variance analysis or budget variance analysis), FP&A teams can collaborate with department managers to quickly identify and address large variances. Depending on the findings, variances can be favorable or unfavorable. A favorable variance could include higher income than anticipated or sales exceeding targets. An unfavorable variance, on the other hand, can happen when sales numbers plunge below projections or there are higher than expected expenses.

Comparing budget against actual results allows you to investigate the reason behind large variances and, if the variances are negative, proactively take steps to fix the situation. For example, FP&A can work with the business to uncover if unfavorable variances are being caused by changes in market conditions, competitors’ actions, an unexpected event, or an unrealistic forecast.

Generating budget vs. actual reports also gives the FP&A team access to all the information they need to determine and report the state of the business to the chief financial officer (CFO) and other executives.

2. Cash Flow Forecasting Reports

Cash flow forecasts predict the future financial liquidity and cash collection of a business over a specific period of time. Short-term cash flow forecasting is based on actual cash receipt and disbursement data; typically focused on 12 months or less. While long-term cash flow forecasts are projections based on data from the income statement and balance sheet and look beyond 12 months.

Ideally, you should send out a weekly short-term cash flow analysis report to every business function that has the ability to drive cash collection. These types of financial reports track period-to-date activity against cash collection goals to anticipate where the final results will land for the period. Consequently, the FP&A team can collaborate with business managers to quickly spot issues and opportunities to improve the cash position and collection metrics. They can then take those recommendations to the executive team and advise them on real actions the business can take today to improve the cash position of the company—an activity that provides high-impact financial value to the organization.

3. Operational Review Reports

An operational review report is a comprehensive review of the entire organization or a specific department. It can be used to evaluate the organization’s performance to find ways for more efficient resource allocation and target certain initiatives to be scheduled or completed within a specific time frame. It also gives FP&A the ability to spot problems quickly and take corrective action.

FP&A managers should provide operational review reports to line-of-business managers. These reports enable them to model ad hoc analysis, conduct scenario analysis, analyze different outcomes, choose the best course of action, and then track the progress of the project to see how the actuals compare to the original targets.

Operational review reports and related financial forecasting models help business leaders evaluate and plan for different scenarios and conduct “what-if analyses” to make educated business decisions based on a variety of potential options. These decisions can include investing in a new market or launching a new product line, hiring more staff, or evaluating a merger or acquisition.

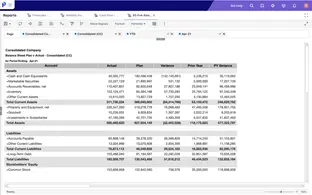

4. Balance Sheet

A balance sheet provides a snapshot of an organization’s financial health at a particular point in time, which makes it one of the most important financial statements. Balance sheets help businesses determine their true net worth because they lay out the assets (what a business owns), liabilities (what a business owes), and shareholder equity/owner’s equity (the difference between the two).

By listing and comparing your assets and liabilities on a balance sheet, you can determine if the business can cover its short-term obligations. If your liabilities exceed your cash balance, then your business may require additional funding and/or liquidity from external sources.

A balance sheet also reveals the company’s debt level. Too much debt indicates a risk of defaulting on debt payments or filing for bankruptcy. By identifying these issues, you can help management avoid long-term financial problems.

In addition, the balance sheet gives potential investors and lenders a good idea of the company’s financial position so they can better understand where their investments will go and what they can expect to receive in the future.

5. Income Statement

The income statement, also known as the profit and loss or P&L statement, shows your company’s income and expenses as well as profits or losses during a specified period. It gives you a clear picture of your company’s profitability.

Internally, management and the board of directors analyze information from this financial statement to make key decisions about the company’s standing and operations. For example, they can make pricing decisions, decide whether or not to increase or scale down production, push sales, or target a new audience. Externally, investors use the income statement to decide whether or not to invest in a company based on its growth potential and ability to generate a profit. Creditors also use the income statement to see if a business is able to pay off its loans or take out a new one.

6. Cash Flow Statement

The cash flow statement outlines how much cash is generated (from sales, investments, dividends, etc.) and spent (to loan repayments, payroll, bills, etc.) by a business over a certain period of time. It is based on the operating, investing, and financing activities of a company, and the numbers are pulled from the income statement and balance sheet.

This statement provides insights into the liquidity and solvency of the firm. It shows how a business manages its cash for operations, paying off debt, and funding current expenses or future investments. A cash flow statement also helps lenders and investors determine the possibility of repayment.

Accurate FP&A reporting is fundamental for strategic financial planning and decision-making

Creating the infrastructure for more meaningful and accurate financial and management reporting and data analysis enables FP&A and the business to improve the management of the company’s resources, make decisions faster, and optimize future financial results.

Before you go, remember these 3 things…

- FP&A reporting improves decision-making by aligning actuals, forecasts, and strategy in real time.

- Budget vs. actual, cash flow, and operational reports< are essential for financial visibility and agility.

- Accurate financial reports empower faster decisions, better planning, and stronger performance outcomes.

Get even more from your financial planning and analysis.

Download our white paper to learn about the most important best practices.

FAQs

What is FP&A reporting and why is it important?

FP&A reporting refers to the process of analyzing a company’s financial data to support planning, forecasting, and decision-making. It helps Finance teams compare actual performance to budgets, identify trends, and guide strategic choices. Strong FP&A reporting improves visibility, accountability, and agility across the business.

What are the most common types of FP&A reports?

Common FP&A report types include budget vs. actual reports, cash flow forecasts, operational reviews, income statements, balance sheets, and cash flow statements. Each report provides different insights to help track performance, manage risks, and support informed decision-making.

How does Planful make FP&A reporting easier for finance teams?

Planful streamlines FP&A reporting by automating manual tasks, integrating real-time data, and enabling collaboration across departments. Unlike tools that require heavy IT involvement or siloed data, Planful gives Finance teams a single source of truth with built-in reporting, modeling, and forecasting capabilities, no spreadsheet juggling required.

Latest Posts

Blogs

Interviews, tips, guides, industry best practices, and news.